In a world where environmental concerns are growing, businesses are seeking sustainable solutions to reduce their impact on the planet. B2B fintech companies are at the forefront of this movement, driving the change towards a greener future. With their innovative technologies and strategic partnerships, these companies are revolutionising the financial industry while prioritising sustainability.

From digital payments to carbon footprint tracking, B2B fintech companies worldwide offer a range of sustainable solutions for businesses. Their cutting-edge platforms enable companies to streamline processes, reduce waste, and lower their energy consumption. By integrating sustainable practices into financial operations, B2B fintech is not only driving cost savings but also contributing to global efforts for a more sustainable future.

As the demand for eco-friendly options continues to grow, B2B fintech companies are stepping up to the challenge. By harnessing the power of technology, they are empowering businesses to make environmentally conscious decisions without compromising efficiency or profitability. Through their efforts, B2B fintech is paving the way for a greener and more sustainable future for businesses worldwide.

The Importance of Sustainability in the Financial Industry

When it comes to sustainability, the financial sector is no exception. This industry plays a significant role in the global economy, and its practices have wide-ranging impacts on the environment. From energy consumption to paper waste, traditional financial processes contribute to the carbon footprint and environmental degradation.

Recognising the need for change and providing businesses with sustainable solutions, B2B fintech companies are helping to reduce the environmental impact of financial operations. This shift towards sustainability is not only driven by ethical considerations but also by the growing demand from consumers and investors for environmentally responsible practices.

By adopting sustainable fintech solutions, businesses can not only reduce their ecological footprint but also improve their reputation and attract environmentally conscious customers. Sustainable practices can also result in cost savings, as businesses can optimise processes, reduce waste, and lower energy consumption. The integration of sustainability into financial operations is a win-win situation, benefiting both the environment and the bottom line.

Key Challenges and Opportunities in Sustainable Fintech

While the adoption of sustainable fintech solutions present numerous opportunities, it is not without its challenges. One key challenge is the need for businesses to balance sustainability with profitability. Many businesses may be hesitant to invest in sustainable fintech solutions due to concerns about the upfront costs or potential disruptions to existing processes. However, B2B fintech companies, like SwiF are addressing these challenges by providing cost-effective and seamless solutions that integrate with existing systems.

The transition to sustainable fintech also allow opportunities for collaboration and partnerships. B2B fintech companies are collaborating with other stakeholders, including financial institutions, technology providers, and sustainability experts, to develop and implement sustainable solutions. These partnerships foster knowledge sharing, innovation, and the co-creation of new products and services.

How B2B Fintech is Driving the Adoption of Sustainable Practices

One area where B2B fintech is making a significant impact is in digital payments. By offering secure and efficient digital payment platforms, B2B fintech companies are eliminating the need for paper-based transactions, reducing waste, and lowering the carbon footprint associated with traditional payment methods.

Another area is in supply chain financing. By leveraging blockchain technology, B2B fintech companies are enabling businesses to track and verify the sustainability credentials of their suppliers. This transparency helps businesses make informed decisions about their supply chain partners, encouraging the adoption of sustainable practices throughout the value chain.

Additionally, some B2B fintech companies are developing innovative solutions for carbon footprint tracking and reporting. These solutions enable businesses to measure and monitor their carbon emissions in real-time, empowering them to identify areas for improvement and take proactive measures to reduce their environmental impact. When businesses are provided with the data and insights they need, B2B fintech will drive the adoption of sustainable practices on a global scale.

Successful Sustainable Fintech Initiatives

The opportunities for businesses to collaborate with B2B fintech companies are limitless.

Globally some successful cases have already shown the potential role and impact of B2B fintech on sustainability.

One example involves a partnership between a B2B fintech company and a leading retail chain to develop a digital payment platform incentivising customers to choose eco-friendly products, thereby driving customer loyalty and boosting sales.

Another case study showcases a collaboration between a B2B fintech firm and a renewable energy provider to offer affordable financing for green projects, aiding in emissions reduction and supporting renewable energy growth.

These examples represent just some of the cases in which B2B fintech can actively drive sustainable practices across industries, employ innovation and partnerships to pave the way for a greener future.

Innovations and Technologies Shaping Sustainable Fintech

One key technology that is driving sustainability in the financial industry is blockchain. Blockchain technology provides a secure and transparent platform for tracking and verifying sustainability credentials, such as carbon emissions and supply chain sustainability. This in turn enables businesses to make informed decisions based on verified sustainability data.

Artificial intelligence and machine learning are also contributing to sustainable fintech by enabling businesses to analyse large volumes of data and identify patterns and trends. With the power and potential of AI, B2B fintech companies can help businesses optimise their processes, reduce waste, and make data-driven decisions that contribute to sustainability goals.

Internet of Things (IoT) devices are another technology shaping sustainable fintech. IoT devices can collect real-time data on energy consumption, water usage, and other sustainability indicators, providing businesses with valuable insights for optimising resource allocation and reducing environmental impact.

These technological innovations are revolutionising the financial industry and enabling businesses to embrace sustainability in a scalable and efficient manner.

Conclusion

The future of sustainable B2B fintech is promising. As businesses and consumers increasingly prioritise sustainability, the demand for sustainable fintech solutions will continue to grow. B2B fintech companies are well-positioned to meet this demand by providing innovative and scalable solutions that drive sustainable practices.

Through strategic partnerships, technological advancements, and regulatory support, B2B fintech companies are creating a supportive ecosystem for businesses to embrace sustainability. The integration of sustainability into financial operations not only benefits the environment but also offers cost savings and business opportunities.

As the world navigates the challenges of climate change and environmental degradation, B2B fintech is playing a crucial role in driving change towards a greener future. Through technology, collaboration, and innovation, B2B fintech is paving the way for a more sustainable and prosperous future for businesses worldwide.

Seeking the right partner to incorporate B2B2C Fintech solutions into your organisation? Contact our team to discover how SwiF can assist your company in transitioning towards a more sustainable future.

SwiF is Malaysia’s Leading-Edge B2B2C Fintech Solution.

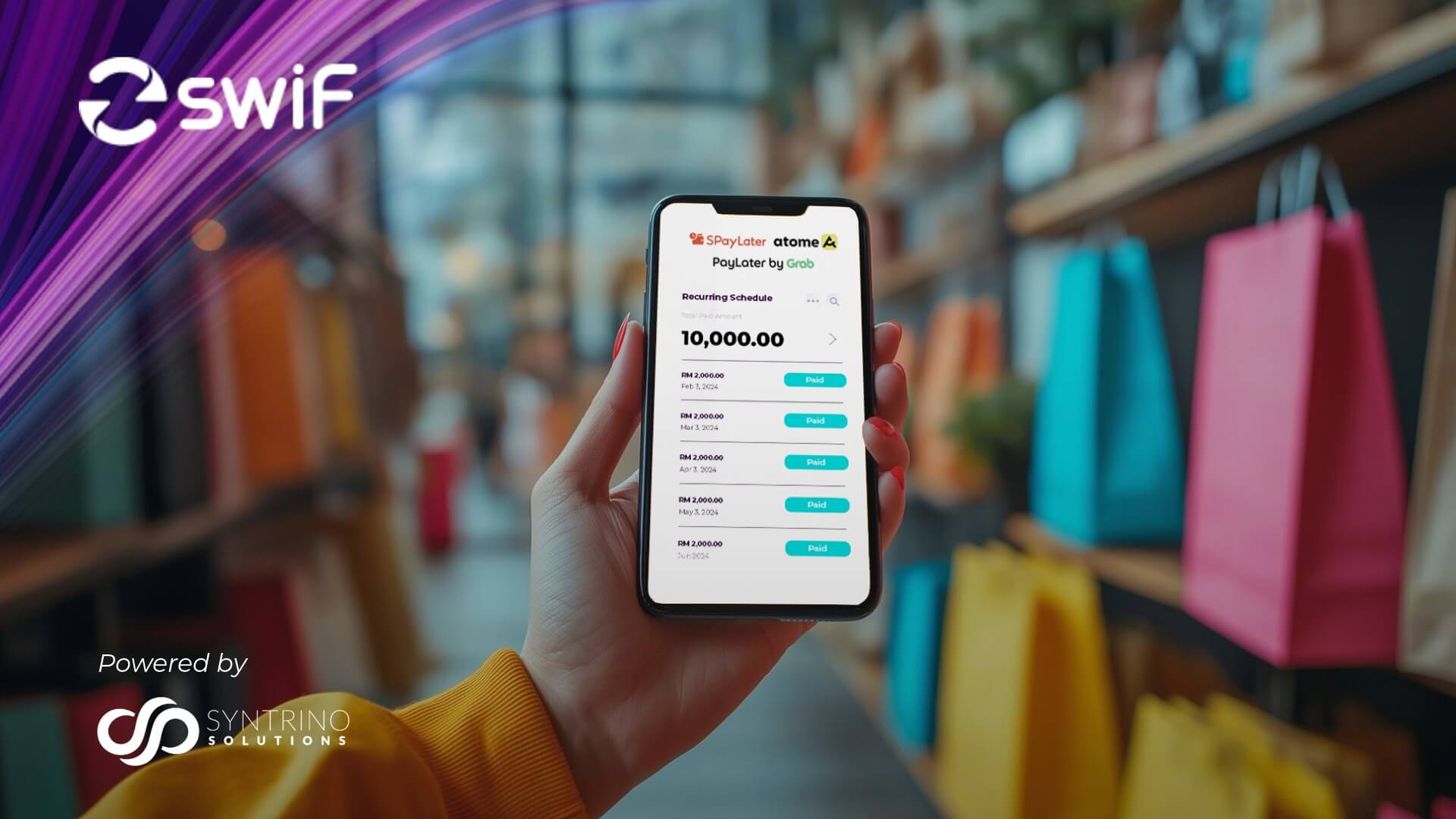

Powered by Syntrino Solutions, Southeast Asia’s leader in supply chain management, SwiF gives you access to a variety of collection and payment methods to streamline all aspects of your business operations.

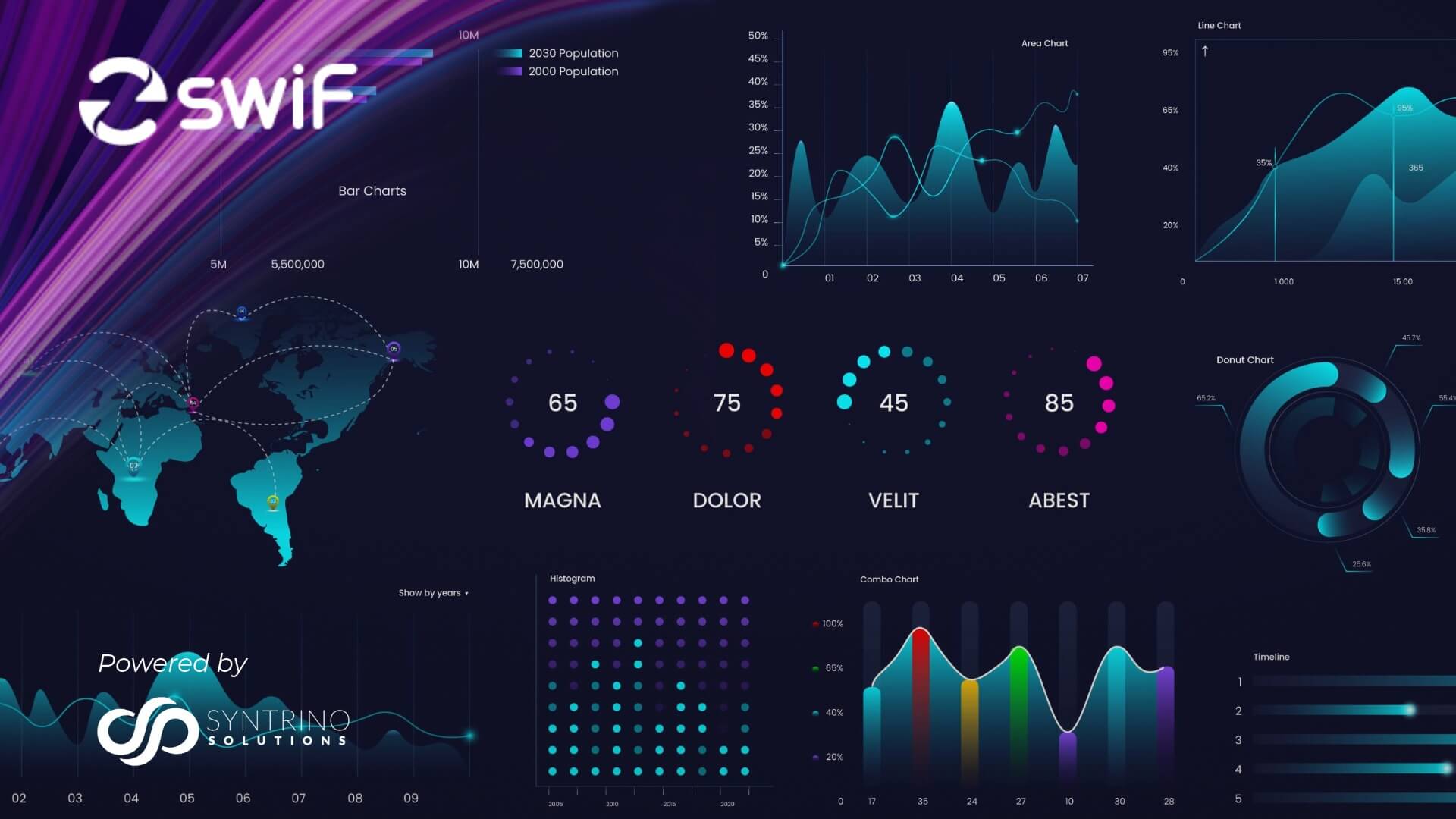

From major credit cards to online banking, e-wallets, Buy Now Pay Later, auto-debit, instalment options, and invoice financing, SwiF helps facilitate all your transactions and stay on top of your business with advanced analytics and reporting.

SwiF also takes regulatory compliance to the next level by integrating its innovative e-invoicing plug-in, ensuring your business remains at the forefront of regulatory standards.