In today’s ever-evolving business landscape, staying ahead requires both innovation and the strategic adoption of cutting-edge technologies. One of the technological advancements that’s transforming the way businesses manage their financial processes is B2B fintech. In this guide, we will dive into what B2B fintech is, its key components, and why your business needs it to thrive in the current economic landscape.

Understanding B2B Fintech

What is B2B Fintech?

B2B fintech, short for Business-to-Business financial technology, is the implementation of innovative technologies to streamline, automate, and enhance financial processes between businesses. It encompasses a broad range of solutions designed to improve efficiency, simplify transactions, reduce costs, and optimise financial decision-making within the B2B sector.

Key Components of B2B Fintech

1. Collection and Payment Solutions

B2B fintech offers advanced collection and payment solutions, replacing traditional manual processes with automated systems. This includes payment gateways, payment links, e-wallets, and platform features that facilitate seamless financial transactions between businesses.

2. Working Capital Management

Efficient management of working capital is crucial for the success of a business. B2B fintech solutions provide tools for optimising cash flow, managing receivables and payables, accessing real-time data into business health and ensuring that businesses have the liquidity needed to operate smoothly.

3. Supply Chain Management

B2B fintech platforms are transforming supply chain management with innovative solutions for financing transactions along the supply chain. Some of the benefits include optimising and automating workflows, reducing errors and cost, and enhancing collaboration and communication.

4. Business Lending Platforms

Fintech has revolutionised the lending landscape for businesses. Online platforms and alternative lenders leverage technology to provide quicker access to funding, more flexible terms, and data-driven lending decisions.

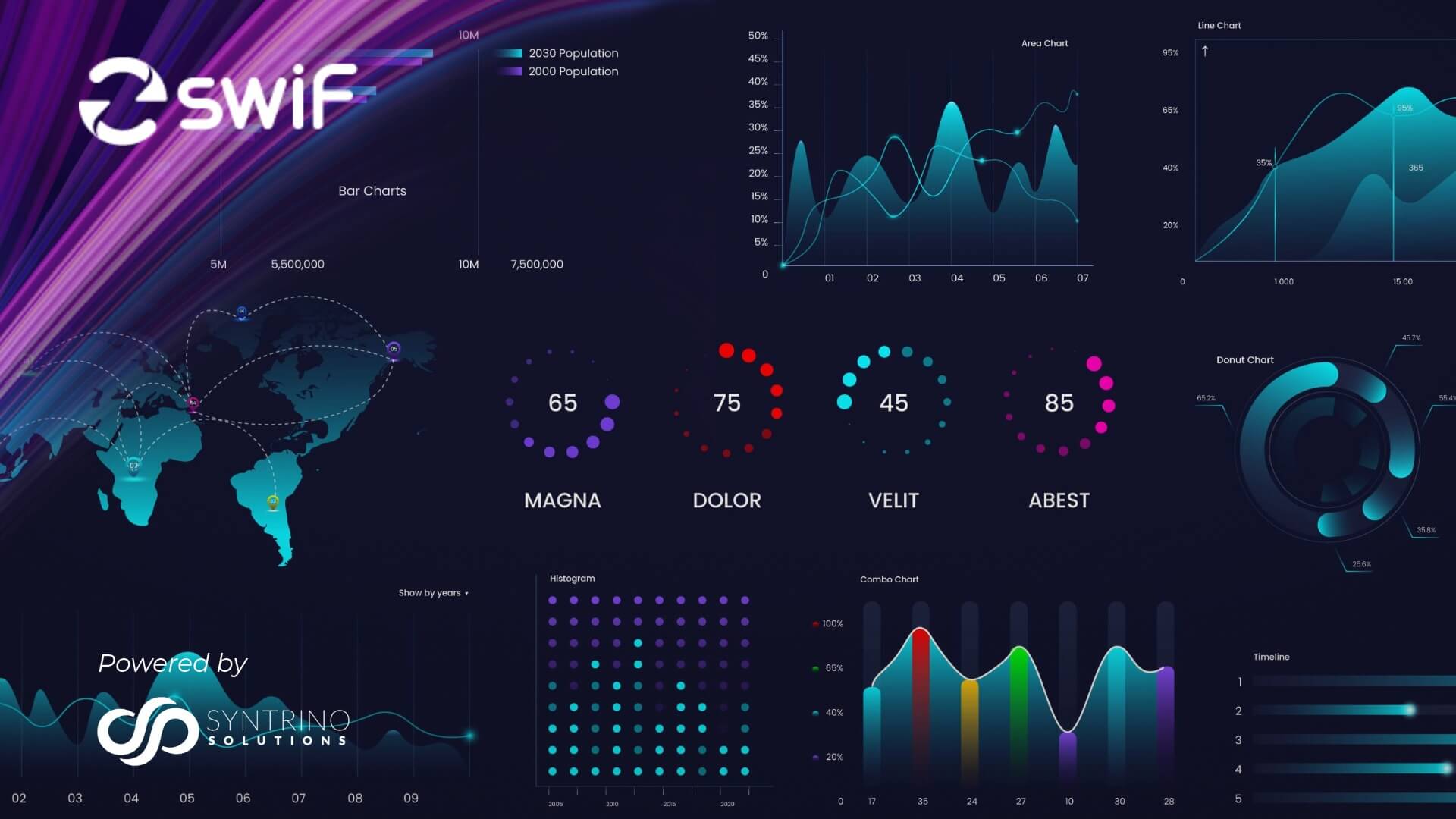

5. Data Analytics and Business Intelligence

B2B fintech harnesses the power of data analytics to provide businesses with actionable insights. Real-time visibility, optimised financial methods and transactions allow for data-driven decision-making.

Why Your Business Needs B2B Fintech

1. Improve Your Efficiency and Productivity

B2B fintech solutions are designed to automate repetitive and time-consuming financial tasks. This not only reduces your risk of errors associated with manual processes but also frees up valuable time for your finance team to focus on more strategic activities.

2. Gain Better Cash Flow

B2B fintech solutions provide tools that enable you to optimise your cash flow by automating invoicing, tracking payments, and managing working capital more effectively. This, in turn, allows your business to maintain a healthy balance between receivables and payables.

3. Access Alternative Financing

Traditional lending processes can be time-consuming. B2B fintech introduces alternative lending platforms that leverage technology to assess credit worthiness quickly and provide businesses with faster access to funding. This is particularly valuable if you are an SMEs looking to navigate financial challenges.

4. Streamline Your Payment Processes

B2B fintech solutions simplify and accelerate your payment processes. Digital payment platforms, e-invoicing, and real-time transactions contribute to faster, more secure, and cost-effective payment methods. You can run your business more conveniently and strengthen your relationship with suppliers and customers.

5. Make Data-Driven Decision

B2B fintech can empower your business with advanced analytics and business intelligence tools. These tools can help you leverage your data, offer insights into market trends, customer behaviour, and financial performance. Data-driven decision-making becomes a strategic advantage in a competitive business environment.

6. Increase Transparency and Security

B2B fintech solutions, enhance transparency and security in financial transactions.

Advanced encryption technologies ensure that payment data and sensitive customer information are transmitted securely between the customer, the merchant, and the payment processor, creating trust and confidence in your business.

7. Embrace Digital Transformation

The global business landscape is undergoing a rapid digital transformation, and B2B fintech is at the forefront of this revolution. Adopting fintech solutions positions your business to adapt to changing market dynamics, meet customer expectations, and remain competitive in an increasingly digital business environment.

8. Access Customised Financial Solutions

B2B fintech platforms often provide customisable solutions to help you meet the specific financial needs of your business. Whether it’s tailoring payment terms, adjusting credit limits, or creating personalised financial dashboards, these platforms offer flexibility to adapt to the unique requirements of different industries and businesses.

Conclusion

B2B fintech enables businesses to thrive in the digital age. From streamlined financial processes to data-driven decision-making and access to alternative financing, the benefits are diverse and impactful. In addition, embracing B2B fintech positions your company to be compliant and ready to advance in the realms of ESG (Environmental, Social, and Governance) initiatives and the transformative era of Industrial 4.0.

As businesses navigate an ever-evolving landscape, the adoption of B2B fintech becomes a critical aspect of their strategic planning. Whether you’re a small startup or an established enterprise, integrating fintech solutions into your financial ecosystem can position your business for success, providing the tools and insights needed to navigate the complexities of modern finance with agility and efficiency. Embrace the power of B2B fintech – your gateway to a more streamlined, secure, and prosperous financial future.

SwiF is Malaysia’s Leading-Edge B2B2C Fintech Solution.

Powered by Syntrino Solutions, Southeast Asia’s leader in supply chain management,

SwiF gives you access to a variety of payment methods for all your business transactions both online and offline including all major credit cards, online banking, micro-financing, and e-wallet.