Businesses are constantly looking for innovative strategies to enhance customer experience and drive growth. One transformative approach is the adoption of instalment options, particularly through B2B2C fintech solutions like SwiF. This article explores how these payment alternatives can unlock significant potential for businesses, improve cash flow, and foster customer loyalty.

Understanding Instalment Options

Instalment options allow consumers to break down larger purchases into smaller, manageable payments over a specified period. This flexibility not only makes high-ticket items more accessible but also encourages customers to make purchases they might otherwise defer.

The Mechanics of Instalment Payments

- Structure: Instalment plans typically divide the total cost into equal monthly payments, often with a predetermined interest rate or even interest-free options.

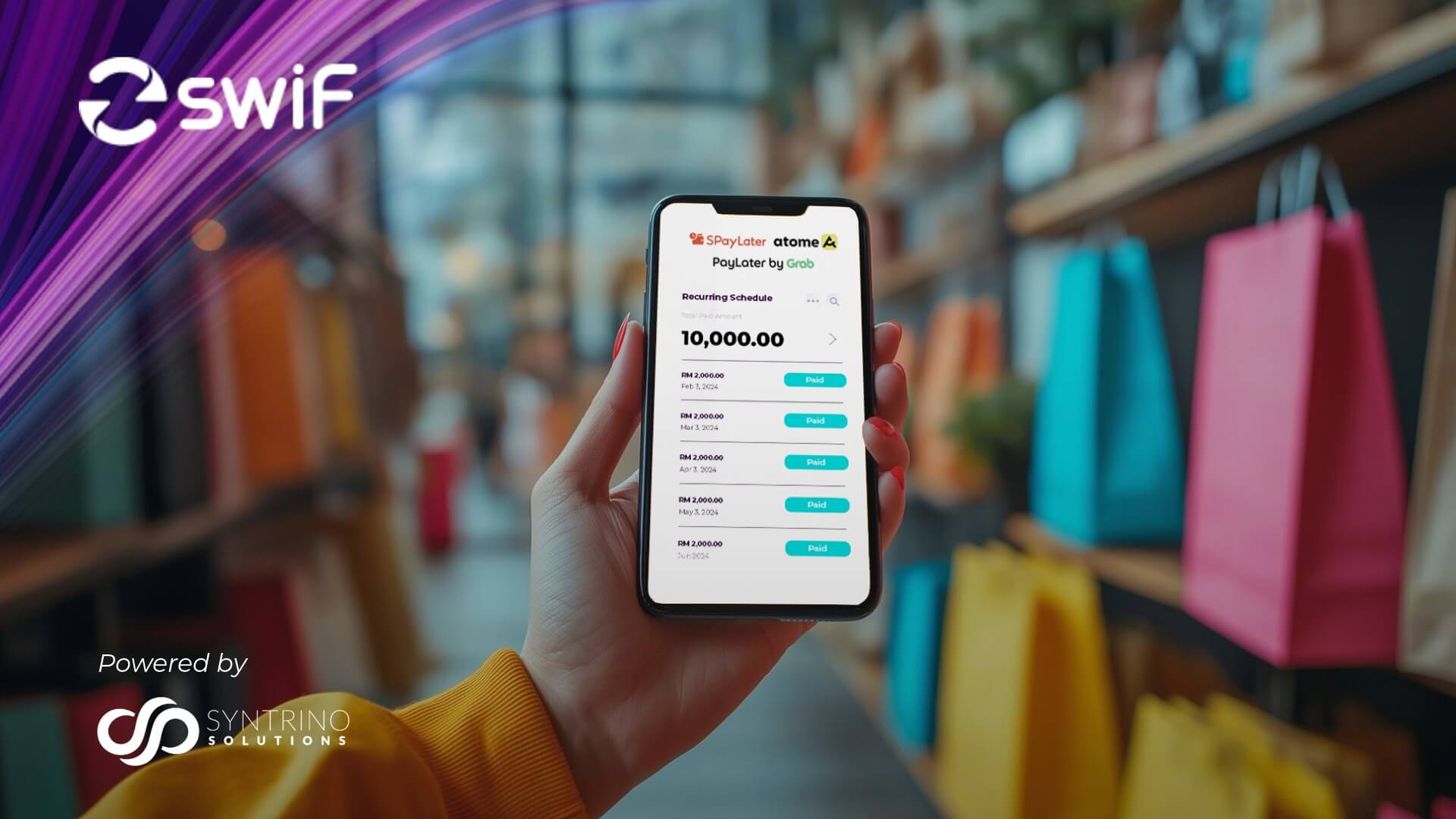

- Types: Common forms include credit card instalments and Buy Now, Pay Later (BNPL) schemes, each catering to different purchasing needs.

- Integration: These payment options can be seamlessly integrated into existing payment systems, making it easy for businesses to adopt them.

Why Both Businesses and Consumers Prefer Instalment Payments

- Affordability: Splitting payments makes higher-value purchases more feasible for both business and consumers, aligning with their budgeting strategies.

- Financial Flexibility: Customers appreciate the ability to manage their cash flow without sacrificing their purchasing power.

- Enhanced Shopping Experience: Instalment options can significantly improve the overall shopping experience, leading to higher customer satisfaction.

The Role of B2B2C Fintech Solutions

B2B2C fintech solutions are designed to facilitate transactions between businesses, their customers and end consumers, enhancing the payment experience for all parties.

Streamlining Transactions

- Automation: These solutions automate the payment process, reducing the administrative burden on businesses.

- Real-time Processing: Instant approvals and seamless transactions enhance the customer experience, making purchases quicker and easier.

Empowering Businesses

- Access to Capital: By receiving full payment upfront while customers pay in instalments, businesses can better manage their cash flow and invest in growth opportunities.

- Data Insights: B2B2C fintech platforms often provide valuable analytics, helping businesses understand consumer behaviour and preferences.

Enhancing Cash Flow with Instalment Options

One of the most significant benefits of offering instalment options is the positive impact on cash flow.

Immediate Revenue Recognition

- Upfront Payments: Businesses receive the entire payment at the time of the transaction, which improves liquidity and allows for immediate reinvestment.

- Predictable Income Streams: Instalment plans create a reliable revenue model, helping businesses forecast cash flow more accurately.

Reducing Financial Strain

- Lower Risk of Bad Debt: By transferring the risk of non-payment to the payment provider, businesses can focus on growth without the stress of potential defaults.

- Simplified Collections: With the payment provider managing collections, businesses can streamline their operations and reduce administrative costs.

Driving Sales Growth through Instalment Plans

Instalment options can significantly boost sales by encouraging consumers to make larger purchases.

Increasing Average Transaction Value

- Consumer Confidence: Knowing they can pay in instalments often gives consumers the confidence to invest in higher-value products.

- Cross-Selling Opportunities: When customers are comfortable with their payment options, they are more likely to explore additional products and services.

Seasonal Sales and Promotions

- Flexibility During Peak Seasons: Businesses can leverage instalment options during high-demand periods, allowing customers to make purchases they might otherwise delay.

- Targeting Specific Segments: Tailored instalment offers can attract different customer segments, from budget-conscious shoppers to those looking for premium products.

Building Competitive Advantage with Flexible Payments

In a competitive landscape, offering instalment options can set a business apart from its rivals.

Meeting Consumer Expectations

- Evolving Payment Preferences: Today’s consumers expect flexibility in payment methods. Businesses that offer instalment options are more likely to attract and retain customers.

- Enhanced Brand Loyalty: Positive experiences with flexible payment plans can lead to repeat business and long-term customer relationships.

Differentiating Through Innovation

- Unique Value Proposition: By incorporating innovative payment solutions, businesses can create a compelling value proposition that resonates with consumers.

- Attracting New Customers: A robust payment strategy can help businesses capture market share from competitors who do not offer similar options.

Improving Customer Satisfaction and Loyalty

Instalment payment options are not just about financial transactions; they significantly enhance the overall customer experience.

Empowering Purchasing Decisions

- Financial Control: Customers appreciate having control over their budgets, leading to increased satisfaction and loyalty.

- Positive Shopping Experience: Simplifying the purchasing process contributes to a more enjoyable shopping experience, encouraging repeat visits.

Fostering Long-Term Relationships

- Trust and Reliability: Offering flexible payment options builds trust with consumers, making them more likely to return for future purchases.

- Engagement through Communication: Regular communication about payment plans and options can keep customers engaged and informed.

Credit Card Instalments vs. Buy Now, Pay Later (BNPL)

Both credit card instalments and BNPL options offer unique benefits, catering to different customer and consumer needs and preferences.

Credit Card Instalments

- Longer Payment Terms: This option allows consumers to spread payments over several months or even years, making it suitable for larger purchases.

- Loyalty Programs: Many credit card providers offer rewards or incentives for using their instalment payment options, further enhancing customer appeal.

Buy Now, Pay Later (BNPL)

- Short-Term Flexibility: BNPL solutions are ideal for smaller, immediate purchases, allowing consumers to split payments without interest.

- Seamless Integration: Many BNPL services can be easily integrated into e-commerce platforms, providing a smooth checkout experience.

Use Cases for Instalment Options

Understanding practical applications of instalment options can help businesses identify opportunities for implementation.

Equipment Purchases

- Manufacturing Sector: A manufacturing company needing new machinery can benefit from credit card instalment options, allowing for significant capital investment without immediate cash outflow.

Bulk Purchases

- Wholesale and Retail: Offering instalment options for bulk purchases can help partners manage cash flow while preserving working capital.

Seasonal Sales Strategies

- Retail Flexibility: Retailers can use BNPL solutions during off-peak seasons to encourage purchases, smoothing out cash flow throughout the year.

Conclusion

Adopting a B2B2C fintech solution like SwiF that offers instalment options is more than just a trend; it’s a strategic move towards long-term success. By enhancing cash flow, driving sales, building a competitive edge, and improving customer satisfaction, businesses can create a robust model that meets the evolving needs of today’s businesses and consumers alike. Embracing flexible, customer-centric solutions will undoubtedly unlock new business potential in an ever-changing marketplace.

By leveraging the power of instalment options, businesses can not only thrive but also foster deeper connections with their customers, paving the way for sustained growth and success.