Introduction

Buy Now, Pay Later (BNPL) has transformed consumer payments, with 85% of Malaysians embracing mobile options in 2025 (Fintech News Malaysia). Now, this flexible financing model is revolutionising B2B transactions, enabling SMEs to offer instalment plans to business clients, enhancing cash flow and loyalty. In Malaysia’s $207 billion digital payment market, 44.8% of SMEs face liquidity challenges due to delayed payments (SME Bank Malaysia). SwiF, Malaysia’s leading B2B2C payment hub, integrates instalment payments and invoice financing with its e-invoicing plug-in, ensuring immediate liquidity and compliance with Malaysia’s LHDN e-invoicing mandate. This article explores how B2B BNPL drives growth, strengthens client relationships, and supports SME success. Learn actionable strategies to leverage SwiF’s tools and thrive in Malaysia’s competitive B2B2C market in 2025.

The Rise of B2B BNPL in Malaysia

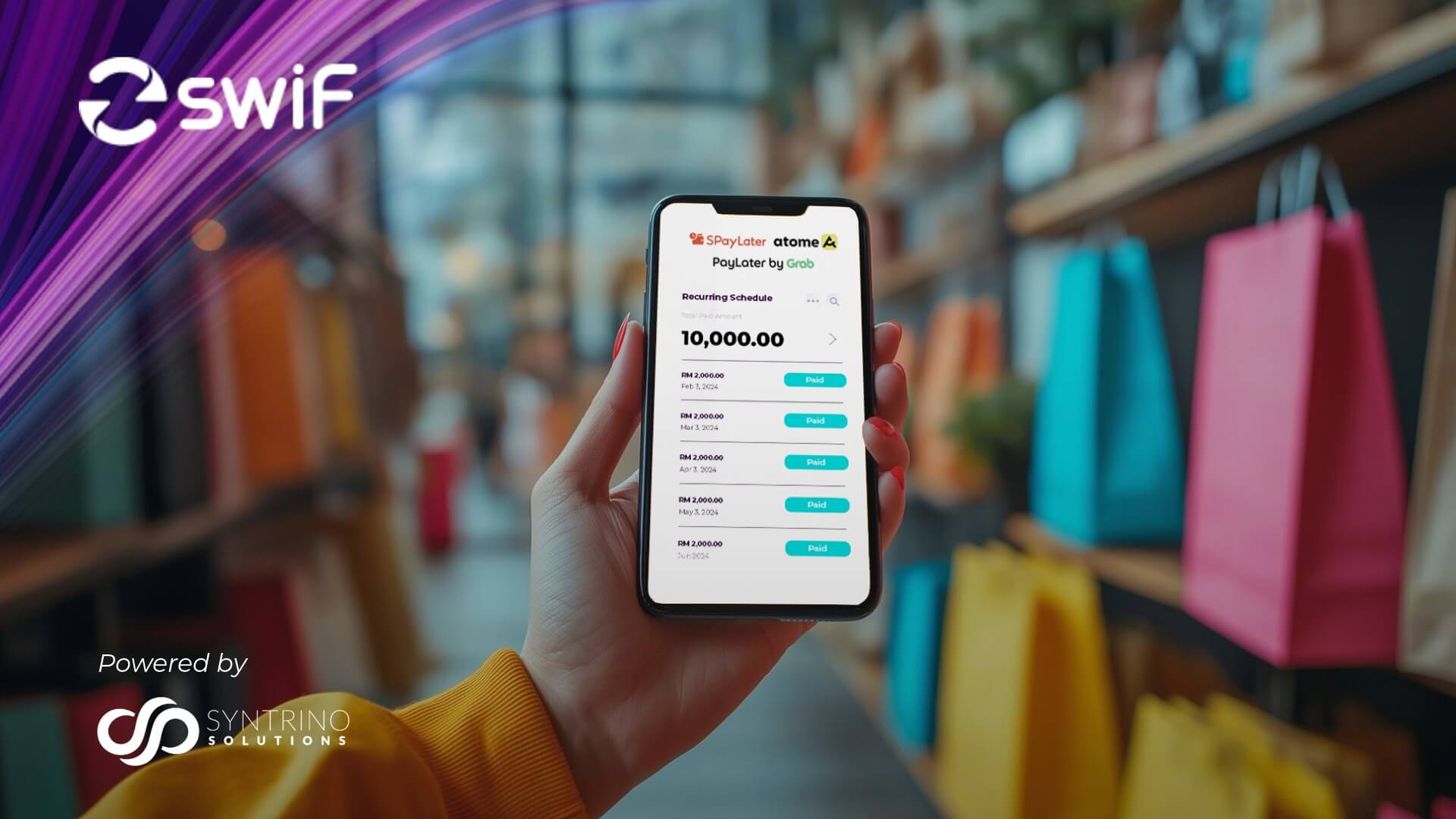

The shift from consumer to B2B BNPL is transforming Malaysia’s SME landscape. With a $207 billion digital payment market projected for 2025 (Market Research Malaysia), businesses demand flexible payment terms to manage cash flow. BNPL allows SMEs to offer instalments to B2B clients, mirroring consumer trends while addressing liquidity challenges. Budget 2025’s RM3.8 billion in SME loans and RM50 million in Digital Matching Grants (SME Corp Malaysia) underscore the push for digital solutions like BNPL to drive growth. SwiF’s instalment plans enable SMEs to provide credit card and BNPL options, ensuring upfront payments while clients pay over time. This empowers suppliers, wholesalers, and service providers to compete without straining finances. Embrace B2B BNPL with SwiF to unlock new revenue streams and stay ahead in Malaysia’s digital economy.

How B2B BNPL Boosts SME Cash Flow

Delayed payments plague 44.8% of Malaysian SMEs, hindering operations and growth (SME Bank Malaysia). B2B BNPL addresses this by allowing SMEs to offer instalment plans while receiving funds upfront via financing partners. SwiF’s instalment payments and invoice financing, supported by platforms like Funding Societies (Funding Societies), ensure immediate liquidity. For example, a manufacturer offering BNPL for equipment sales can use invoice financing to access funds instantly, avoiding cash flow gaps. This reduces bad debt risk and provides predictable income, enabling SMEs to invest in inventory or marketing. Unlike traditional loans, these solutions offer speed and flexibility.

Strengthening B2B Client Relationships

Offering flexible payment terms through B2B BNPL builds trust and loyalty with business clients. In Malaysia, where SMEs compete fiercely, BNPL differentiates businesses by easing clients’ financial burdens. SwiF’s instalment plans allow suppliers to offer attractive payment terms to retailers, encouraging repeat orders and long-term partnerships. For instance, a wholesaler providing BNPL for bulk inventory purchases can strengthen ties with small retailers, increasing order frequency. This flexibility enhances client satisfaction, with 72% of Malaysians viewing digital payment solutions as secure (Mastercard via Focus Malaysia). SwiF’s payment hub ensures seamless BNPL integration, making it easy to offer tailored terms without administrative hassle. By fostering stronger B2B relationships, SMEs can secure consistent revenue streams and market share.

Seamless Integration with e-Invoicing

Malaysia’s LHDN e-invoicing mandate, requires SMEs to adopt compliant digital solutions. SwiF’s e-invoicing plug-in, embeds BNPL and invoice financing options in LHDN-compliant invoices, streamlining collections and ensuring compliance. For example, an SME can send e-invoices with instalment terms to B2B clients, accessing funds instantly via financing partners like Funding Societies. This reduces payment delays and administrative costs, freeing resources for growth. Budget 2025’s RM50 million Digital Matching Grants support such digitalisation efforts, making now the ideal time to adopt SwiF’s solutions. By integrating e-invoicing with BNPL, SMEs meet regulatory requirements while accelerating cash flow.

Financing Synergies for Liquidity

SwiF’s invoice financing, complements B2B BNPL by providing instant capital while clients pay in instalments. This synergy ensures SMEs maintain liquidity despite extended payment terms. For instance, a service provider offering BNPL to B2B clients can use invoice financing to fund marketing campaigns, receiving funds upfront while clients pay over months. This approach minimises cash flow disruptions, with Funding Societies noting that 73.2% of SMEs expect revenue growth but face liquidity hurdles. SwiF’s payment hub automates financing processes, reducing costs and complexity compared to traditional loans. By integrating BNPL and invoice financing, SMEs can invest in growth without waiting for payments.

Complementing B2B BNPL with Cross-Border e-Wallet Payments

While B2B BNPL drives domestic growth, SwiF’s cross-border e-wallet solutions (e.g., AliPay, WeChat Pay) complement it for regional expansion. SMEs can offer BNPL to local B2B clients and accept e-wallet payments from international customers, ensuring flexibility across markets. For example, a Malaysian SME uses instalment plans for local wholesalers and e-wallets for Singaporean retailers, diversifying revenue. With 20% of SMEs prioritising cross-border transactions (Fintech News Malaysia), SwiF’s payment hub supports seamless, low-cost international payments, outperforming traditional banks. This versatility enables SMEs to scale regionally without sacrificing cash flow. Combine SwiF’s BNPL and cross-border solutions to unlock global growth opportunities in Malaysia’s $207 billion digital economy.

Mitigating B2B BNPL Risks

Offering B2B BNPL carries credit risks, but SwiF’s analytics and CTOS integration mitigate these challenges. SMEs can assess client creditworthiness before offering instalments, ensuring safe transactions. For example, a supplier uses SwiF’s dashboard to screen a retailer’s payment history, confidently providing BNPL terms. SwiF’s PCI DSS Level 1 security and FraudLabs Pro further protect against fraud, aligning with the 72% of Malaysians trusting digital payments (Mastercard via Focus Malaysia). Real-time analytics track payment patterns, helping SMEs manage risks and optimise terms. This data-driven approach minimises defaults while maximising BNPL’s benefits.

Conclusion

B2B BNPL is transforming how Malaysian SMEs manage cash flow, build client relationships, and compete in a $207 billion digital economy. SwiF’s instalment payments, invoice financing and e-invoicing plug-in empower businesses to offer flexible terms while ensuring liquidity and LHDN compliance. Paired with cross-border e-wallet solutions, SwiF drives local and regional growth. Don’t let payment delays hinder your SME. Sign up with SwiF to leverage cutting-edge tools for sustainable success.

Explore SwiF’s solutions today and take the next step toward smarter B2B payments.

SwiF is Malaysia’s Leading-Edge B2B2C Fintech Solution.

Our all-in-one Payment Hub empowers businesses to offer flexible, seamless payment options, both online and offline. Accept major credit cards, online banking, e-wallets, BNPL, invoice financing, and micro-financing through a single, integrated system.

SwiF’s smart e-invoicing plug-in simplifies your compliance journey by ensuring every invoice meets LHDN regulatory standards. More than just compliance, it gives you real-time visibility, automated tracking, and actionable analytics to optimise cash flow and business performance.

Built by Syntrino Solutions, Southeast Asia’s supply chain innovation leader, SwiF integrates effortlessly with your existing systems, streamlining every aspect of your B2B2C transactions from invoicing to payment collection.

Related Articles:

Credit Card vs. e-Wallet vs. BNPL

Top 10 Strategies to Boost SME Cash Flow

Embedded Payment Links & E-Invoicing for Cash Flow

Boosting Business Potential: The Benefits of Instalment Payments