In 2025, payment fraud is expected to reach unprecedented levels as digital transactions continue to surge across Southeast Asia and beyond. As fraudsters become more sophisticated, businesses must stay ahead by implementing advanced fraud prevention strategies. Whether you’re an SME or a large enterprise, safeguarding your payment ecosystem is no longer optional—it’s critical.

At SwiF, we understand the importance of secure transactions. Our all-in-one fintech platform empowers businesses to protect their operations while ensuring a seamless payment experience for their customers. In this article, we’ll explore five proven ways to reduce payment fraud in 2025—and how SwiF can help.

1. Implement AI-Powered Fraud Detection

Why it matters: Traditional rule-based systems are no longer sufficient to detect today’s sophisticated fraud attempts. Fraudsters constantly evolve their tactics, making it difficult for static systems to keep up.

What to do: Invest in AI-driven fraud detection tools that analyse transaction patterns in real-time. Machine learning algorithms can identify unusual behaviours and flag potentially fraudulent activities before they cause harm.

How SwiF helps: SwiF’s AI-powered fraud monitoring continuously learns from transaction data, providing real-time alerts and automated blocking of suspicious activities. This proactive approach minimises false positives and reduces chargebacks.

2. Strengthen Security with Multi-Factor Authentication (MFA)

Why it matters: Passwords alone aren’t enough to protect customer accounts. Compromised login credentials are a common entry point for fraudsters.

What to do: Enforce multi-factor authentication for both internal teams and customers. MFA adds an extra layer of security by requiring users to verify their identity through a secondary method, such as an OTP, biometrics, or device recognition.

How SwiF helps: SwiF offers flexible MFA options to ensure only authorised users can access accounts and approve transactions. Our platform provides businesses with simple yet robust authentication tools that don’t compromise the user experience.

3. Use Tokenization and End-to-End Encryption

Why it matters: Sensitive data, such as cardholder details, are prime targets for cybercriminals. Protecting this information is essential to prevent data breaches and build customer trust.

What to do: Implement tokenization and encryption to secure payment data. Tokenization replaces sensitive information with non-sensitive equivalents (tokens), while encryption protects data during transmission and storage.

How SwiF helps: SwiF is PCI DSS Level 1 certified, ensuring the highest standards of security. We have successfully upgraded our compliance from PCI DSS v3.2 to v4.0.1, the latest edition of PCI DSS Level 1, putting us at the forefront of payment security. We use tokenization and end-to-end encryption to protect every transaction, reducing compliance risks and providing peace of mind for both merchants and customers.

4. Monitor Transactions in Real-Time

Why it matters: Time is critical when it comes to preventing payment fraud. Early detection can mean the difference between stopping fraud in its tracks and dealing with significant financial losses.

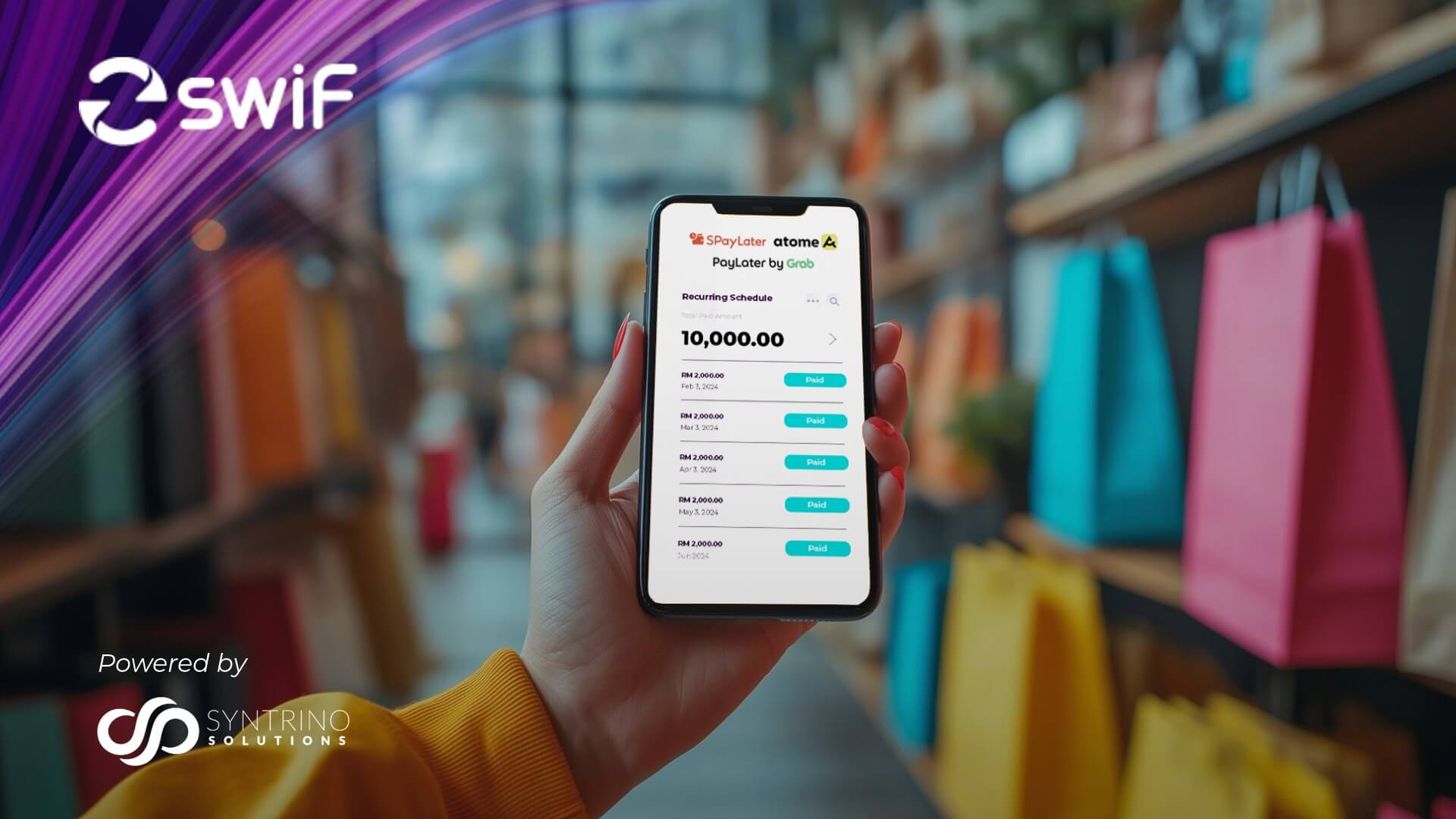

What to do: Use a dashboard that provides real-time transaction monitoring and alerts. Monitor high-risk transactions and set up automated rules to flag irregularities.

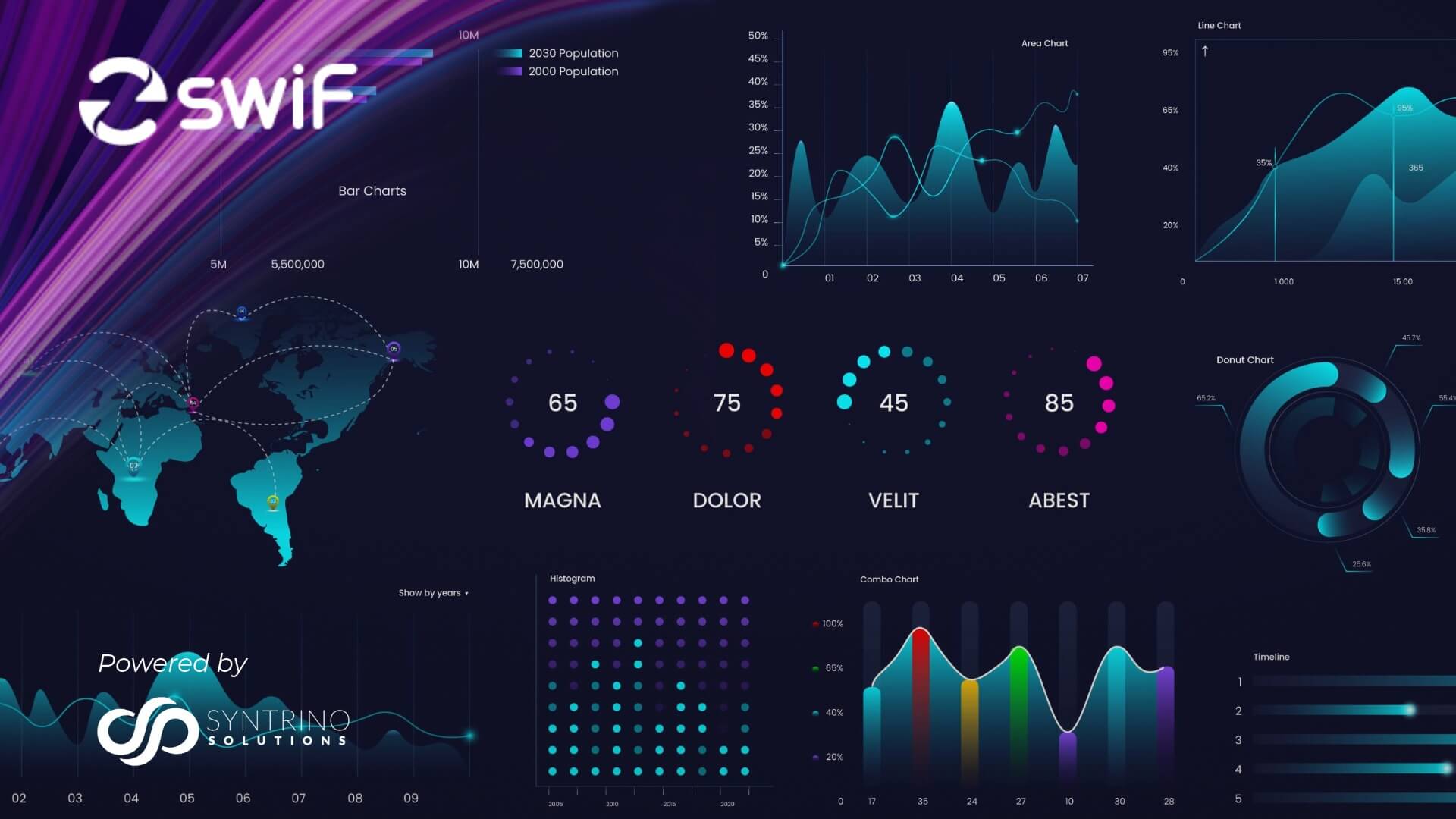

How SwiF helps: SwiF’s intuitive dashboard delivers real-time insights into every transaction. Businesses can track payment activity, spot irregularities instantly, and make data-driven decisions to protect their operations.

5. Educate Your Team and Customers

Why it matters: Human error is one of the biggest contributors to fraud. Employees and customers who are unaware of the latest scams are more likely to fall victim to social engineering or phishing attacks.

What to do: Regularly educate your team and customers on emerging fraud threats. Provide clear guidelines on spotting suspicious activities and encourage prompt reporting of any concerns.

How SwiF helps: As your fintech partner, SwiF provides educational resources and best practices to help businesses stay informed. We believe in empowering businesses and their stakeholders to be the first line of defense against fraud.

Conclusion

As digital payments become the norm, payment fraud will remain a persistent threat. But with the right strategies—and the right fintech partner—you can safeguard your business and enhance customer confidence.

At SwiF, security is at the core of everything we do. Our comprehensive payment solutions are designed to protect businesses, streamline collections, and enable smarter, safer transactions.

Ready to reduce payment fraud and protect your business in 2025?

Discover SwiF’s Secure Payment Solutions

Want to know more about our level of security? Explore Our Fraud Prevention Tools

SwiF is Malaysia’s Leading-Edge B2B2C Fintech Solution.

Powered by Syntrino Solutions, Southeast Asia’s leader in supply chain management, SwiF’s digital collection and payment gateway seamlessly integrates with your existing systems, streamlining all your B2B2C transactions.

SwiF empowers businesses to offer flexible payment options, both online and offline.

Our innovative e-invoicing plug-in ensures your business stays at the forefront of regulatory standards, while advanced monitoring and analytics keep you on top of your business performance at all times.

Related Articles

Key cybersecurity strategies for B2B fintech

Need Expert Guidance? Contact support@swifs.io