SMEs are the lifeblood of Malaysia’s economy, contributing RM580 billion to GDP and employing over 7.3 million people***. Yet, 70% of SMEs grapple with cash flow challenges, exacerbated by delayed payments, economic uncertainty, and regulatory shifts like Malaysia’s LHDN e-invoicing mandate. Without steady cash flow, even the most promising businesses risk stalling*.

Fortunately, strategic financial management can turn the tide. By adopting proactive strategies, SMEs can ensure liquidity, reduce financial stress, and unlock growth potential. From optimising invoicing to leveraging digital tools, the right approach can transform challenges into opportunities. As a leading payment hub, SwiF empowers SMEs with seamless payment, invoicing, and financing solutions to navigate Malaysia’s competitive B2B2C landscape. In this article, we share the top 10 strategies to boost cash flow and financial stability, helping your SME thrive in 2025 and beyond.

1. Streamline Invoicing for Faster Payments

Timely invoicing is critical to maintaining cash flow, yet many SMEs struggle with delayed payments, waiting 50% longer for collections than a few years ago*. Sending clear, professional invoices immediately after delivering goods or services can accelerate payments. Automation is key: use e-invoicing platforms to reduce errors and ensure compliance with Malaysia’s LHDN mandate.

SwiF’s e-invoicing solution simplifies this process. As a Peppol-accredited provider, SwiF enables SMEs to generate, submit, and track e-invoices effortlessly while attaching payment links for instant settlements. Offer early payment discounts or shorten terms from 60 to 30 days to incentivise prompt payments. By tightening your invoicing system, you can minimise delays and keep cash flowing. Start today with SwiF’s compliant, user-friendly platform to transform your invoicing process and boost liquidity.

2. Offer Diverse Payment Options

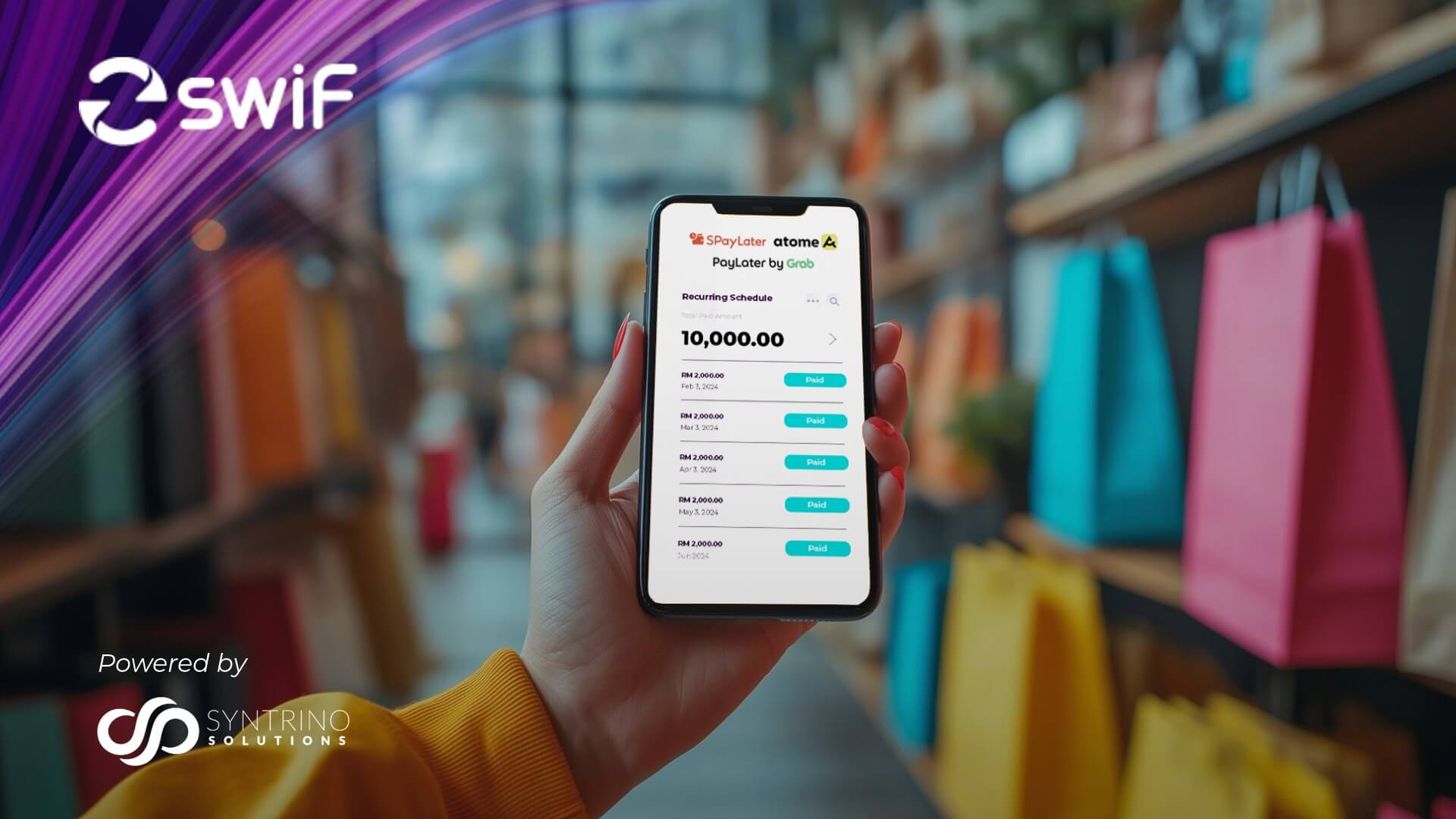

Customers expect convenience, and offering multiple payment methods can significantly improve collection rates. In Malaysia, preferences range from credit cards and e-wallets to DuitNow and Buy Now Pay Later (BNPL). SMEs that limit options risk losing sales and delaying cash inflows. SwiF’s payment solutions upport over 20 methods, enabling businesses to accept payments online, in-store, or via social media platforms like WhatsApp and Instagram. This flexibility caters to diverse customer needs, boosting conversion rates and ensuring faster cash flow. For example, sharing payment links via SMS or email allows even non-e-commerce businesses to collect payments seamlessly. By integrating SwiF’s secure, PCI DSS-compliant gateway, SMEs can enhance customer satisfaction and reduce payment friction. Explore SwiF’s versatile payment options to make transactions effortless and keep your cash flow steady.

3. Adopt Subscription Models for Predictable Revenue

Subscription models create recurring revenue streams, offering SMEs predictable cash flow to cover expenses and plan investments. This approach is ideal for businesses with regular customer interactions, such as service providers or retailers. SwiF’s subscription billing feature automates recurring payments, allowing SMEs to set up flexible plans and collect funds via auto debits . This reduces administrative overhead and ensures consistent income. For instance, a consultancy can offer monthly retainers, or a retailer can introduce subscription boxes, both supported by SwiF’s platform. By stabilising revenue, subscriptions help SMEs navigate seasonal fluctuations or economic uncertainty. Implement this strategy with SwiF’s tools to simplify billing and maintain a steady cash flow, empowering your business to focus on growth rather than chasing payments.

4. Unlock Cash with Invoice Financing

Delayed payments are a common hurdle, with 44.8% of Malaysian SMEs facing liquidity issues due to late invoices**. Invoice financing offers a solution by unlocking cash tied up in unpaid invoices, providing immediate working capital.

SwiF’s invoice financing allows SMEs to access funds quickly without waiting for clients to pay. This alternative to traditional bank loans offers flexibility and speed, helping businesses cover operational costs or invest in growth. For example, a supplier can finance invoices to maintain inventory during peak seasons. By partnering with SwiF, SMEs can bridge cash flow gaps and stay competitive. Discover how SwiF’s financing solutions can provide the liquidity your business needs to thrive, even when payments are delayed.

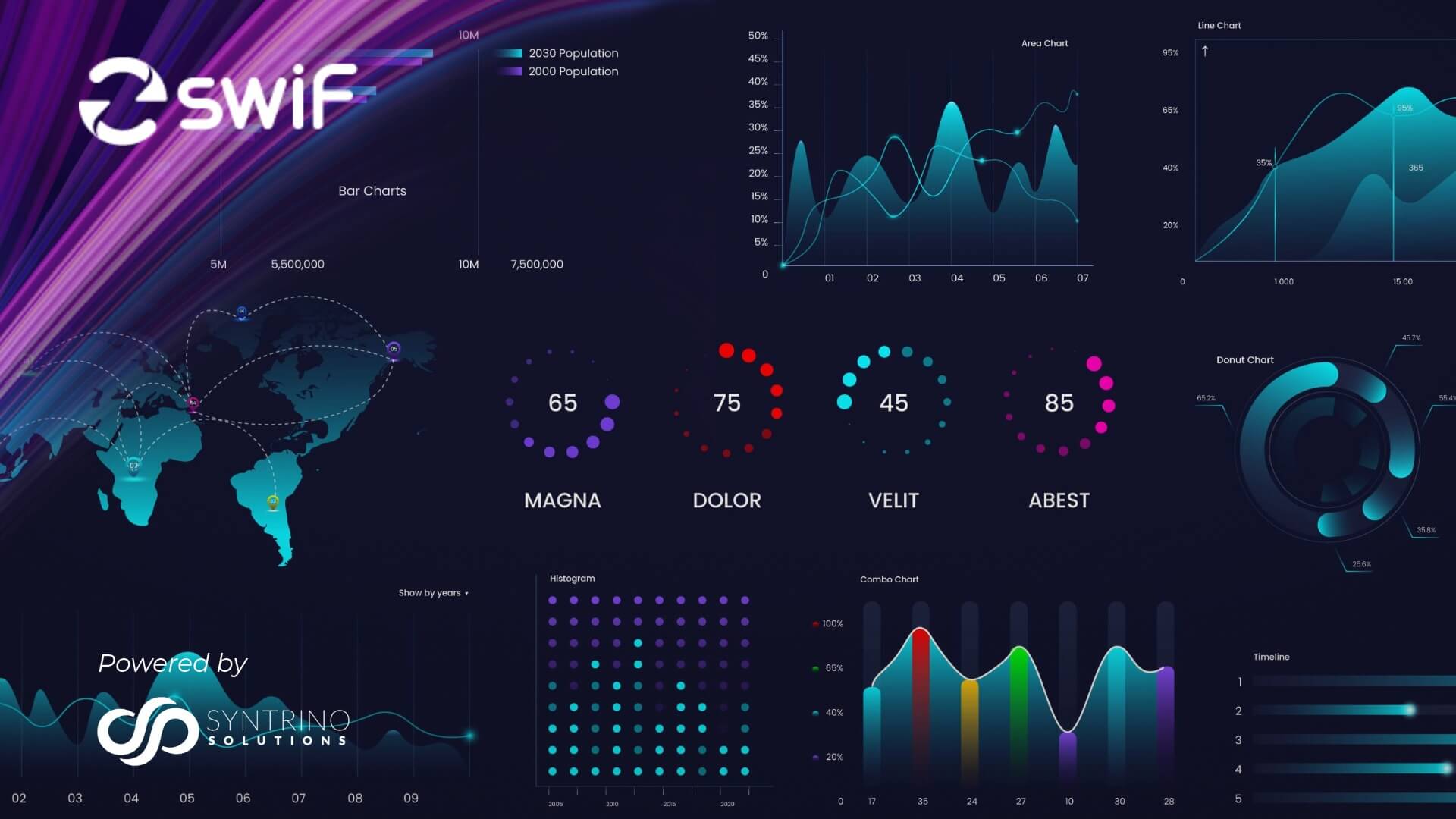

Understanding your cash flow cycle, when revenue arrives and expenses are due, is essential for financial stability. Regular monitoring helps identify gaps before they become crises. Without real-time insights, SMEs risk poor inventory or production decisions that disrupt cash flow****.

SwiF’s dashboard provides a centralised view of revenue, customer trends, and payments, enabling data-driven decisions. For instance, tracking seasonal trends (e.g., December retail spikes) helps plan staffing or marketing. This visibility allows SMEs to anticipate shortfalls and act proactively. By leveraging SwiF’s analytics, businesses can optimise cash flow and avoid surprises. Start using SwiF’s real-time tools to gain control over your finances and build a resilient SME.

6. Negotiate Favourable Payment Terms

Clear payment terms are crucial for cash flow. Negotiating shorter cycles (e.g., 30 days instead of 60) or offering early payment discounts can encourage clients to pay faster. SMEs should also conduct financial checks on new customers before extending credit to minimise risks.

SwiF’s auto debit feature enforces timely payments by automatically collecting funds from clients’ accounts, reducing the need for follow-ups. This streamlines collections and ensures consistent cash inflows. For example, a B2B2C supplier can set up auto debits for regular clients, improving predictability. By combining smart negotiation with SwiF’s automated tools, SMEs can maintain steady cash flow and reduce payment delays. Explore SwiF’s solutions to enforce terms that work for your business.

7. Reduce Operational Costs

High operational costs can drain cash reserves, especially during slow periods. SMEs should regularly review expenses, such as software subscriptions or supplier contracts, to identify savings. Adopting cost-effective tools is a smart way to optimise spending without sacrificing efficiency*. SwiF’s platform offers transparent pricing with no hidden fees, helping SMEs manage transaction costs effectively. By consolidating payments, invoicing, and financing into one platform, SwiF reduces the need for multiple costly tools. For instance, its all-in-one payment hub streamlines financial operations, saving time and money. SMEs can also negotiate bulk discounts with suppliers or use SwiF’s virtual terminals to cut hardware costs. Start optimising your expenses with SwiF’s cost-efficient tools to bolster your cash flow and financial stability.

8. Build a Cash Reserve

A financial buffer is essential for weathering unexpected expenses or slow months. Experts recommend maintaining a reserve equivalent to 2–3 months of operating expenses**. This cushion provides peace of mind and ensures SMEs can operate without relying on costly loans.

SwiF’s fast settlement feature ensures quick access to funds, helping businesses build reserves efficiently. For example, prompt settlements from diverse payment methods allow SMEs to set aside a portion of revenue regularly. By combining SwiF’s tools with disciplined budgeting, SMEs can create a safety net to navigate economic uncertainty. Begin building your cash reserve with SwiF’s rapid settlement solutions to secure your SME’s financial future.

9. Leverage Data-Driven Forecasting

Accurate forecasting helps SMEs anticipate cash flow gaps and plan for seasonal cycles, such as school-year demand spikes. Without data-driven insights, businesses may struggle with inventory or staffing decisions, impacting liquidity**.

SwiF’s analytics tools provide insights into payment patterns and customer behaviour, enabling precise forecasting. For instance, an SME can predict peak sales periods and adjust marketing budgets accordingly. Digital tools also ensure compliance with Malaysia’s accounting standards, simplifying financial planning. By leveraging SwiF’s data capabilities, SMEs can make informed decisions to maintain cash flow stability. Start using SwiF’s analytics to forecast smarter and stay ahead of financial challenges.

10. Ensure Regulatory Compliance

Compliance with Malaysia’s LHDN e-invoicing mandate is non-negotiable for SMEs, as errors can delay payments and disrupt cash flow. Non-compliance risks penalties, further straining finances. Digital solutions streamline adherence while improving efficiency****. SwiF, as a Peppol-accredited provider, offers a compliant e-invoicing platform that simplifies invoice creation, submission, and tracking. This ensures SMEs meet regulatory requirements without added complexity. By integrating e-invoicing with payment links, SwiF accelerates collections while maintaining compliance. SMEs can focus on growth rather than navigating red tape. Ensure your business stays compliant and cash flow-ready with SwiF’s tailored e-invoicing solutions.

Conclusion

Cash flow is the lifeline of every SME, and proactive strategies can transform financial challenges into opportunities. By streamlining invoicing, diversifying payments, and leveraging tools like SwiF, Malaysian SMEs can achieve stability and growth in a competitive B2B2C market. Don’t let cash flow hurdles hold your business back. Discover how SwiF (https://swifs.io/) can simplify payments, invoicing, and financing to empower your SME. Sign up today to unlock the tools you need to thrive in 2025 and beyond. Take control of your cash flow now, your business deserves it.

Sources:

SwiF is Malaysia’s Leading-Edge B2B2C Fintech Solution.

Our all-in-one Payment Hub empowers businesses to offer flexible, seamless payment options, both online and offline. Accept major credit cards, online banking, e-wallets, BNPL, invoice financing, and micro-financing through a single, integrated system.

SwiF’s smart e-invoicing plug-in simplifies your compliance journey by ensuring every invoice meets LHDN regulatory standards. More than just compliance, it gives you real-time visibility, automated tracking, and actionable analytics to optimise cash flow and business performance.

Built by Syntrino Solutions, Southeast Asia’s supply chain innovation leader, SwiF integrates effortlessly with your existing systems, streamlining every aspect of your B2B2C transactions from invoicing to payment collection. Related Articles