Introduction

Malaysia’s SMEs, comprising 97% of businesses and contributing 38% to GDP, form the backbone of the nation’s economy, employing over 7 million people***. In 2025, with 85% of Malaysians using mobile payments and rising competition, SMEs must scale smartly whilst fostering customer loyalty to stay ahead*. FinTech is transforming this landscape, offering tools to streamline operations, enhance customer experiences, and drive revenue growth. As Malaysia’s leading payment hub, SwiF empowers SMEs with seamless solutions including its payment gateway, e-invoicing, and financing to thrive in the B2B2C market. This article outlines 10 actionable strategies to leverage FinTech for revenue growth and lasting customer relationships. From personalised payments to global expansion, discover how SwiF can help your SME navigate Malaysia’s digital economy and achieve success in 2025 and beyond.

1. Offer Seamless Payment Experiences

With 85% of Malaysians using e-wallets like GrabPay and Touch ‘n Go, seamless payment options are key to customer satisfaction and loyalty*. SMEs offering diverse methods reduce cart abandonment and encourage repeat purchases. SwiF’s payment gateway supports over 20 methods, including DuitNow, BNPL, and cards, enabling transactions online, in-store, or via social media like WhatsApp. For instance, a retailer can share payment links via SMS, simplifying purchases for customers without a website. This flexibility boosts conversion rates and accelerates cash flow. By integrating SwiF’s PCI DSS-compliant gateway, SMEs meet consumer expectations for convenience, fostering loyalty. Start offering seamless payments with SwiF to keep customers returning.

2. Personalise Customer Interactions with Data

Data-driven personalisation can increase customer retention by 10–15%. SwiF’s analytics tools provide insights into payment patterns, enabling SMEs to tailor promotions or services. For example, a café can identify frequent buyers and offer targeted discounts, strengthening loyalty. With 99% of Malaysians likely to adopt emerging payment methods in 2025, understanding preferences is critical**. FinTech analytics help SMEs anticipate needs, such as offering BNPL for high-value purchases. By leveraging SwiF’s data capabilities, businesses can create personalised experiences that drive repeat business and growth. Use SwiF’s analytics to unlock customer insights and build stronger connections today.

3. Streamline Operations with e-Invoicing

Now mandatory, Malaysia’s LHDN e-invoicing ensures compliance whilst boosting efficiency***. Automated e-invoicing reduces errors and speeds up payments, freeing resources for growth. SwiF’s e-invoicing solution, Peppol-accredited, simplifies invoice creation, submission, and tracking whilst integrating payment links for instant collections. For example, a B2B2C supplier can automate invoicing for regular clients, reducing administrative overhead. This efficiency supports scaling by allowing SMEs to focus on core operations. Ensure compliance and streamline processes with SwiF’s e-invoicing platform to drive growth effortlessly.

4. Boost Cash Flow with Invoice Financing

Rising costs and delayed payments strain SME liquidity, with 73.2% expecting revenue growth but facing cash flow challenges **. SwiF’s invoice financing integration unlocks funds from unpaid invoices, providing immediate capital for inventory, marketing, or expansion. Unlike traditional loans, this FinTech solution offers speed and flexibility. For example, a wholesaler can finance invoices to restock during peak seasons, maintaining growth momentum. By partnering with SwiF, SMEs can bridge cash flow gaps and seize opportunities. Discover how SwiF’s financing solutions empower your business to scale without delays.

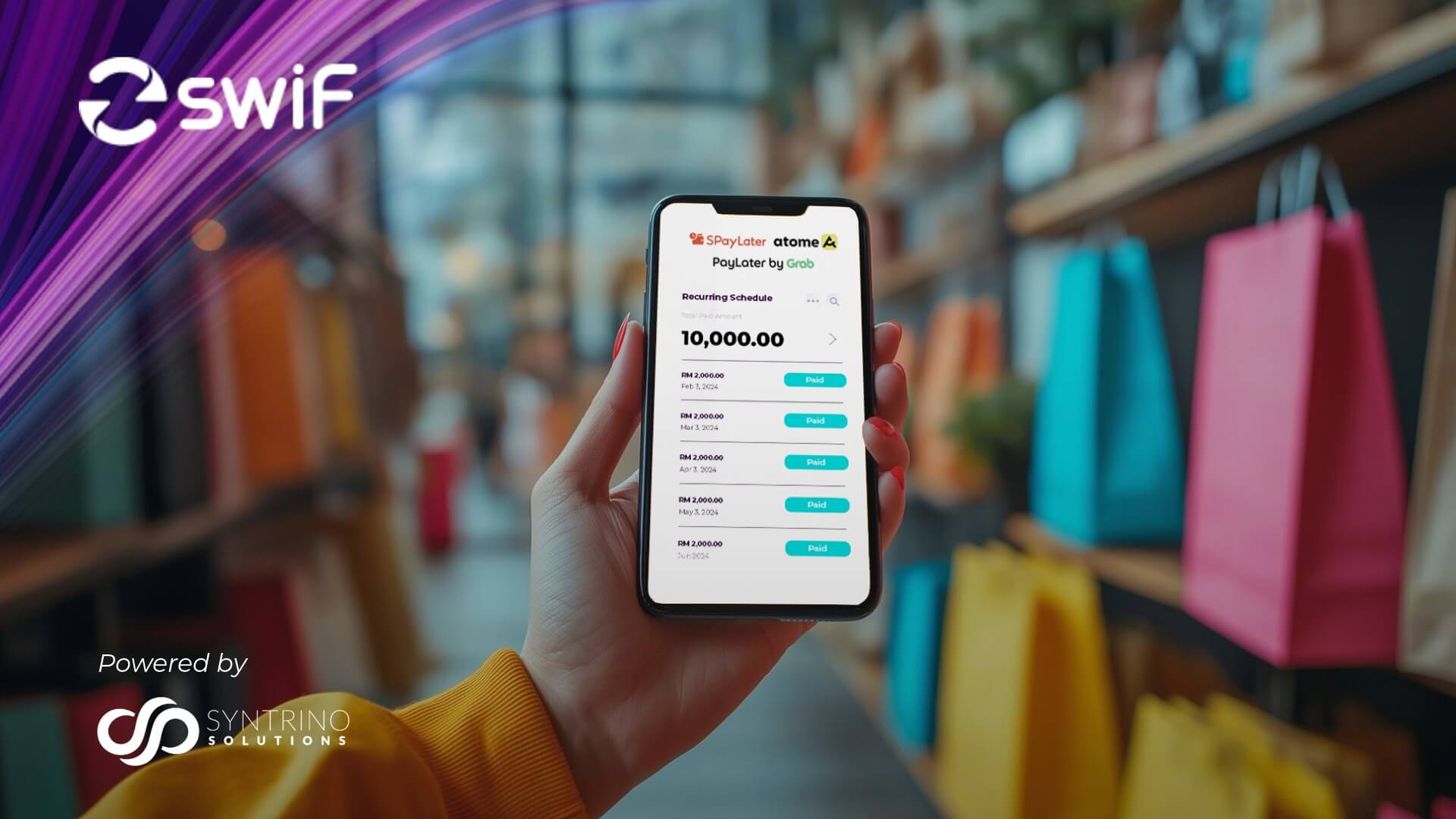

5. Launch Subscription Models for Recurring Revenue

Subscription models ensure predictable revenue, fostering stability and customer loyalty. SwiF’s subscription billing automates recurring payments, and is ideal for service providers. For instance, a fitness studio can set up monthly memberships, ensuring steady cash flow. With 63% of SMEs still relying on cash payments, transitioning to digital subscriptions via FinTech boosts efficiency*. SwiF’s auto debit feature minimises missed payments, enhancing retention. Implement subscriptions with SwiF to drive consistent revenue and long-term customer relationships.

6. Expand Globally with Cross-Border Payments

Malaysia’s digital economy opens global markets, with 20% of SMEs prioritising cross-border transactions*. SwiF’s payment solutions support secure, low-cost international payments, outperforming traditional banks. For example, an e-commerce SME can sell to Singapore or Thailand, diversifying revenue. SwiF’s platform ensures seamless transactions, helping SMEs scale globally whilst maintaining customer trust. Expand your reach with SwiF’s cross-border payment tools to unlock new growth avenues.

7. Enhance In-Store Transactions with FinTech

In-store experiences matter, with 68.9% of transactions now contactless*. SwiF’s terminals and Soundbox enable fast, secure payments, improving customer satisfaction in physical stores. For example, a café using SwiF’s terminals can process e-wallet payments quickly, reducing wait times and boosting loyalty. FinTech tools also streamline back-end operations, ensuring faster settlements. Enhance your in-store transactions with SwiF’s solutions to drive sales and keep customers returning.

8. Leverage Loyalty Programmes with FinTech

Loyalty programmes drive repeat business, especially when integrated with FinTech. SwiF’s platform tracks transaction data, enabling SMEs to offer rewards or discounts based on purchase history. For instance, a retailer can provide loyalty points for e-wallet payments, incentivising repeat purchases. With 72% of Malaysians viewing biometric payments as secure, trust in digital solutions is high****. SwiF’s payment gateway supports seamless loyalty integration, enhancing customer retention. Build loyalty programmes with SwiF to strengthen relationships and drive growth.

9. Optimise Marketing with Real-Time Insights

Effective marketing maximises ROI, and FinTech analytics provide the edge. SwiF’s dashboard offers real-time insights into customer spending, helping SMEs target high-value segments. For example, an online store can identify peak purchase times and adjust ad spend accordingly. With second-generation FinTech startups leveraging AI for advanced analytics, SMEs can stay competitive†. SwiF’s tools ensure data-driven decisions, optimising marketing for growth. Use SwiF’s analytics to refine your marketing strategy and boost revenue.

10. Build Resilience with Fast Settlements

Liquidity is critical for scaling, yet many SMEs face delays in accessing funds**. SwiF’s fast settlement feature ensures quick access to payments, enabling reinvestment in operations or customer initiatives. For example, prompt settlements allow a retailer to restock inventory faster, supporting growth. With Malaysia’s digital payment market projected to reach $207 billion in 2025, fast settlements are a game-changer††. Build resilience with SwiF’s rapid settlement solutions to fuel your SME’s success.

Conclusion

Malaysia’s SMEs face a dynamic digital economy in 2025, where FinTech is key to scaling and building customer loyalty. By leveraging tools like e-invoicing, payment gateways , and financing, SMEs can streamline operations, enhance customer experiences, and drive growth. SwiF empowers businesses to thrive in the B2B2C market with innovative solutions. Don’t miss the chance to elevate your SME. Sign up with SwiF today to unlock the tools needed to succeed in Malaysia’s digital future. Take the next step, your business is ready!

Sources

*Fintech News Malaysia

**Experian Malaysia

***The ASEAN Post

****Mastercard via Focus Malaysia

†Funding Societies

††Market Research Malaysia

SwiF is Malaysia’s Leading-Edge B2B2C Fintech Solution.

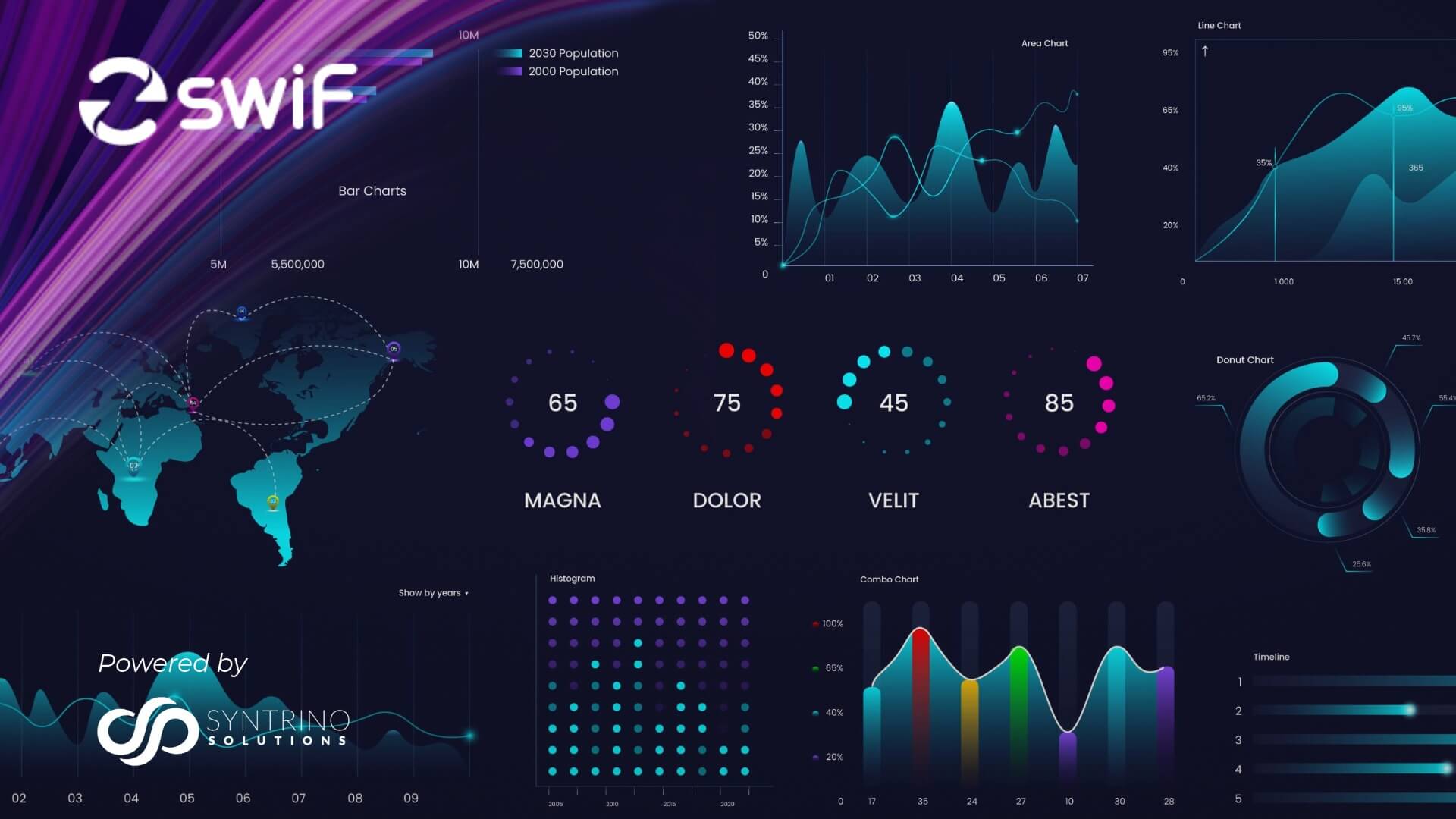

Our all-in-one Payment Hub empowers businesses to offer flexible, seamless payment options, both online and offline. Accept major credit cards, online banking, e-wallets, BNPL, invoice financing, and micro-financing through a single, integrated system.

SwiF’s smart e-invoicing plug-in simplifies your compliance journey by ensuring every invoice meets LHDN regulatory standards. More than just compliance, it gives you real-time visibility, automated tracking, and actionable analytics to optimise cash flow and business performance.

Built by Syntrino Solutions, Southeast Asia’s supply chain innovation leader, SwiF integrates effortlessly with your existing systems, streamlining every aspect of your B2B2C transactions from invoicing to payment collection.