The Impact of Fintech on Cashflow Management

Cashflow management is a critical aspect of business operations, as it directly impacts an organisation’s financial health, growth potential, and ability to seize opportunities. Traditional methods of managing cashflow often involve manual processes, complex spreadsheets, and the risk of human error. However, the advent of B2B2C fintech has brought in a new era of automated, efficient, and data-driven cashflow management.

By leveraging the power of B2B2C fintech, businesses can gain greater visibility into their financial inflows and outflows, enabling them to make informed decisions, anticipate cash shortages, and optimise resource allocation. This, in turn, can lead to improved profitability, reduced operational costs, and enhanced financial resilience.

This article delves into the key features and benefits of implementing a B2B2C fintech platform to revolutionise your cashflow management.

Key Features & Benefits of a B2B2C Fintech Platform

A robust B2B2C fintech platform offers a multitude of features to consider:

- Automated Invoicing and Billing: B2B2C fintech solutions often include integrated invoicing and billing systems that streamline the process of generating, sending, and tracking invoices.

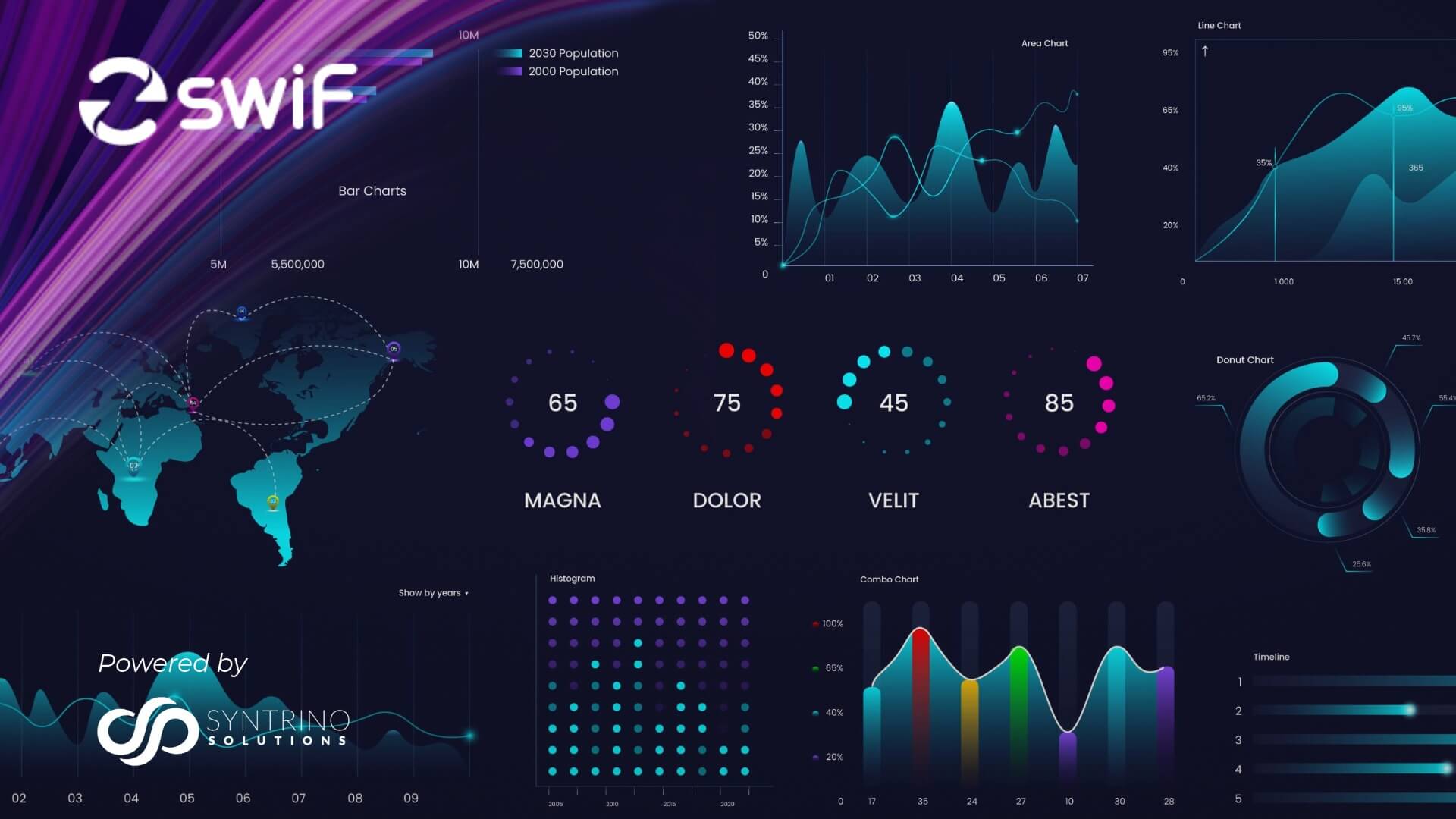

- Intelligent Reporting and Analytics: B2B2C fintech’s intelligent reporting and analytic capabilities incorporate sophisticated data analytics and machine learning algorithms to provide real-time visibility and insights into your organisation’s cashflow i.e. monitor incoming payments, outstanding invoices and projected cash balances. These insights can help you identify trends, predict cash shortages, and make informed decisions.

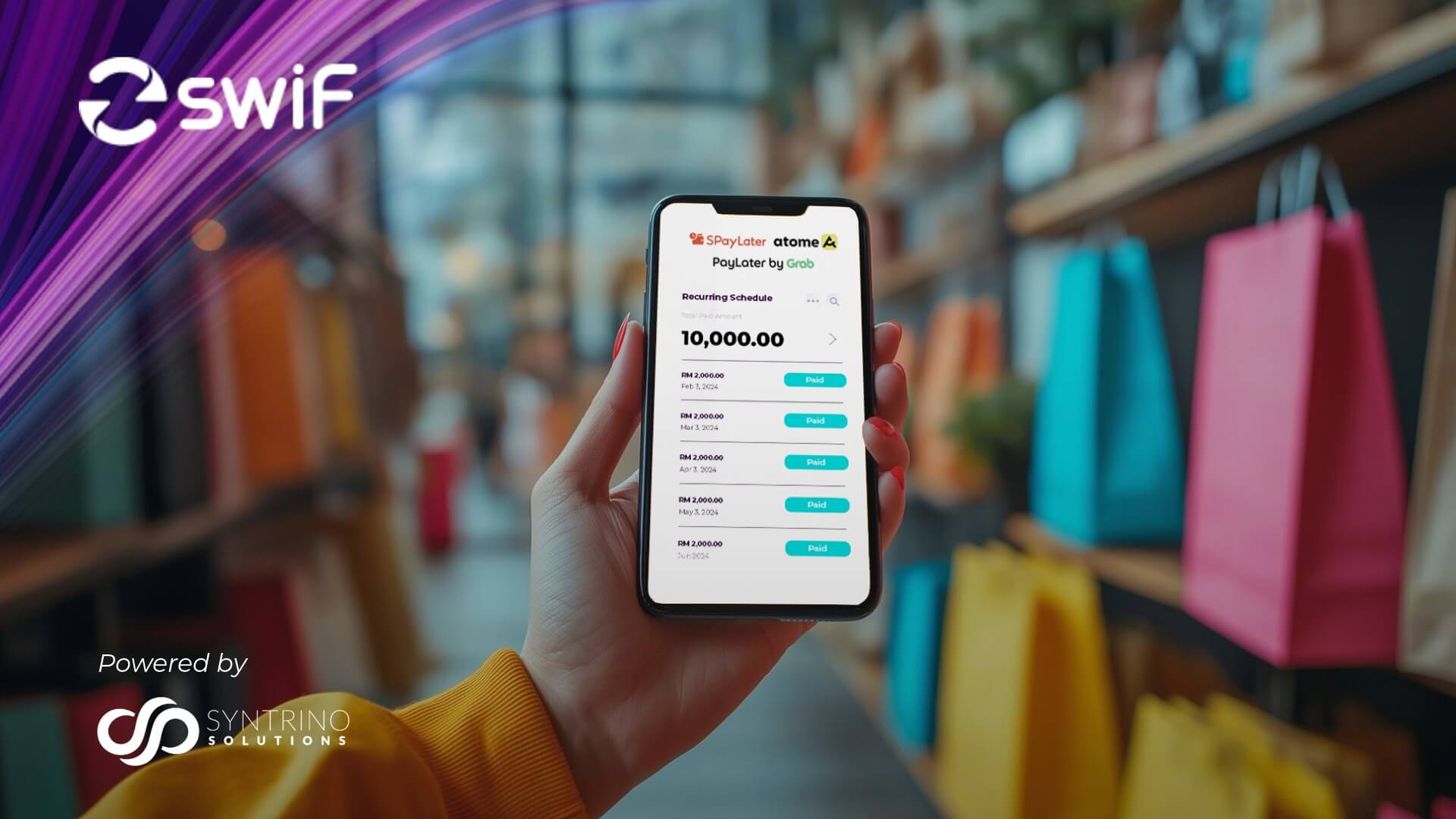

- Integrated Payment Processing: B2B2C fintech platforms like SwiF, offer seamless integration with payment gateways, allowing your customers to make payments securely and conveniently. This streamlined payment processing can accelerate cash collection and improve the overall customer experience.

- Automated Reconciliation: B2B2C fintech solutions often include automated reconciliation features that match incoming payments with outstanding invoices, reducing the time and effort required for manual reconciliation tasks.

Implementing a Payment Gateway for Seamless Transactions

At the heart of a successful B2B2C fintech solution lies a robust payment gateway that facilitates seamless transactions between your business and your customers. By integrating a reliable payment gateway, you can enhance the overall customer experience, streamline cashflow, and mitigate the risks associated with traditional payment methods.

Consider the following key factors:

- Security and Compliance: Ensure that the payment gateway you choose adheres to the highest security standards and is compliant with industry regulations, such as PCI-DSS (Payment Card Industry Data Security Standard), to protect your customers’ sensitive financial information.

- Multichannel Support: Look for a payment gateway that supports a variety of payment methods, including credit/debit cards, digital wallets, and alternative payment options, to cater to the diverse preferences of your customer base.

- Seamless Integration: Choose a payment gateway that seamlessly integrates with your B2B2C fintech platform, enabling a frictionless payment experience and streamlined data flow between the two systems.

- Reporting and Analytics: Opt for a payment gateway that provides comprehensive reporting and analytics capabilities, allowing you to track transaction details, identify payment trends, and make informed decisions about your cashflow management strategies.

The Key Takeouts of B2B2C Fintech Platform Integration

The integration of cutting-edge technology and its impact on cashflow management cannot be overstated. As you embrace the integration of B2B2C fintech platform in your cashflow management, your organisation will begin to experience:

- Improved Visibility and Transparency: By integrating your accounting systems, payment gateways, and other financial data sources, B2B2C fintech platforms offer a comprehensive view of your organisation’s cashflow for tight control over your financial resources.

- Enhanced Collaboration and Communication: Many B2B2C fintech solutions offer collaborative features, such as shared dashboards, automated notifications, and integrated communication channels. This facilitates seamless collaboration between your finance team, business stakeholders, and customers, fostering a more transparent and efficient cashflow management process.

- Scalability and Flexibility: As your business grows and evolves, a B2B2C fintech platform should be able to scale with your requirements, accommodating increased transaction volumes, new payment methods, and evolving regulatory compliance needs.

Conclusion

The adoption of B2B2C fintech solutions has become a strategic imperative for organisations seeking to improve their cashflow management. Experience the advanced features and capabilities of these platforms to streamline your financial operations, enhance visibility, and make data-driven decisions to optimise your cash flow.

Want to learn more about how B2B2C fintech can transform your cashflow management? Schedule a consultation with our team of experts today. We’ll help you assess your specific needs, identify the right solutions, and guide you through the implementation process to ensure a seamless transition and maximum ROI.

SwiF is Malaysia’s Leading-Edge B2B2C Fintech Solution.

Powered by Syntrino Solutions, Southeast Asia’s leader in supply chain management, SwiF’s digital collection and payment gateway streamlines B2B2C transactions with simplicity, transparency, and visibility.

Our comprehensive Payment Gateway solution enables businesses to accept various payment methods, online and offline, including major credit cards, online banking, invoice financing, and e-wallets. With our recent collaboration with Funding Societies Malaysia, SwiF Payment Gateway now seamlessly incorporates micro-financing capabilities.