Optimising Seasonal Shopping Trends for Maximum Profit

Chinese New Year is one of the most significant and widely celebrated festivals across the globe, especially in regions with large Chinese communities. It is a time of joy, family gatherings, and most importantly for businesses, a season of heightened consumer spending. As businesses seek to capitalise on this festive period, adopting a robust payment gateway can be instrumental in driving sales and enhancing the customer experience.

Capitalising on Seasonal Shopping Trends

Chinese New Year is synonymous with a surge in shopping activities. From buying new clothes and home decor items to purchasing gifts and festive foods, consumers are eager to spend. For businesses, this presents a golden opportunity to maximise sales. However, to truly leverage this seasonal spike, it is crucial to offer a seamless and fast payment process. A well-designed payment gateway ensures that businesses capture more sales by providing a smooth and efficient transaction experience. With the capability to handle multiple transactions simultaneously, it eliminates the risk of transaction failures or delays, thereby keeping customers satisfied and increasing purchase completion rates.

Ensuring a Seamless Customer Experience

During the festive season, customers are often pressed for time and looking for quick, hassle-free shopping experiences. A payment gateway plays a vital role in providing convenience and ease to customers. Features such as quick payment processing, mobile compatibility, and multiple payment options reduce friction and enhance the overall shopping experience. Businesses can significantly improve customer satisfaction and conversion rates by integrating a reliable payment gateway, that caters to the busy schedules of consumers during this time of year.

Managing Higher Transaction Volumes

The spike in consumer spending during Chinese New Year leads to a significant increase in transaction volumes. For businesses, managing this surge efficiently is critical to maintaining customer trust and ensuring smooth operations. A robust payment gateway is designed to handle high transaction volumes with ease, offering features such as fraud protection, scalability, and real-time transaction monitoring. These capabilities ensure that businesses can manage the increased sales without compromising on security or performance. By using an effective payment gateway, businesses can avoid the pitfalls of overloaded systems and provide a seamless shopping experience to their customers.

Maximising Sales with Multiple Payment Options

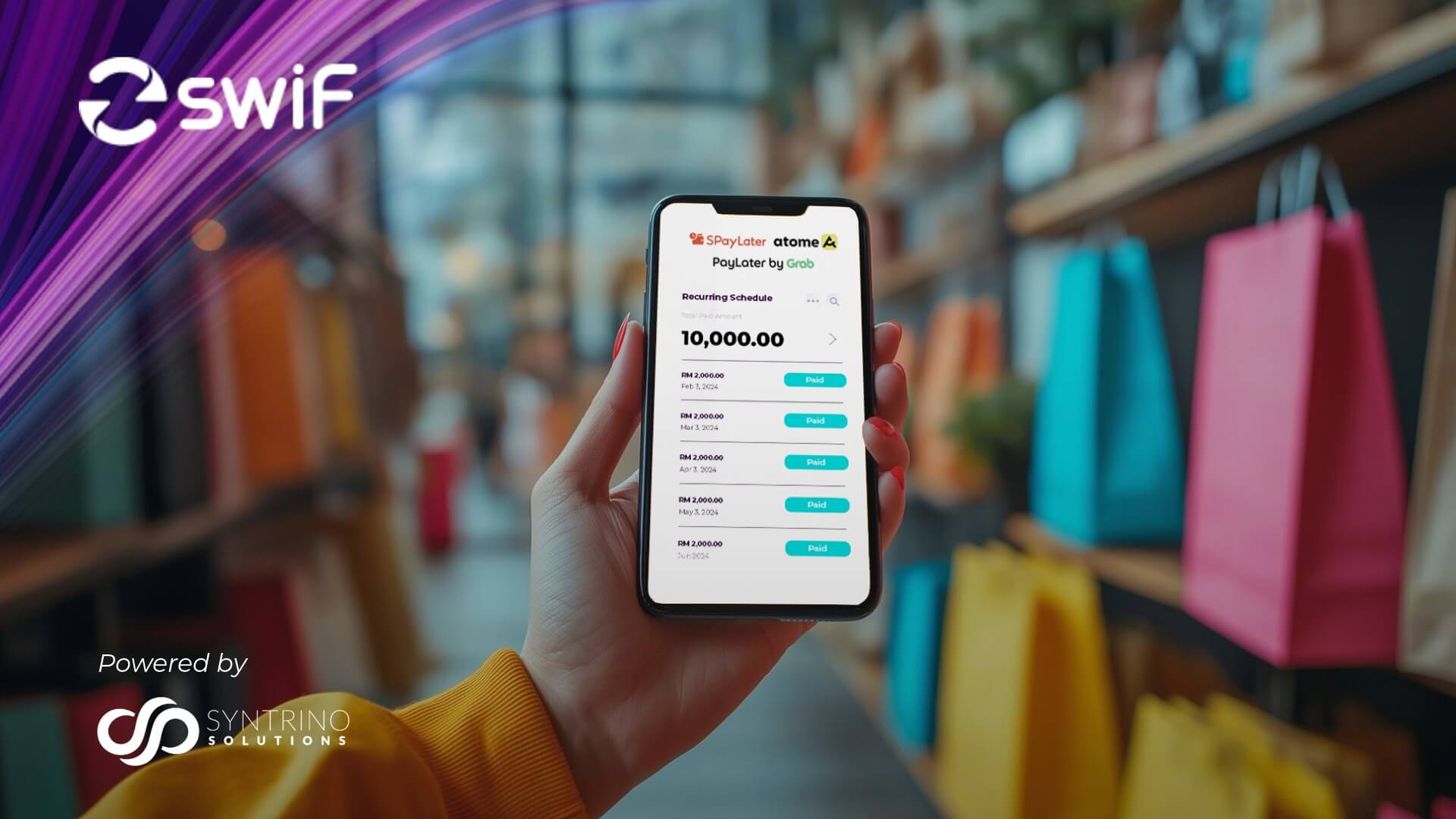

One of the key factors in driving sales is offering customers multiple payment options. During Chinese New Year, consumers may prefer different payment methods based on convenience, preferences, or availability of funds. A versatile payment gateway supports various payment options, including credit cards, digital wallets, BNPL and online bank transfers, ensuring that businesses cater to every consumer preference. By providing a range of payment methods, businesses can attract more customers and improve their chances of closing sales. This flexibility in payment options not only enhances the customer experience but also boosts sales conversion rates.

Simplifying Gift Card and Voucher Transactions

Gift-giving is an integral part of Chinese New Year celebrations. Businesses can tap into this market by offering gift cards and vouchers, which are popular choices for festive gifts. A payment gateway that seamlessly integrates with gift card and voucher offerings, makes it easy for customers to purchase and redeem them. This integration simplifies the transaction process and encourages more customers to buy gift cards, driving additional sales for businesses. By adopting a payment gateway that supports gift card transactions, businesses can leverage the festive spirit of gift-giving to boost their revenue.

Enhancing Customer Loyalty

A seamless and efficient payment experience can significantly enhance customer loyalty. When customers find it easy to make purchases and experience minimal friction during transactions, they are more likely to return to the same business for future purchases. A reliable and user-friendly payment solution encourages repeat business. By ensuring that customers have a positive shopping experience during Chinese New Year, businesses can build a loyal customer base that extends beyond the festive season.

Streamlining Business Operations

Adopting a payment gateway not only benefits customers but also streamlines business operations. The payment gateway automates various aspects of the transaction process, reducing the need for manual intervention and minimising errors. This automation allows businesses to focus on other critical areas such as inventory management, customer service, and marketing strategies. By simplifying the payment process, businesses can operate more efficiently and effectively during the busy festive season.

Leveraging Data Insights

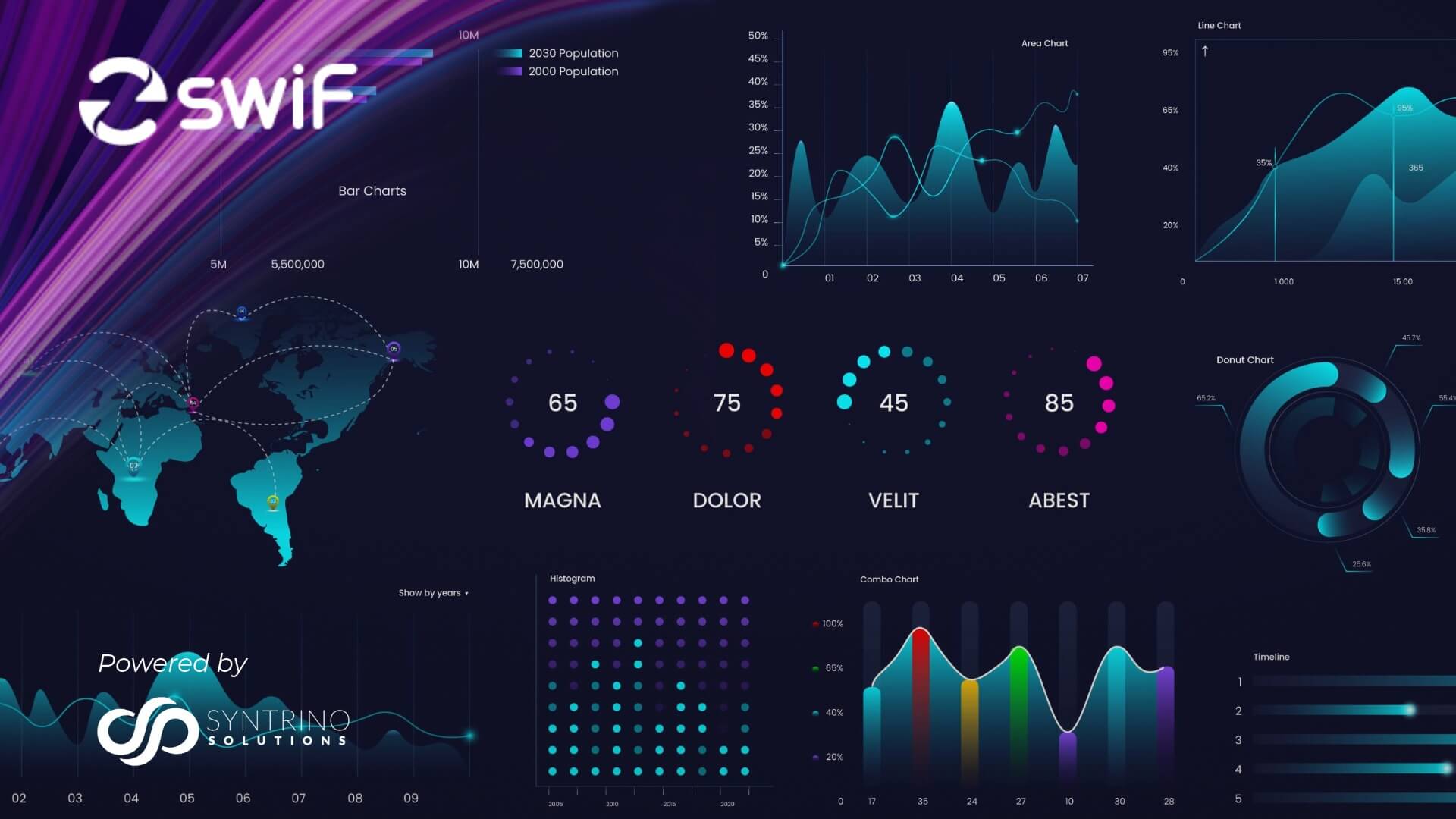

In addition, a sophisticated payment gateway like SwiF provides businesses with valuable data insights. Detailed transaction reports and analytics can help businesses understand consumer behaviour, preferences, and spending patterns during Chinese New Year. These insights enable businesses to make informed decisions, optimise their sales strategies, and tailor their offerings to meet customer needs. By leveraging data from the payment gateway, businesses can enhance their marketing efforts and maximise their sales potential.

Ensuring Regulatory Compliance

Compliance with regulatory requirements is essential for businesses, especially when handling financial transactions. Adhering to all relevant regulations and standards ensures that businesses remain compliant. This compliance not only protects businesses from legal issues but also instils confidence in customers, who can trust that their payments are secure and handled responsibly. By adopting a payment gateway, businesses can focus on growth and sales while ensuring that all regulatory obligations are met.

Conclusion

Adopting a payment gateway during Chinese New Year brings numerous advantages. From capitalising on increased consumer spending to ensuring a smooth customer experience, handling higher transaction volumes, and boosting sales through multiple payment options, a robust payment gateway is essential for businesses aiming to maximise their sales this festive season. By simplifying gift card transactions, strengthening customer loyalty, streamlining operations, leveraging valuable data insights, and maintaining regulatory compliance, a comprehensive payment solution fosters growth and success for businesses. This Chinese New Year, harness the power of a reliable payment gateway to drive your business forward.

We invite you to explore our solutions and experience the positive impact on your sales performance.

SwiF is Malaysia’s Leading-Edge B2B2C Fintech Solution.

Powered by Syntrino Solutions, Southeast Asia’s leader in supply chain management, SwiF’s digital collection and payment gateway seamlessly integrates with your existing systems, optimising all your B2B2C transactions.

SwiF empowers businesses with flexible payment options, both online and offline.

Our innovative e-invoicing plug-in ensures your business stays ahead of regulatory requirements, while advanced monitoring and analytics provide real-time insights into your business performance.