Offering the right payment methods isn’t just about convenience, it’s about maximising conversion, improving cash flow, and meeting customer expectations.

Whether you’re an SME retailer, B2B service provider, or scaling a B2B2C brand in Malaysia or Southeast Asia, choosing between credit cards, e-wallets, and Buy Now Pay Later (BNPL) can feel overwhelming.

So, which payment option is best suited to your business?

Let’s break it down.

Why Choosing the Right Payment Option Matters

A smooth and flexible payment experience can:

- Reduce cart abandonment

- Improve cash flow

- Boost customer retention

- Provide valuable insight into customer preferences

According to recent fintech trends, businesses offering two or more payment options can increase conversions by up to 30%. For SMEs and B2B2C merchants especially, adapting to diverse customer behaviours is no longer optional, it’s essential.

Explore SwiF’s Payment Gateway and Collection Tools

Credit Cards: The Traditional Power Player

How They Work:

Credit cards remain widely used in B2B and high-value consumer transactions, particularly for subscriptions, invoiced services, or recurring payments.

✅ Advantages:

- Quick fund settlement (typically within T+1 or T+2)

- Strong fraud protection (PCI DSS, tokenization)

- Ideal for automated billing, SaaS, and professional services

❌ Disadvantages:

- Higher merchant fees (1.5%–3%)

- Less appealing to price-sensitive or unbanked customers

- Less popular among younger and micro-enterprise segments

Best For:

Consultancies, software providers, business services, and high-ticket one-off purchases

Learn More About Credit Card Collection Benefits – link https://swifs.io/receive-payments-credit-card/

e-Wallets: Everyday Convenience for a Mobile-First Market

How They Work:

e-wallets like GrabPay, Boost, Touch ‘n Go, and ShopeePay allow mobile users to make quick, cashless payments through QR code scans or in-app checkout.

✅ Advantages:

- Strong adoption among mobile-first consumers

- Useful for on-site collections, deliveries, or event sales

- Real-time settlement and typically lower fees than card payments

❌ Disadvantages:

- Less suited for large B2B or invoiced transactions

- Fragmented market (users favour different wallets)

- Relies on customer familiarity with digital tools

Best For:

Retailers, food and beverage businesses, freelancers, delivery services, and market stalls

See How SwiF Supports e-Wallet Payments

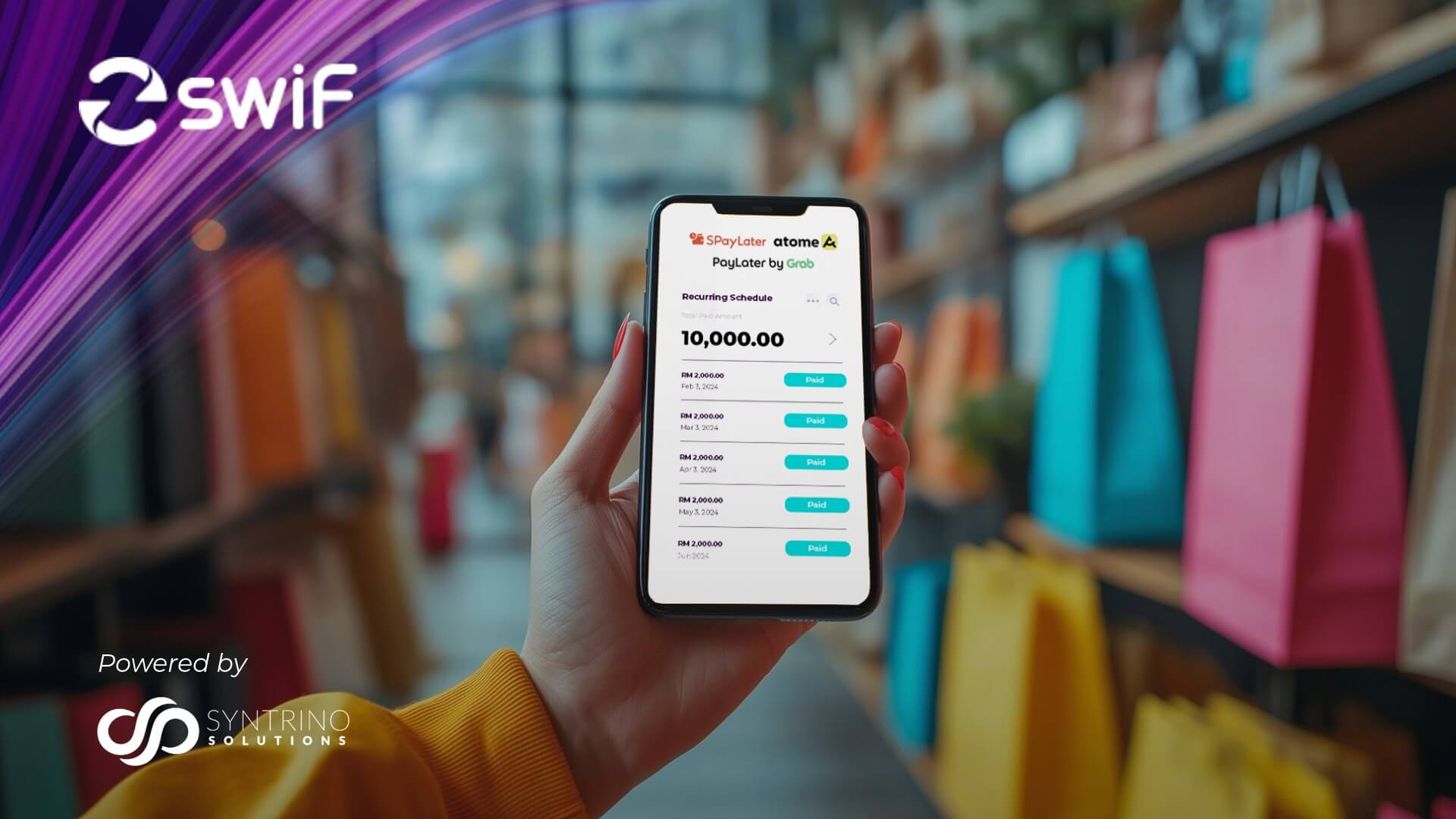

BNPL: Flexible Financing for Bigger Baskets

How It Works:

BNPL enables customers to split their purchases into instalments. Your business receives full payment upfront while the customer repays in 3 to 6 months.

✅ Advantages:

- Increases order size and conversion rates

- Eliminates payment risk for the merchant

- Helps businesses reach customers who prefer flexible financing

❌ Disadvantages:

- Some customers may require credit checks

- Not ideal for small purchases

- Possible perception risks around promoting customer debt

Best For:

B2B2C services, training providers, equipment sellers, digital agencies, and wholesale distributors

Explore How SwiF Supports BNPL

SwiF Insight: Why Offering All Three = A Strategic Advantage

Instead of choosing just one, SwiF enables you to offer all three payment options from a single payment hub, fully integrated across your website, mobile, POS, or social channels.

With SwiF, you can:

- Accept credit cards, FPX, e-wallets, DuitNow QR, and BNPL at once

- Tailor your checkout experience for each customer profile

- Access real-time reports to see which payment methods are converting best

- Offer split payments, partial payments, or recurring billing with no hassle

Compare All SwiF Payment Solutions Here

Final Thoughts: Let Data Guide Your Payment Strategy

There’s no universal “best” payment method. The right approach depends on your:

- Business model

- Customer demographics

- Cash flow goals

But what’s certain is this: the more payment flexibility you offer, the more revenue opportunities you unlock.

SwiF makes it simple to give your customers choice, while giving you control and visibility over every transaction.

Ready to Optimise Your Payment Mix?

Whether you’re just starting out or scaling regionally, SwiF helps you offer the right mix of modern payment methods for your business and your customers.

Book a Free Payment Strategy Session

Get Started with SwiF Today

SwiF is Malaysia’s Leading-Edge B2B2C Fintech Solution.

Our all-in-one Payment Hub empowers businesses to offer flexible, seamless payment options—both online and offline. Accept major credit cards, online banking, e-wallets, BNPL, invoice financing, and micro-financing through a single, integrated system.

SwiF’s smart e-invoicing plug-in simplifies your compliance journey by ensuring every invoice meets LHDN regulatory standards. More than just compliance, it gives you real-time visibility, automated tracking, and actionable analytics to optimise cash flow and business performance.

Built by Syntrino Solutions, Southeast Asia’s supply chain innovation leader, SwiF integrates effortlessly with your existing systems—streamlining every aspect of your B2B2C transactions from invoicing to payment collection.

Related Articles