When it comes to B2B2C transactions, customers expect a seamless and convenient payment experience, while businesses must balance the needs of their business with the needs of their customers.

In this article, we uncover the benefits of offering customisable payment plans, explore how they can enhance customer satisfaction and drive sales, and discuss best practices for implementing B2B2C fintech solutions in your business.

The Importance of Flexible Payment Options

Flexible payment options are a crucial component of the B2B2C fintech landscape. They enable businesses to cater to the diverse financial needs and preferences of their customers, ultimately enhancing the overall user experience. By offering customisable payment plans, companies can differentiate themselves from the competition, build stronger customer relationships, and drive long-term loyalty.

Advantages of Offering Customisable Payment Plans

- Improved Customer Satisfaction: Flexible payment options empower customers to choose payment terms that align with their financial capabilities, leading to higher satisfaction and reduced friction in the payment process.

- Increased Conversion Rates: By providing customers with the ability to pay in a manner that suits their needs, companies can experience a significant boost in conversion rates, as customers are more inclined to complete transactions.

- Enhanced Cashflow Management: Customisable payment plans allow businesses to better manage their cashflow, as they can offer payment terms that align with their own financial requirements and obligations.

- Competitive Advantage: In the crowded B2B2C market, the ability to offer flexible payment options can be a powerful differentiator, helping businesses stand out from the competition and attract a wider customer base.

- Improved Data-Driven Insights: By analysing customer payment behaviour and preferences, businesses can gain valuable insights to refine their payment offerings and optimise the overall customer experience.

Increased Customer Satisfaction Through Flexible Payment Options

One of the primary benefits of offering flexible payment options in B2B2C is the positive impact on customer satisfaction. When customers are empowered to choose payment terms that align with their financial situation, they are more likely to complete transactions and feel valued by the business. This, in turn, can lead to higher customer loyalty, increased repeat business, and positive word-of-mouth referrals.

How Flexible Payment Options Can Drive Sales And Revenue

Flexible payment options can have a direct and significant impact on sales and revenue generation. By catering to the diverse financial needs of customers, your business can remove barriers to purchase, leading to higher conversion rates and increased sales.

Best Practices For Implementing Flexible Payment Options

- Conduct Market Research: Thoroughly understand your target audience’s payment preferences and financial needs to develop the most suitable flexible payment options.

- Offer a Variety of Payment Plans: Provide customers with a range of customisable payment plans, including instalments, deferred payments, and pay-over-time options, to cater to diverse financial situations.

- Ensure Transparent Communication: Clearly communicate the terms and conditions of your flexible payment options, including any fees or interest rates, to maintain trust and transparency with your customers.

- Leverage Technology: Invest in a robust and trusted payment processing platform that can seamlessly handle the management of flexible payment plans, ensuring a smooth and efficient experience for both your customer and business.

- Continuously Optimise: Regularly review customer feedback, monitor payment data, and make adjustments to your flexible payment offerings to ensure they remain relevant and aligned with evolving customer needs.

Tools And Technologies For Managing Flexible Payment Options

Effective management of flexible payment options in B2B2C requires the integration of specialised tools and technologies. Some key solutions include:

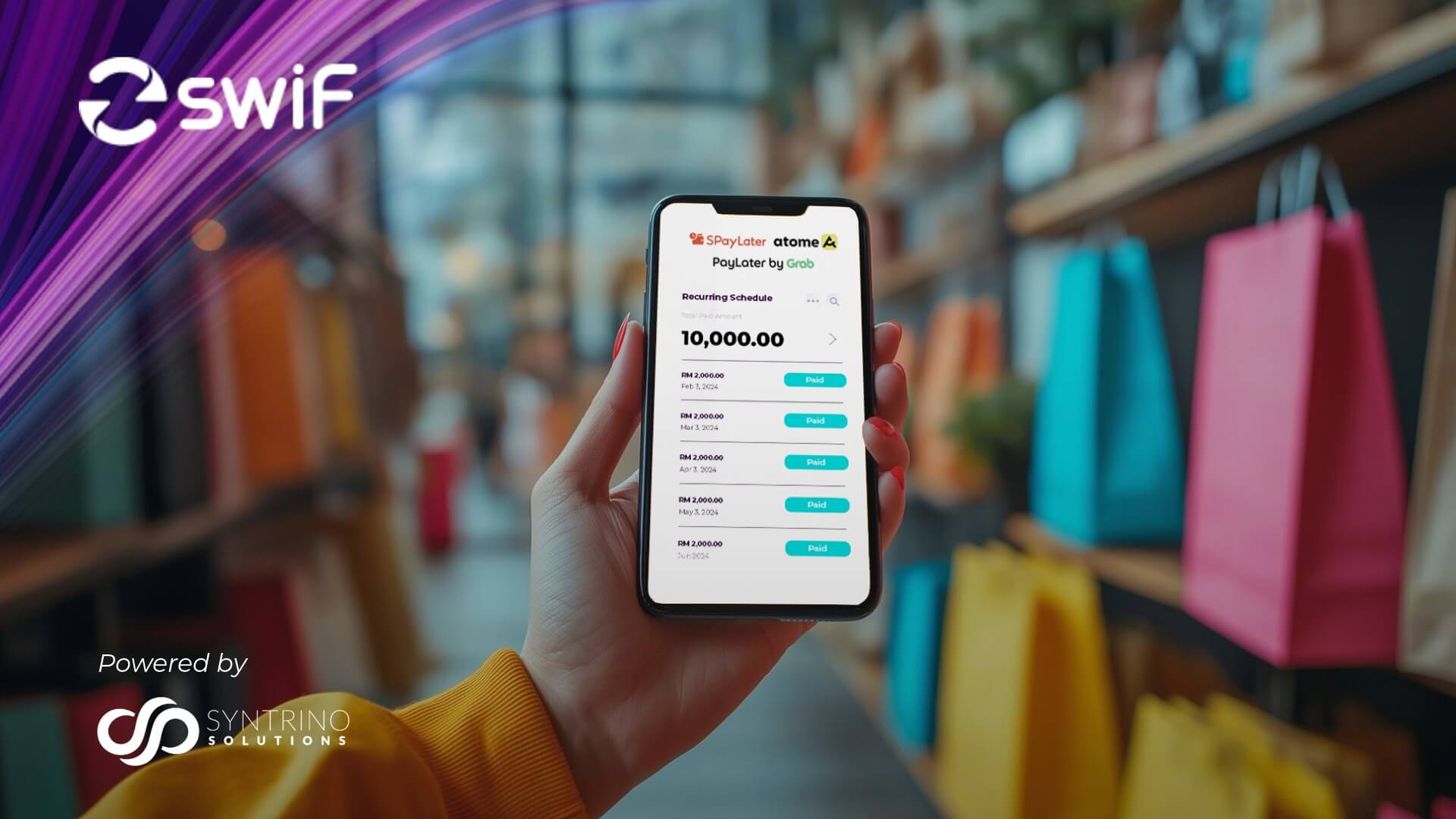

- Payment Processing Platforms: Advanced payment gateways that can handle complex payment plans, recurring billing, and automated reconciliation.

- Customer Relationship Management (CRM) Systems: CRM platforms that enable the tracking of customer payment history, preferences, and communication.

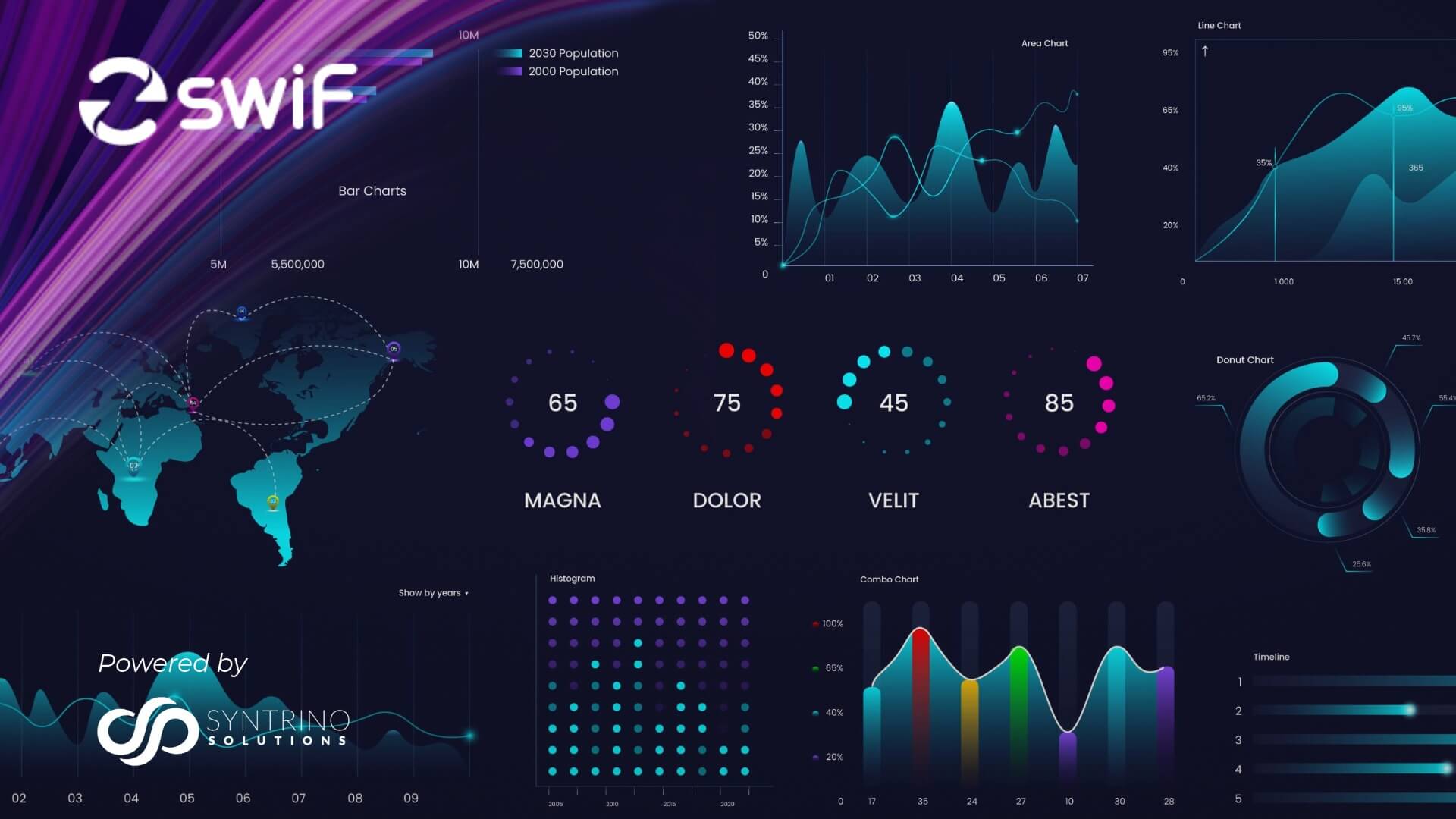

- Data Analytics Tools: Sophisticated analytics solutions that provide insights into customer payment behaviour, trends, and the performance of flexible payment options.

- Automation and Workflow Management: Automated systems that streamline the administration of flexible payment plans, including e-invoicing, reminders, and collections.

- Integrated Reporting: Comprehensive reporting and dashboard solutions that offer real-time visibility into the performance and impact of flexible payment options.

Challenges and Solutions in Offering Flexible Payment Options

While the benefits of flexible payment options in B2B2C fintech are clear, there are also challenges that businesses must navigate. These include:

- Risk Management: Carefully assess and mitigate the potential risks associated with offering flexible payment plans, such as default rates and bad debt.

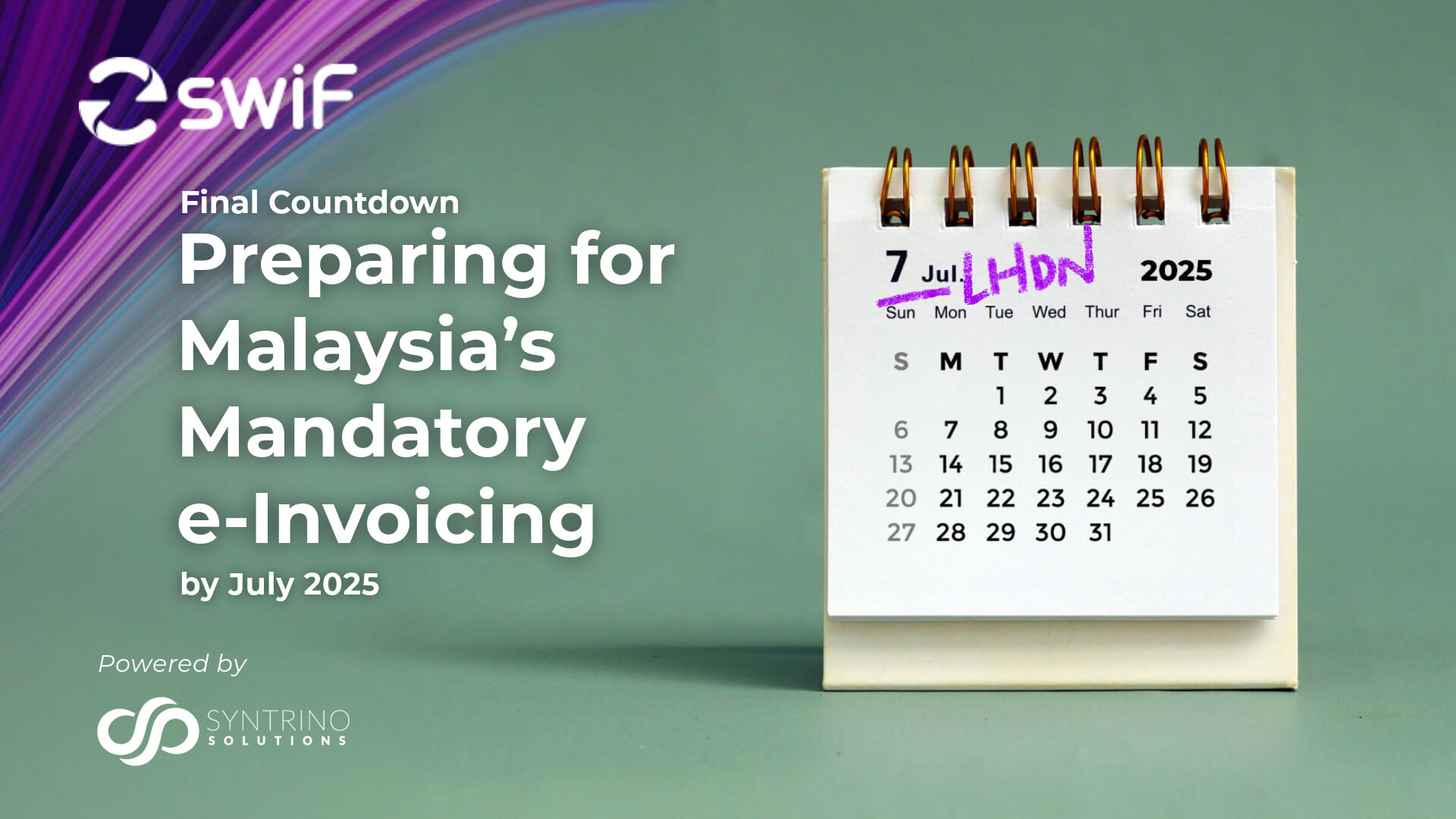

- Compliance and Regulations: Ensure that your flexible payment options comply with relevant financial regulations and industry standards to avoid legal and reputational risks.

- Operational Complexity: Manage the increased administrative burden and complexity involved in administering and reconciling flexible payment plans.

- Customer Education: Proactively educate customers on the available flexible payment options and their associated terms to avoid confusion and misunderstandings.

- Integration with Existing Systems: Seamlessly integrate flexible payment solutions with your existing financial, accounting, and customer management systems to maintain a cohesive and efficient operational environment.

By addressing these challenges through strategic planning, process optimisation, and the deployment of appropriate technologies, fintech can help companies successfully implement flexible payment options and reap the rewards of enhanced customer satisfaction, increased sales, and long-term revenue growth.

Conclusion

The ability to offer flexible payment options represents a critical differentiator for your business. By empowering your customers with customisable payment plans, your company can improve satisfaction, drive sales, and strengthen long-term relationships. The advantages of flexible payment options are manifold, from increased conversion rates to enhanced cashflow management and competitive advantage.

To learn more about how flexible payment options can transform your business, schedule a consultation with our team of experts. We’ll help you develop a tailored strategy to unlock the full potential of customisable payment plans and drive sustainable growth.

SwiF is Malaysia’s Leading-Edge B2B2C Fintech Solution.

Powered by Syntrino Solutions, Southeast Asia’s leader in supply chain management, SwiF’s digital collection and payment gateway seamlessly integrates with your existing systems, streamlining all your B2B2C transactions.

SwiF empowers businesses to offer flexible payment options, both online and offline, including major credit cards, online banking, e-wallets, BNPL, invoice financing, and micro-financing.

Our innovative e-invoicing plug-in ensures your business stays at the forefront of regulatory standards, while advanced monitoring and analytics keep you on top of your business performance at all times.