A New Solution for an Old Cash Flow Problem

Late payments. Endless invoice chasing. Unpredictable revenue streams.

For businesses in Malaysia, especially B2B and B2B2C models, these issues are far too common.

But with Malaysia’s push towards mandatory e-invoicing and fintech innovations like embedded payment links, you now have an opportunity to solve all three problems in one go.

Fact: Companies using embedded payment links report up to 35% faster collections.

What Is an Embedded Payment Link in an e-Invoice?

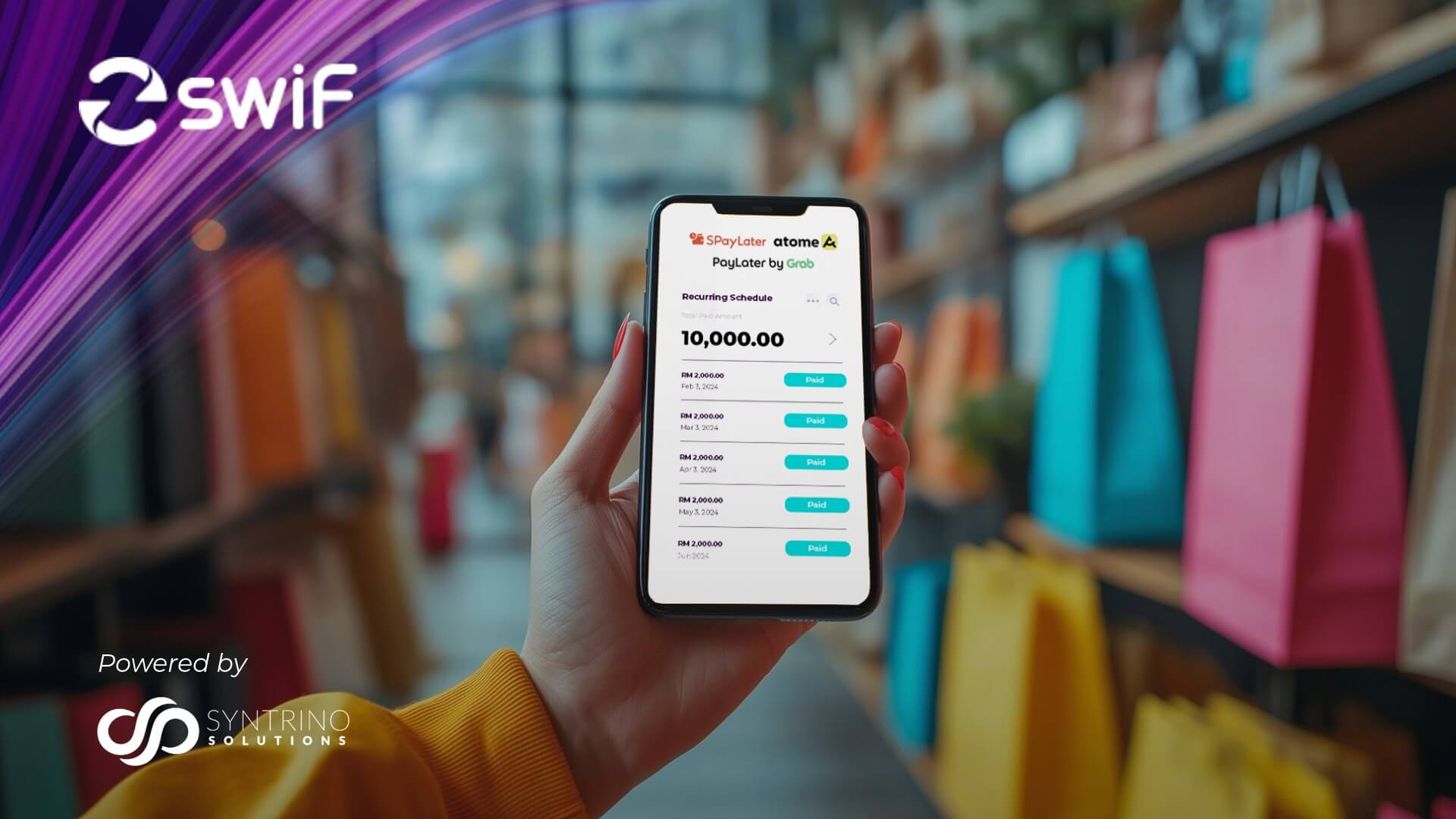

An embedded payment link is a clickable “Pay Now” button or QR code placed directly within your e-invoice. When your customer receives the invoice, they can instantly pay via:

- FPX (Online Bank Transfers)

- Credit & Debit Cards

- BNPL (Buy Now, Pay Later)

- e-Wallets (GrabPay, TNG, Boost, ShopeePay)

No additional logins. No friction. Just fast, secure payments.

With SwiF’s integrated solution, all of this is automated. Plus you get LHDN compliance, auto-reminders, and real-time tracking built in.

Discover Flexible Payment Methods

5 Ways Embedded Payment Links Improve Cash Flow

1. Get Paid Faster

When you make it easy to pay, customers pay faster. No more bank transfers or email confirmations. Just a click.

2. Automate Collections and Reminders

SwiF lets you set invoice due dates and send auto-reminders, reducing late payments without needing manual follow-up.

3. Better Forecasting and Cash Flow Visibility

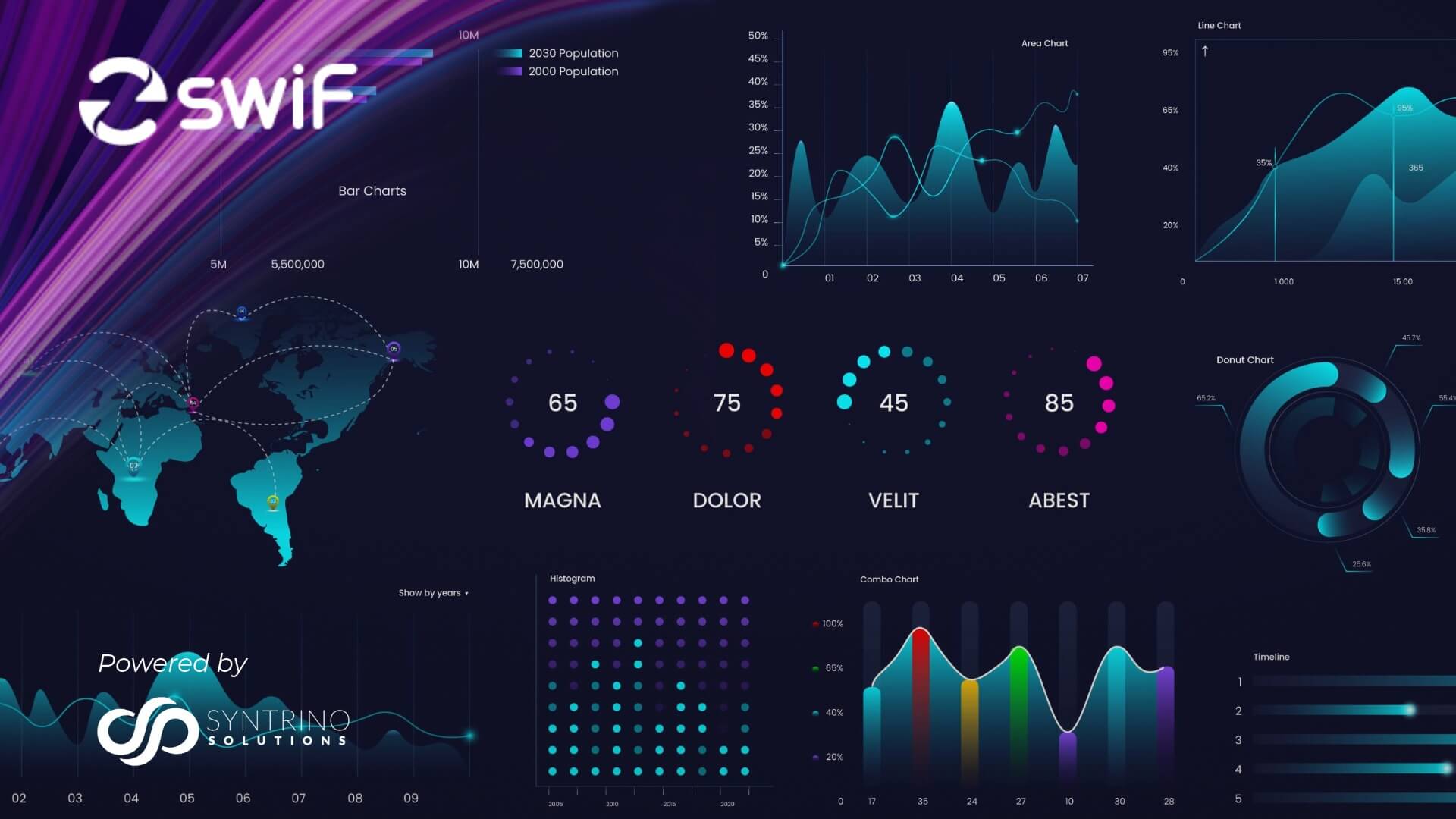

Track payments, view statuses in real time, and predict cash inflows accurately with SwiF’s dashboard.

4. Save Time with Less Admin Work

Embedded links reduce reconciliation steps and admin costs by automating collections and integrating with your ERP and accounting tools.

5. Enhance the Customer Experience

Customers can choose their preferred payment method and complete payment in seconds, boosting satisfaction and repeat purchases.

Proven Results: Faster Payments, Less Stress

A mid-sized tech distributor in Kuala Lumpur was facing delays of over 45 days on average for invoice payments. Their finance team was bogged down with manual tracking, email reminders, and reconciliations.

After switching to SwiF’s e-invoicing with embedded payment links:

- 60% of invoices were paid within 10 days.

- Auto-reminders reduced manual follow-ups by over 70%.

- Their finance team saved an estimated 12 hours per week, reallocating resources to growth initiatives.

- Cash flow stabilised, allowing the company to reinvest confidently in inventory and regional expansion.

This is just one example of how digital payments, when paired with e-invoicing, deliver real business outcomes: faster collections, less admin, and greater financial control.

Stay Compliant with LHDN and Get Paid Faster

Malaysia’s Inland Revenue Board (LHDN) has rolled out a phased e-invoicing mandate that will impact all businesses by July 2025.

While many see this as just a tax requirement, forward-thinking businesses are turning it into a cash flow optimisation strategy and SwiF helps you do exactly that.

SwiF Helps You Comply AND Get Paid Faster

LHDN-Approved Integration

SwiF integrates directly with the MyInvois Portal, converting and submitting UBL JSON e-invoices for LHDN validation, ensuring your invoices are compliant and audit-ready.

Payment Links Embedded in Every Invoice

Add a “Pay Now” button or QR code to every e-invoice, allowing your customer to pay instantly via FPX, credit/debit card, DuitNow, BNPL, or e-wallet, without leaving the invoice.

Auto-Due Dates and Scheduled Reminders

Set due dates and let SwiF send automated reminders before and after payment deadlines, reducing late payments without chasing clients manually.

Digital Signature & Security Built In

Each invoice is digitally signed for authenticity and complies with Bank Negara Malaysia and LHDN’s electronic document security protocols.

Real-Time Tracking & Audit Trails

Track invoice validation, delivery, payment status, and settlement, all from your dashboard. Easily export reports for tax, finance, or internal auditing purposes.

Why Choose SwiF?

- Over 600,000+ e-invoices processed monthly

- Fully LHDN-compliant API integration

- Real-time dashboards and analytics

- Support for FPX, Cards, DuitNow, BNPL, and E-wallets

- Easy integration with ERPs like SAP, Oracle, and QuickBooks

- Trusted by businesses across Malaysia and ASEAN

Conclusion: Turn Your Invoices Into a Cash Flow Engine

E-invoicing isn’t just about compliance, it’s an opportunity to improve the speed, predictability, and ease of your collections process.

By embedding payment links into your e-invoices, you create a frictionless path to faster revenue.

SwiF is Malaysia’s Leading-Edge B2B2C Fintech Solution.

At the forefront of innovation, SwiF offers an advanced e-invoicing plug-in that ensures your business stays in full compliance with regulatory standards. Powered by Syntrino Solutions, Southeast Asia’s leader in supply chain management, SwiF seamlessly integrates with your existing systems to streamline all your B2B2C transactions.

With SwiF’s comprehensive suite of payment solutions, businesses can offer flexible payment options—both online and offline—such as major credit cards, online banking, e-wallets, BNPL, invoice financing, and micro-financing.

Our innovative e-invoicing plug-in is designed to simplify your compliance journey, ensuring your invoices meet regulatory standards while empowering you with real-time monitoring and advanced analytics to optimise business performance.

Need Expert Guidance?

Book a Free Demo of SwiF e-Invoicing

Learn More About Our LHDN-Compliant Solutions (send to e-invoicing page – https://swifs.io/payment-gateway-e-invoice-plug-in/

Related Articles