The business environment is undergoing rapid changes, necessitating constant innovation to ensure long-term success. The days of dealing with physical cash and manual transactions are a thing of the past. In today’s era, where manual processes are becoming obsolete, incorporating a B2B2C collection & payment gateway can be a game-changer for businesses. In this article, we will dive into the various advantages of embracing a B2B2C collection & payment gateway and its potential to revolutionise business operations.

B2B2C Collection & Payment Gateways

Before exploring the benefits, it’s key to grasp the concept of a B2B2C collection & payment gateway. Acting as a secure conduit between customers and merchants, it enables the seamless acceptance of payments for both online and in-person transactions. It simplifies credit and debit card processing, facilitates FPX online banking, and supports various other payment methods. Additionally, it streamlines the often-complex task of reconciliation, ensuring both security and efficiency.

Benefits of Using a B2B2C Collection & Payment Gateway for Your Business

Increased Security and Fraud Protection

Enhanced security is one of the primary concerns for any business owner. With the rise of cyber threats and fraudulent activities, safeguarding sensitive customer information is paramount. By adopting a B2B2C collection & payment gateway, you can rest assured knowing that your customers’ data is protected through encryption and other security measures, including fraud detection systems, minimising the risk of fraudulent activities and enhancing customer trust.

Seamless Customer Experience

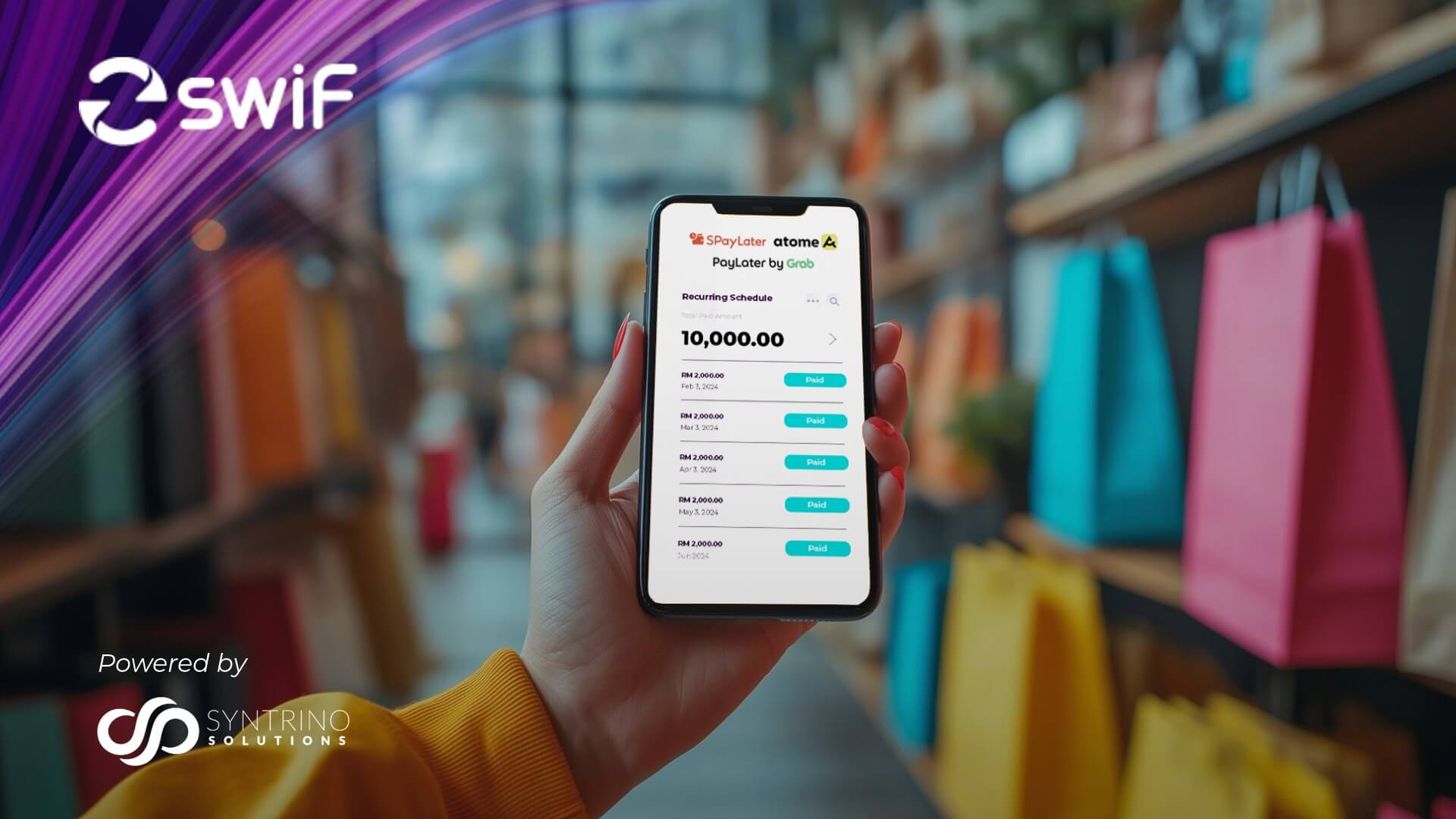

In a world where customers expect a frictionless purchasing journey, a B2B2C collection & payment gateway provides just that. By integrating it into your website, or mobile app, you can enable customers to make payments seamlessly, without the need for manual intervention. This improved checkout experience not only enhances customer satisfaction but also increases the likelihood of repeat business.

Simplified Payment Process

Gone are the days of handling cash, writing checks, or waiting for wire transfers to clear. A B2B2C collection & payment gateway streamlines the payment process by automating the entire transaction. Customers can choose their preferred payment method and proceed with just a few clicks, increasing the speed of collections for your business. The gateway handles all the complexities, from validating the transfer information to routing funds to the appropriate accounts, allowing you to focus on other aspects of your business.

Expanded Customer Base

Geographical barriers are no longer constraints for your business. A B2B2C collection & payment gateway enables you to accept payments from customers around the world, breaking down barriers and expanding your customer base. With support for multiple currencies and global payment methods, you can cater to diverse customer preferences and tap into new markets, unlocking new opportunities for your business.

Streamlined Financial Management

Keeping track of transactions, reconciling payments, and managing finances can be a complex and time-consuming task for your teams. However, with a B2B2C collection & payment gateway, these processes become streamlined and efficient. It provides access to detailed reporting and analytics, giving you real-time insights into your business’s financial health. You can easily track sales, monitor transaction trends, and generate comprehensive reports, empowering you to make informed decisions.

Integration with Other Business Tools and Platforms

To succeed, businesses depend on a variety of tools and platforms to effectively oversee their operations. A B2B2C collection & payment gateway can seamlessly integrate with your existing systems, such as your e-commerce platform, accounting software, and customer relationship management (CRM) system. This integration eliminates the need for manual data entry, reduces errors, and enhances overall efficiency.

Cost-effectiveness and Efficiency

Manual payment processing can be time-consuming and costly. Adopting a B2B2C collection & payment gateway eliminates the need for manual intervention, reducing operational costs and increasing efficiency. With faster payment processing, you can improve your cash flow and allocate resources to other areas of your business.

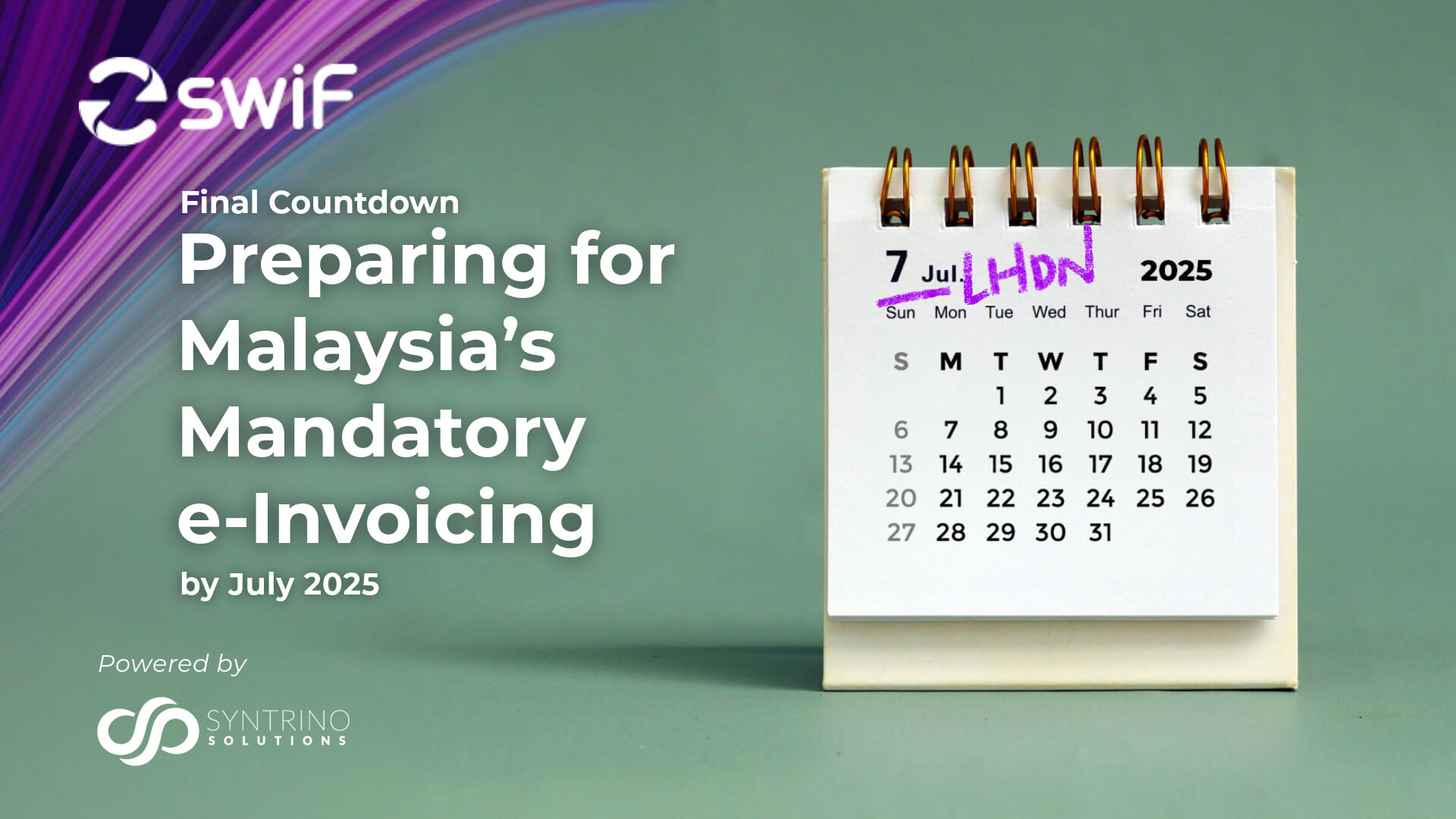

Regulatory Compliance and e-Invoicing

Adherence to regulatory standards is imperative for all businesses. B2B2C collection & payment gateways, like SwiF, prioritise regulatory compliance with innovative features such as our e-invoicing plug-in, ensuring your business stays compliant with evolving regulations.

Scalability and Flexibility

As your business grows, scalability becomes paramount. B2B2C collection & payment gateways offer scalability and flexibility, accommodating evolving business needs and future expansion.

Competitive Edge

Incorporating a B2B2C collection & payment gateway isn’t just advantageous; it’s essential for maintaining a competitive edge. Businesses that embrace digital transformation and prioritise customer experience are better positioned for long-term success.

Conclusion

Adopting a collection & payment gateway is no longer a luxury but a necessity for B2B2C businesses of all sizes. The benefits are plentiful, from enhanced security and fraud protection to seamless customer experiences and streamlined financial management. By choosing the right collection & payment gateway, you can unlock the full potential of your business, expand your customer base, and stay ahead of the competition.

Choosing the Right Collection & Payment Gateway for Your Business

With the multitude of payment gateways available, selecting the right one for your business is crucial. Consider factors such as security features, compatibility with your existing systems, compliance, pricing structure, customer support, and scalability. Conduct thorough research, read reviews, and consult industry experts to make an informed decision that aligns with your business goals and requirements.

Ready to revolutionise your business operations? Contact our team for information on how SwiF can propel your business towards further success.

SwiF is Malaysia’s Leading-Edge B2B2C Fintech Solution.

Powered by Syntrino Solutions, Southeast Asia’s leader in supply chain management, SwiF gives you access to a variety of collection and payment methods to streamline all aspects of your business operations. From major credit cards to online banking, e-wallets, Buy Now Pay Later, auto-debit, instalment options, and invoice financing, SwiF helps facilitate all your transactions.

SwiF also takes regulatory compliance to the next level by integrating its innovative e-invoicing plug-in, ensuring your business remains at the forefront of regulatory standards.