In the vibrant chaos of a Kuala Lumpur night market, picture a vendor juggling steaming satay skewers and impatient customers. Cash transactions slow everything down; counting notes, making change, and worrying about hygiene in the humid air. Many customers walk away, phones in hand, preferring the speed of a quick digital tap or scan. This isn’t just a missed sale; it’s a sign of Malaysia’s evolving payment landscape, where digital methods are reshaping how businesses operate.

Malaysia’s shift from cash to digital has been remarkable, fueled by tools like DuitNow QR and popular e-wallets such as Touch ‘n Go. Electronic payment volumes have soared in recent years, reflecting a broader appetite for convenience and security. Yet, for small and medium enterprises (SMEs), the heartbeat of our economy, offline collections often lag behind. Many still rely on cash due to familiar routines or perceived barriers to tech adoption. Across Southeast Asia, similar stories unfold: mobile wallets are booming in places like Indonesia and Thailand, inspiring Malaysia’s own cashless push and highlighting the need for accessible offline solutions.

Enter NFC Tap-to-Pay, Dynamic QR via Soundbox, and physical terminals: practical technologies that make contactless collections effortless. At SwiF, we’re at the forefront, helping Malaysian SMEs bridge this gap without complexity or high costs. These tools aren’t just trends; they’re revenue boosters for high-traffic spots like cafes, food trucks, and market stalls. In this guide, we’ll explore how to adopt them, why they matter, and how SwiF simplifies the process.

The Rise of Offline Digital Payments in Malaysia and SEA

The payment world is going hybrid: while e-commerce grabs headlines, offline point-of-sale (POS) transactions are evolving through contactless innovations. In Malaysia, DuitNow QR has streamlined everything by unifying codes across banks and e-wallets, enabling instant, low-fee transfers that cut down on cash handling, especially in bustling urban hubs where speed is king.

Southeast Asia’s influence can’t be ignored. Mobile wallets have taken off region-wide, with widespread adoption in neighbouring markets showing what’s possible here. Touch ‘n Go’s NFC capabilities exemplify this, blending familiarity with modern tech. Contactless methods like NFC and QR gained massive traction post-pandemic, prioritising hygiene and ease, think a quick tap instead of fumbling for coins. For SMEs, the real hurdle is often insufficient funds or tech intimidation, but affordable tools are changing that.

In Malaysia, this means fewer “missed sales” at everyday hotspots like pasar malam stalls, where customers expect seamless e-wallet scans. Offline digital tools are ensuring businesses stay competitive, and capture every ringgit without the cash clutter.

Understanding Offline Payment Technologies: NFC, QR, and Terminals

To harness these trends, let’s break down the core technologies. Each offers unique strengths, tailored to different business needs, with security baked in to build trust.

NFC Tap-to-Pay

Near-field communication (NFC) powers the “tap and go” experience: customers simply hold their card or phone near a terminal, unlocking with a fingerprint or face ID for verification. It’s secured through tokenization, where sensitive data is replaced with unique codes, preventing fraud even if intercepted.

For SMEs, NFC offers speed with transactions wrapped up in under five seconds, and hygiene, perfect for high-traffic cafes or kiosks where queues form fast. In Malaysia, it’s already common at convenience stores for Visa or Mastercard taps, and it works offline after initial setup, so it is ideal for spotty connectivity in markets.

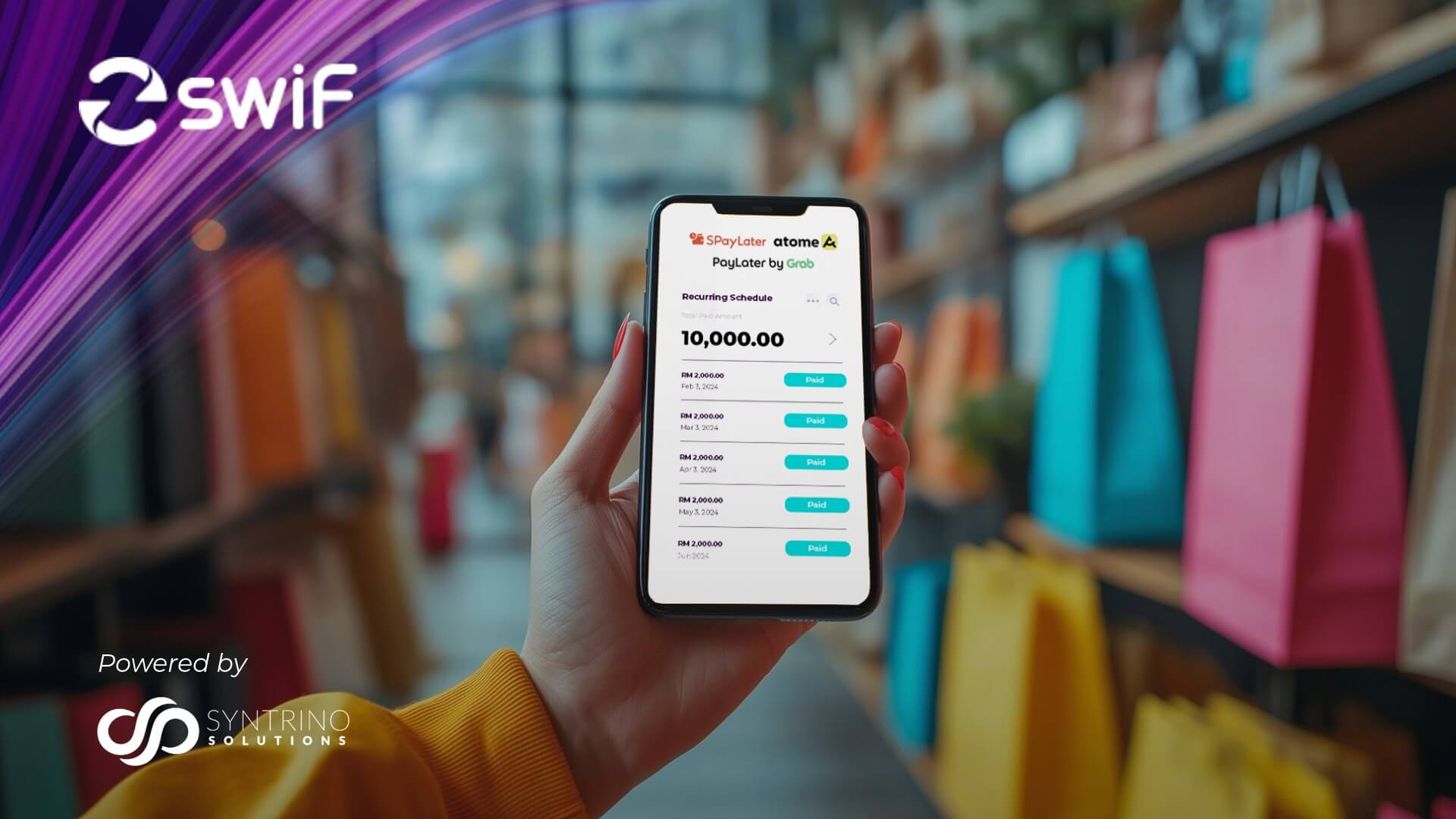

Dynamic QR via Soundbox

Dynamic QR generates fresh codes on-demand via a smartphone app or dedicated Soundbox device. Customers scan with their banking app or e-wallet, confirm the amount, and get instant audio or visual alerts.

The appeal? It’s terminal-free and budget-friendly, requiring minimal hardware like a portable Soundbox. This suits mobile setups such as food trucks, where flexibility rules. It is seamless for e-wallet scans at night markets, turning any stall into a digital powerhouse.

Physical Terminals for Offline Collections

These are portable devices combining NFC and QR readers, often Android-based for easy use. They handle cards, e-wallets, and even unattended kiosks, with offline modes storing transactions until connectivity returns.

Benefits include reliability in remote areas and integration with basic POS for stock tracking. In Malaysia, they’re customised for retail and rural needs, supporting multi-channel acceptance without overwhelming setup.

Here’s a quick comparison to help choose:

| Technology | Cost Barrier | Best For | Security Edge |

|---|---|---|---|

| NFC Tap | Low (phone-based) | Fixed counters | Biometrics + EMV |

| Dynamic QR | Minimal | Mobile vendors | Tokenization + alerts |

| Terminals | Moderate | High-volume | Full encryption |

Blending these reduces cash dependency, streamlining operations for urban Malaysian businesses.

Benefits and Implementation Strategies for Malaysian SMEs

Adopting these technologies delivers tangible wins: quicker collections mean happier customers and up to 30% sales lifts in busy environments. Fraud risks drop with built-in encryption and alerts, while options like embedded financing open doors to underserved buyers. For SMEs, it’s about financial inclusion, turning cash-only constraints into growth engines.

Here’s a straightforward implementation guide:

- Assess Your Needs: Evaluate foot traffic and setup via a free SwiF audit: QR for starters, NFC for speed demons.

- Choose Your Tech: Low-cost QR if budget’s tight; add terminals for scale.

- Integrate Seamlessly: App-based setup is fast; demo staff training ensures smooth rollout.

- Monitor and Optimise: Use real-time dashboards to track flows and tweak offers.

- Scale Up: Layer in cross-border QR for tourist seasons or tourism boosts.

Challenges like upfront costs? SwiF’s flexible packages ease the entry.

Why SwiF is Your Partner for Offline Collections

As Malaysia’s go-to B2B2C payment specialist, SwiF delivers NFC, QR, and terminals with end-to-end encryption and no bulky hardware demands. We’re optimised for local needs: DuitNow, e-wallets, real-time notifications, and e-invoicing plugins, all at competitive rates tailored for SMEs.

What sets us apart? Plug-and-play simplicity that empowers vendors amid Southeast Asia’s digital wave, without the enterprise hassle. We’re helping businesses collect offline seamlessly, proving contactless isn’t just future-proof, it’s profitable now.

Ready to upgrade? Head to our Physical Payment page – for a free demo and start transforming your operations.

Conclusion

NFC, QR, and terminals are closing Malaysia’s offline payment gaps, riding the wave of contactless convenience that’s reshaping commerce. From night markets to neighbourhood cafes, these tools eliminate cash friction, boost efficiency, and future-proof your SME.

In Southeast Asia’s dynamic digital economy, sticking to cash-only is a risk Malaysian businesses can’t afford. Embrace contactless to thrive, capture every transaction, and build lasting customer loyalty.

Ready to modernise? Reach out to one of our fintech experts.

At SwiF, we’re not just processing payments, we’re powering Malaysia’s digital future.

Sources: Bank Negara Malaysia reports, regional fintech studies for contextual insights.