Speed is no longer a luxury; it is a necessity. From order fulfilment to customer service, businesses are under pressure to deliver faster, more seamlessly, and with greater transparency. Now, that demand has reached payment systems too.

Real-time payments are emerging as a powerful tool for businesses seeking greater control over cash flow, improved customer satisfaction, and streamlined operations. Whether you are an SME, managing B2B2C operations, or expanding across borders, real-time payments can support your next phase of growth.

But what are real-time payments, and why should you consider them?

What Are Real-Time Payments?

Real-time payments (RTP) are financial transactions that are initiated, processed, and settled within seconds. Unlike traditional bank transfers that may take one or two business days (T+1 or T+2), real-time payments are completed almost instantly, 24 hours a day, 365 days a year.

In Malaysia, DuitNow is a leading example of this payment infrastructure. Around the world, similar systems such as SEPA Instant in the EU and Faster Payments in the UK are driving instant transaction capabilities across borders.

Why Real-Time Payments Matter for Modern Businesses

1. Improved Cash Flow

Instant settlement gives businesses quicker access to funds. This enables faster reinvestment, smoother supplier payments, and more predictable financial planning, especially for SMEs with tight working capital cycles.

2. Better Customer Experience

Modern consumers expect efficiency at every touchpoint, including how they pay and receive funds. Real-time capabilities allow for quicker order confirmations, immediate refunds, and frictionless checkout processes that enhance customer satisfaction.

3. Operational Efficiency

Real-time payments reduce the need for manual reconciliation and limit delays in accounts processing. Businesses benefit from fewer payment errors, faster reporting, and improved financial oversight.

Cross-Border Transactions: Growing Without the Delays

Expanding regionally or globally often brings complexity in payments. Traditional cross-border transfers are typically slower, expensive, and difficult to track.

Thanks to payment platforms such as Alipay+, WeChat Pay, and our SwiF Cross-Border Payment Gateway, businesses in Malaysia and Southeast Asia can now:

- Accept payments from overseas e-wallets

- Disburse funds quickly to international partners

- Ensure security and compliance throughout the process

These capabilities make international trade and customer acquisition easier, while supporting real-time business growth across borders.

Who Benefits Most from Real-Time Payments?

Real-time payments offer value across various industries:

- Retail and F&B: Immediate settlement improves daily cash flow and supports same-day staff payouts

- Professional Services: Invoicing and payment processes become faster and more reliable

- Digital Platforms and Marketplaces: Timely vendor disbursements improve trust and engagement

- Distributors and B2B2C Brands: High-frequency transactions become easier to track and manage

SwiF in Action: Making Real-Time Payments Work for You

At SwiF, we provide businesses with a complete platform to enable real-time, secure, and intelligent transactions.

With the SwiF payment hub, you can:

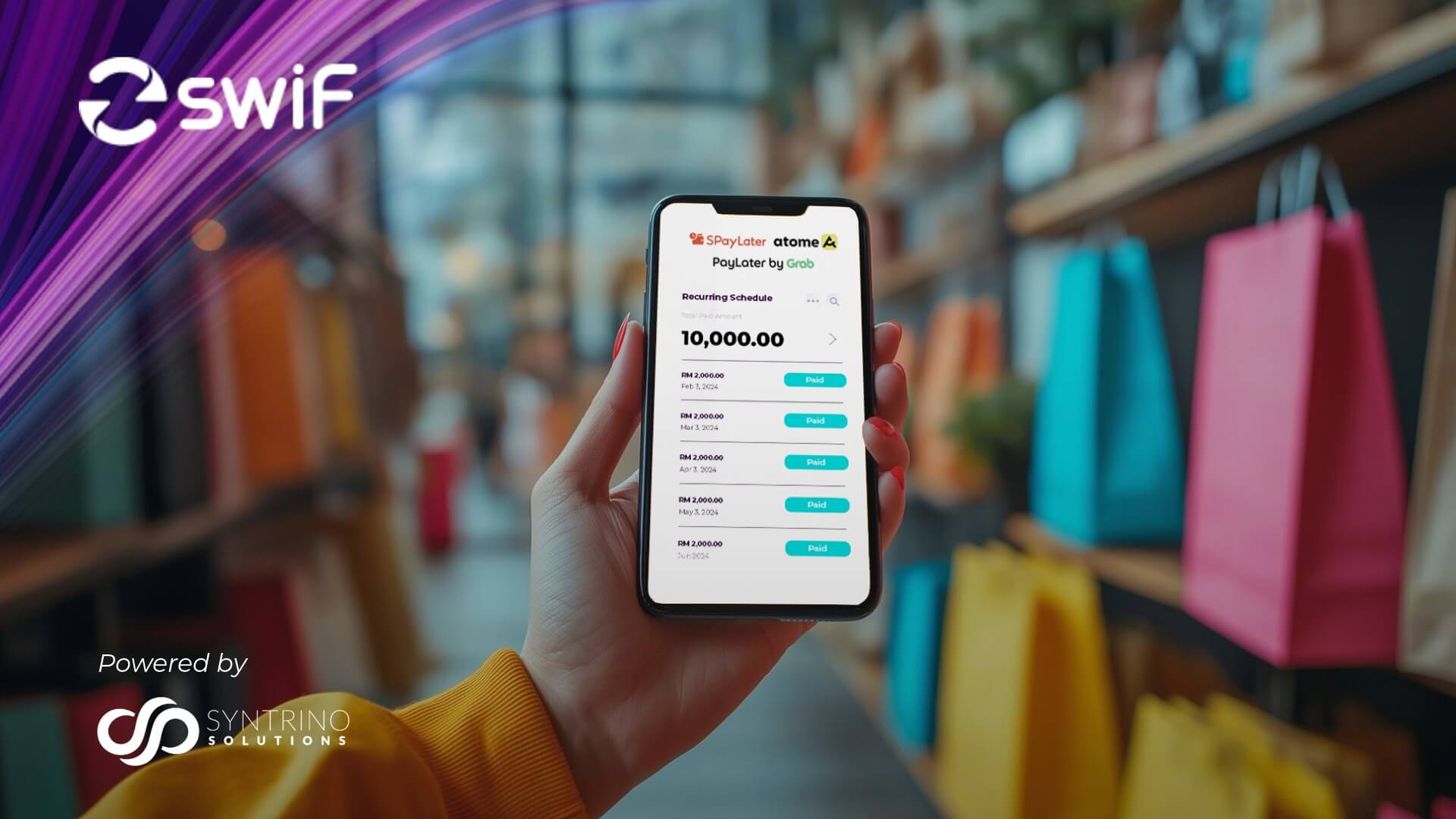

- Accept major credit cards, e-wallets (GrabPay, ShopeePay, Touch ’n Go), DuitNow QR, and Buy Now Pay Later (BNPL)

- Manage cross-border collections and disbursements with platforms such as Alipay+ and WeChat Pay

- Embed payment links into LHDN-compliant e-invoices

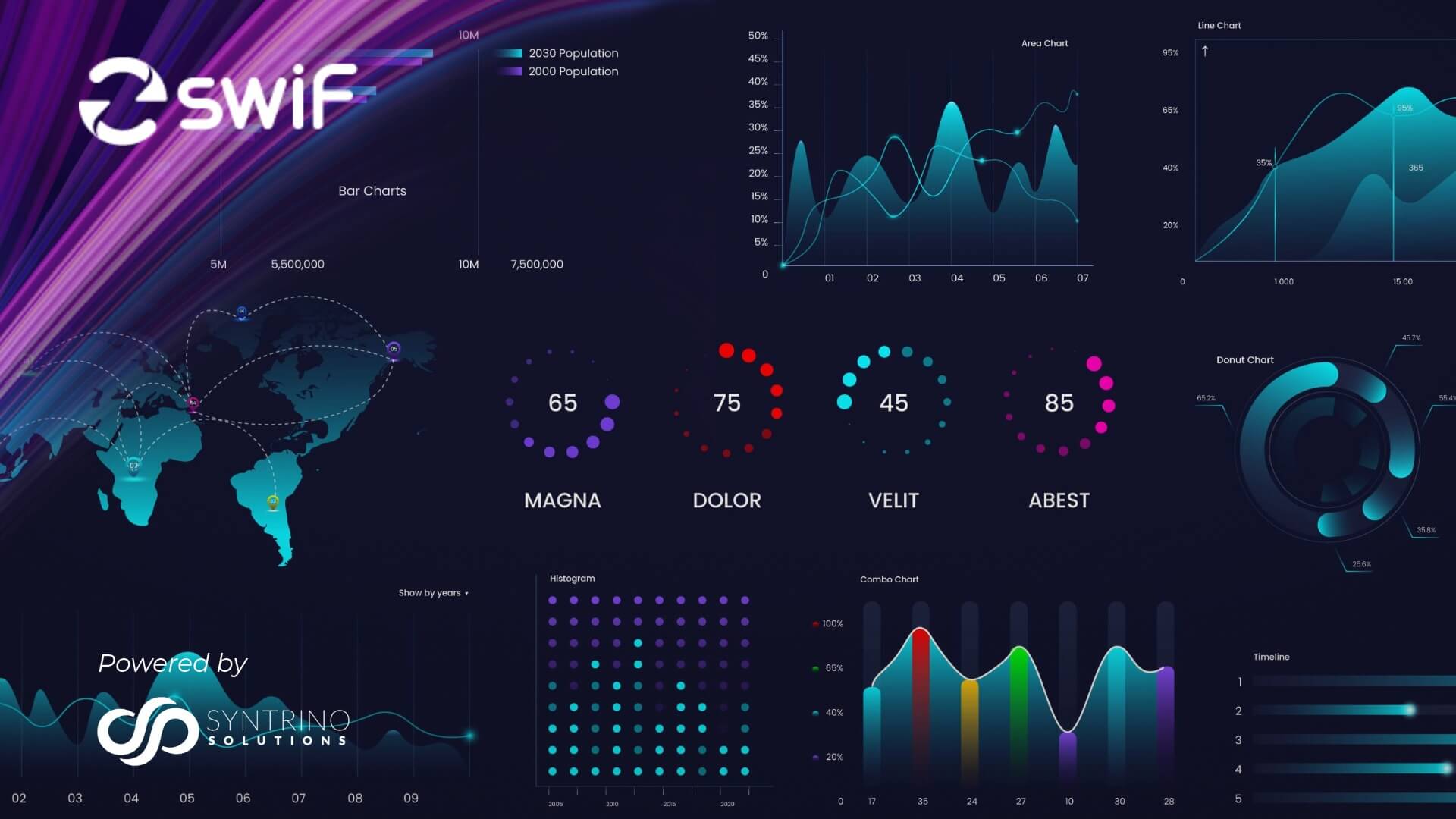

- Access a real-time dashboard to monitor transactions and trends

Whether you operate online, offline, or across both, SwiF helps you simplify your payment ecosystem.

Final Thoughts: More Than Speed, It’s About Strategy

Real-time payments are not just about going faster. They empower better cash flow, smarter business decisions, and a stronger customer experience.

In a competitive landscape, businesses that adopt real-time transaction capabilities position themselves for sustainable and scalable growth.

Ready to Move in Real Time?

Give your customers speed and your business control.

Explore SwiF’s real-time payment solutions today.

Explore SwiF Payment Tools

Book a Free Consultation

Learn More about our Payment Methods

SwiF is Malaysia’s Leading-Edge B2B2C Fintech Solution.

Our all-in-one Payment Hub empowers businesses to offer flexible, seamless payment options, both online and offline. Accept major credit cards, online banking, e-wallets, BNPL, invoice financing, and micro-financing through a single, integrated system.

SwiF’s smart e-invoicing plug-in simplifies your compliance journey by ensuring every invoice meets LHDN regulatory standards. More than just compliance, it gives you real-time visibility, automated tracking, and actionable analytics to optimise cash flow and business performance.

Built by Syntrino Solutions, Southeast Asia’s supply chain innovation leader, SwiF integrates effortlessly with your existing systems, streamlining every aspect of your B2B2C transactions from invoicing to payment collection.