Understanding Malaysia’s e-Invoicing Regulation

The Malaysian government, through LHDN (Inland Revenue Board of Malaysia), is implementing mandatory e-invoicing to digitalise tax reporting, reduce fraud, and streamline business transactions. This regulation affects all businesses and requires them to issue, submit, and store invoices electronically via the MyInvois Portal or an integrated API.

Unlike voluntary digital invoicing, this is a legal requirement—non-compliance could lead to penalties, audits, and business disruptions.

Possibility for Improved Efficiency

Companies that switch to LHDN-compliant e-invoicing are likely to experience fewer tax filing errors and may benefit from faster audits.

Where Malaysia Stands with e-Invoicing Adoption

Malaysia’s e-invoicing rollout is already in full swing, with large corporations leading the way and mid-sized businesses actively integrating LHDN’s MyInvois system. However, many SMEs and micro-enterprises still need to transition before the 1st July 2025 deadline.

What Businesses Should Do Now:

If You’ve Already Implemented e-Invoicing:

- Optimise workflows – Automate bulk submissions & payment tracking.

- Ensure ongoing compliance – Stay updated with any LHDN changes.

- Improve cash flow – Embed payment links in e-invoices for faster collections.

If You Haven’t Started Yet:

- Choose your method – Manual MyInvois uploads vs. API automation.

- Test your system – Validate e-invoice formats before full rollout.

- Train your finance team – Ensure smooth adoption across departments.

Pro Tip: Even if your business isn’t legally required to implement e-invoicing yet, adopting it early enhances efficiency, improves financial accuracy, and reduces tax compliance risks.

Step-by-Step Compliance Roadmap for Businesses

1️. Assess Your Readiness

✓ Ensure your business is ready before the final compliance deadline.

✓ Determine if your current invoicing system can integrate with MyInvois Portal.

2️. Select Your Compliance Method

✓ Manual Upload: Suitable for small businesses with low invoice volumes.

✓ API Integration: Best for mid-sized to large businesses that require automated compliance.

3️. Implement LHDN E-Invoicing Standards

✓ Ensure invoices follow UBL JSON format as per LHDN requirements.

✓Include Unique Identifier Number (UIN), tax details, and QR codes for validation.

4️. Submit & Track E-Invoices via MyInvois

✓ Upload invoices to LHDN’s MyInvois Portal manually or via API.

✓ Track invoice validation in real-time and address any rejected submissions.

5️. Store & Report E-Invoices for Tax Compliance

✓ Maintain digital records for LHDN tax filings and audits.

✓ Ensure secure, long-term storage of e-invoices as per regulatory requirements.

Need automation? SwiF’s API handles the full compliance process seamlessly.

LHDN Enforcement: What Happens If You Don’t Comply?

Failure to comply with Malaysia’s e-invoicing mandate can result in:

X Tax Audits & Investigations – LHDN may request invoice records and conduct audits.

X Financial Penalties – Fines for non-compliance, incorrect filings, or late submissions.

X Business Disruptions – Payment processing delays if invoices are not LHDN-validated.

To avoid penalties, businesses should implement compliance measures well before their deadline.

How Different Business Types Are Affected

- Small Businesses & SMEs – Must transition from manual to digital invoicing before July 2025.

- E-Commerce & Retailers – Need seamless integration to prevent disruptions in customer invoicing.

- Exporters & Large Enterprises – Require multi-currency support and cross-border compliance.

- Service-Based Businesses – Must include digital signatures & tax validation for invoices.

How SwiF Helps Businesses Stay Compliant

SwiF’s e-Invoicing & Payment Gateway Solutions provide:

- Seamless API Integration – Automated submission to MyInvois Portal.

- Real-Time Status Tracking – Notifications for invoice validation & errors.

- Bulk Submission & Reporting – Processing of high volumes of invoices effortlessly.

- Secure Digital Storage – Maintained compliance with audit-ready records.

Want to simplify compliance? Visit SwiF’s E-Invoicing Solutions

Conclusion

The shift to mandatory e-invoicing is more than just a regulatory update—it’s an opportunity to modernise tax compliance, reduce manual work, and improve financial efficiency. Businesses that prepare early will avoid penalties and gain a competitive advantage.

Ensure compliance today! Request a Demo or Sign Up with SwiF now!

SwiF is Malaysia’s Leading-Edge B2B2C Fintech Solution.

At the forefront of innovation, SwiF offers an advanced e-invoicing plug-in that ensures your business stays in full compliance with regulatory standards. Powered by Syntrino Solutions, Southeast Asia’s leader in supply chain management, SwiF seamlessly integrates with your existing systems to streamline all your B2B2C transactions.

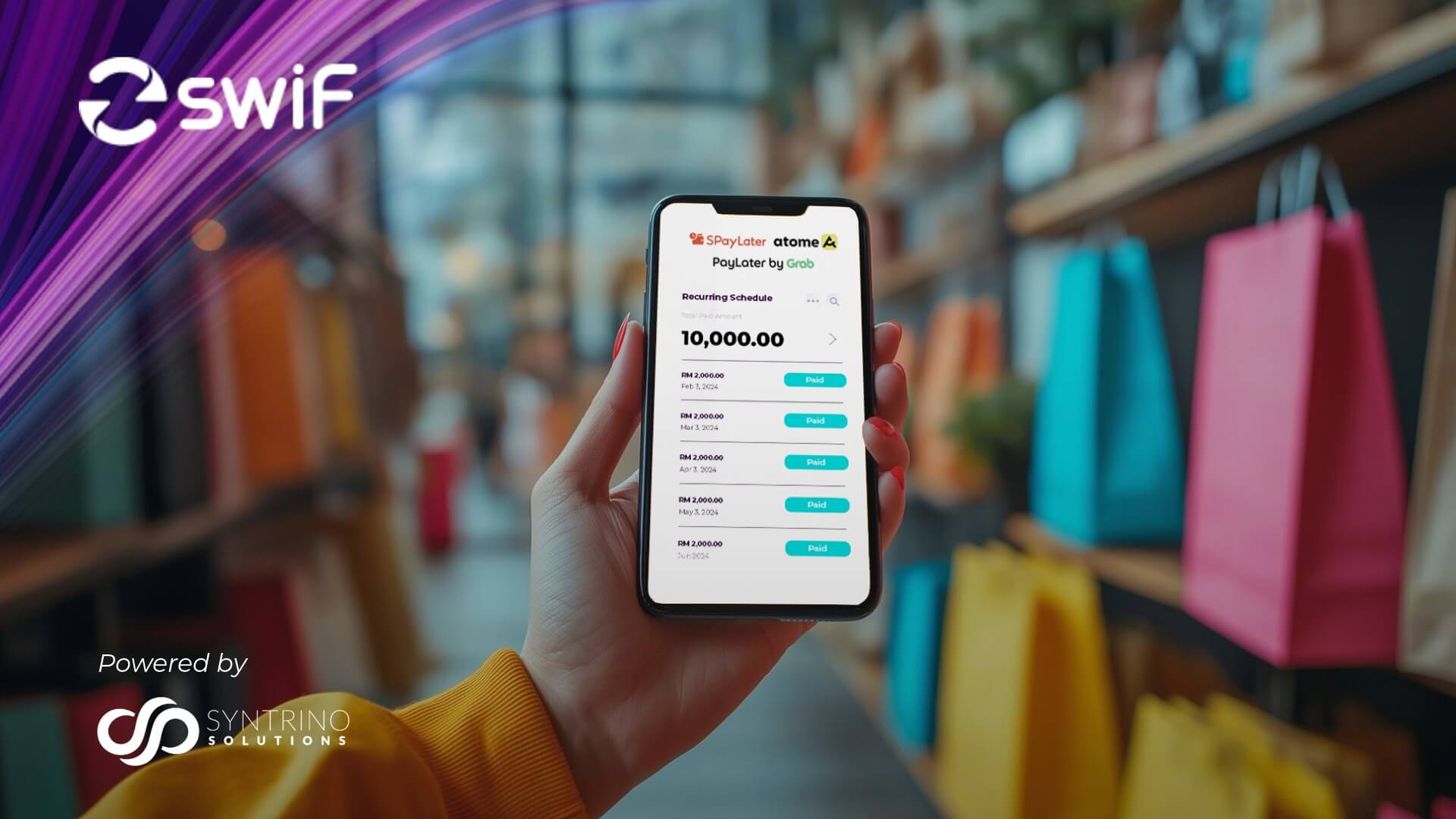

With SwiF’s comprehensive suite of payment solutions, businesses can offer flexible payment options—both online and offline—such as major credit cards, online banking, e-wallets, BNPL, invoice financing, and micro-financing.

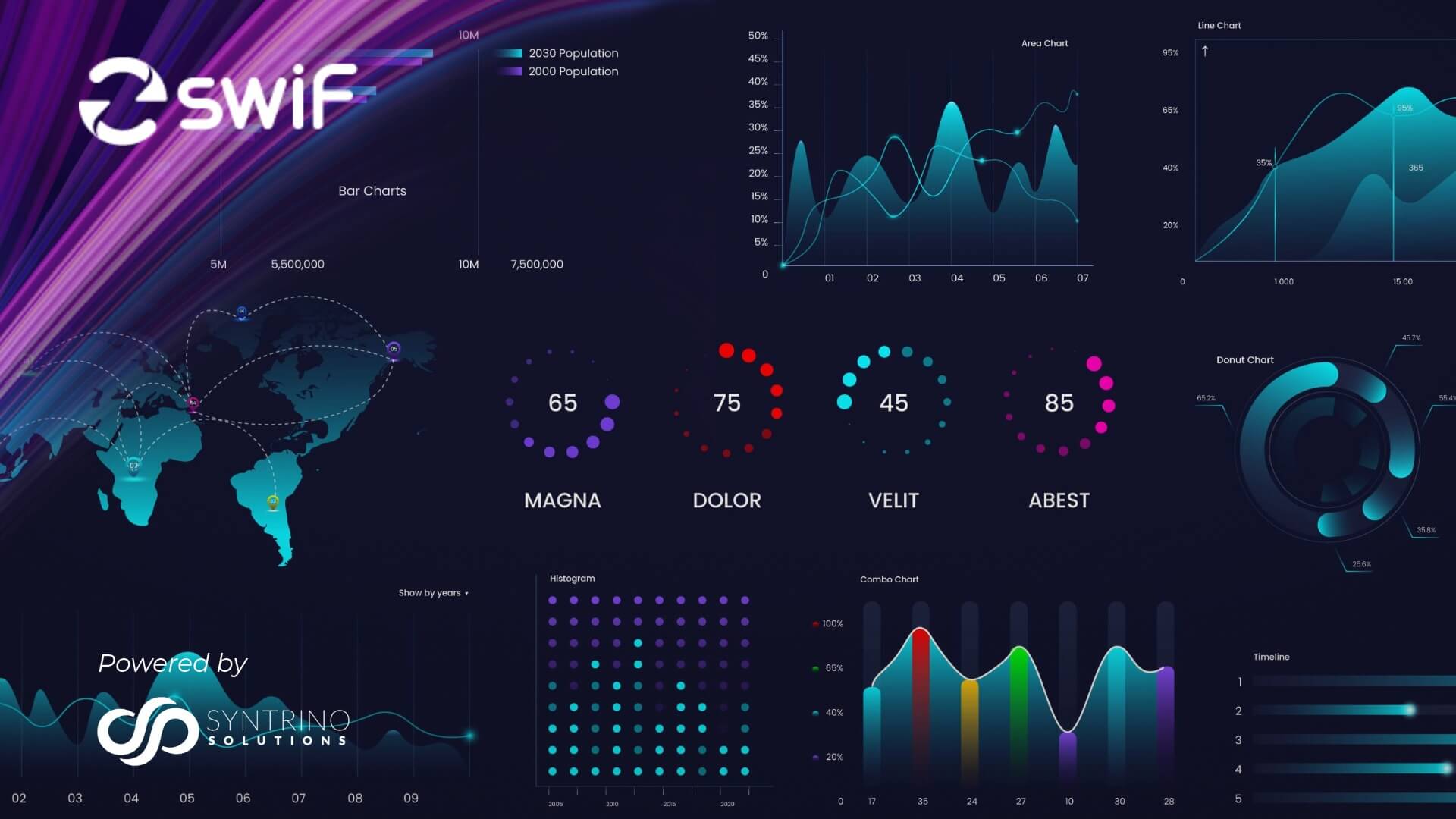

Our innovative e-invoicing plug-in is designed to simplify your compliance journey, ensuring your invoices meet regulatory standards while empowering you with real-time monitoring and advanced analytics to optimise business performance.

Related Articles

10 Ways SwiF Can Simplify Your e-Invoicing Journey

Embrace e-Invoicing with Confidence

Need Expert Guidance? Contact support@swifs.io for e-invoicing compliance assistance.