Embracing e-invoicing can be a daunting task for many businesses, especially as they navigate the complexities of compliance and integration. However, the right tools and solutions can transform this process from a cumbersome chore into a streamlined, efficient, and compliant experience. Enter SwiF, an innovative fintech solution provider who offers an e-invoicing platform that is revolutionising the way businesses approach this critical aspect of their operations.

In this comprehensive article, we’ll explore 10 ways SwiF can help you seamlessly integrate e-invoicing into your business, empowering you to enhance efficiency, ensure compliance, and ultimately, drive growth.

1. Automated LHDN Submissions

One of the key challenges businesses face with e-invoicing is the need to manually submit invoices to the Malaysian tax authority, LHDN. SwiF simplifies this process by automating the submission process. Once an invoice is generated, SwiF automatically schedules it for submission to LHDN, ensuring timely and accurate filings without the need for manual intervention.

Streamlined Workflow

By automating the submission process, SwiF eliminates the time-consuming task of manually uploading each invoice to the MyInvois portal. This frees up your team to focus on more strategic priorities, while the platform handles the administrative burden of e-invoicing compliance.

Real-Time Status Updates

SwiF’s integration with LHDN’s systems provides real-time updates on the status of your invoice submissions. You can easily track the progress of each document, ensuring that any issues are promptly identified and resolved.

Optimised Compliance

With SwiF’s automated submission capabilities, you can rest assured that your e-invoices are being filed in a timely and compliant manner, reducing the risk of penalties or non-compliance.

2. Effortless Document Generation

Generating invoices, credit notes, debit notes, and refund notes can be a time-consuming and error-prone process. SwiF fast-tracks this task by providing a user-friendly web portal where you can easily create and manage all your e-invoicing documents.

Intuitive Interface

SwiF’s document generation module features an intuitive interface that guides you through the process of creating and submitting your e-invoicing documents. This ensures a seamless experience, even for users who are new to e-invoicing.

Automatic Numbering

SwiF’s platform automatically assigns invoice numbers or document numbers to your submissions, eliminating the need for manual tracking and ensuring a consistent, organised record-keeping system.

Flexible Submission Options

After generating your documents, you have the flexibility to either submit them to LHDN directly through the SwiF platform or integrate them with your existing systems for a more streamlined workflow.

3. Seamless SAP B1 Integration

For businesses using SAP B1, SwiF offers a dedicated integration solution that synchronises your self-billed invoices with LHDN with ease. This integration simplifies the compliance process and ensures that your invoicing needs are met accurately and efficiently.

Automated Data Extraction

SwiF’s integration tool effortlessly extracts self-billed invoice data from your SAP B1 system and submits it through the SwiF platform for validation, eliminating the need for manual data entry.

Expedited Compliance

By automating the submission of self-billed invoices, SwiF helps SAP B1 users maintain compliance with LHDN requirements, providing peace of mind and reducing the risk of errors or non-compliance.

Centralised Invoice Management

With SwiF’s integration, your self-billed invoices are consolidated and managed within the SwiF platform, giving you a comprehensive view of your e-invoicing activities and simplifying record-keeping.

4. Efficient TIN Collection

Collecting Tax Identification Numbers (TINs) from customers can be a tedious and time-consuming process. SwiF addresses this challenge by offering a self-update page that empowers customers to enter their TIN information directly.

Automated Verification

SwiF’s self-update page is integrated with LHDN’s server, ensuring that the TIN information provided by customers is validated and exists in the LHDN database. This significantly reduces the risk of rejections due to incorrect TIN entries.

Enhanced Communication

With just a few clicks, you can easily share the self-update URL with individual customers or schedule a broadcast to reach multiple customers simultaneously. This efficient approach saves time and ensures accurate data collection.

Improved Data Accuracy

By enabling customers to directly input their TIN information, SwiF helps eliminate the potential for errors that can arise from manual data entry, further enhancing the overall accuracy of your records.

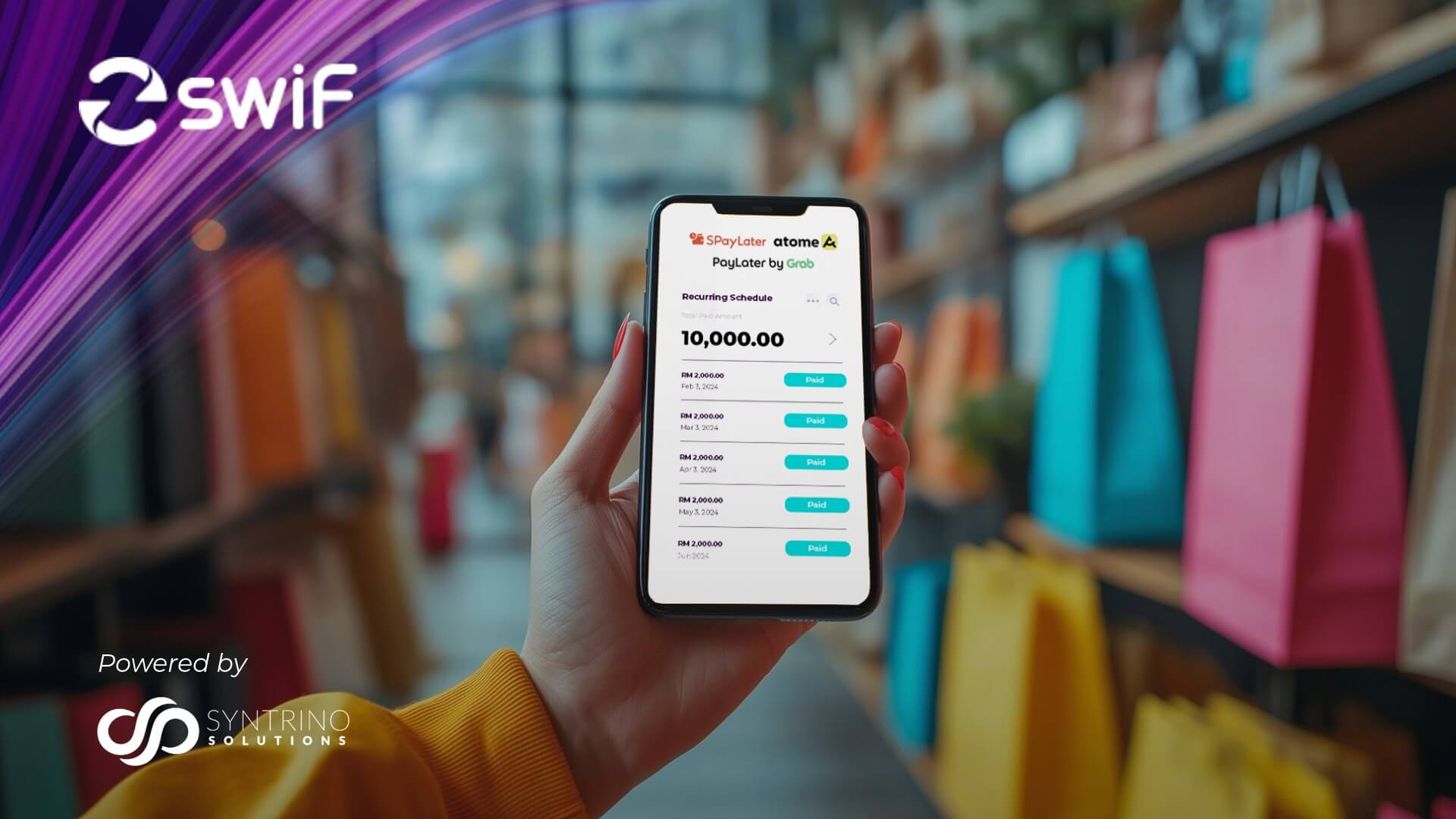

5. Embedded Payment Gateway

SwiF’s integration with the SwiF Payment Gateway simplifies the e-invoicing process by allowing you to embed payment links directly into your invoices. This allows your customers to make direct payments using their preferred payment method, improving cash flow and streamlining the overall invoicing experience.

Effortless Checkout

By incorporating payment links into your e-invoices, you provide your customers with a convenient and straightforward way to settle their outstanding balances, reducing the friction often associated with traditional invoice payment methods.

Improved Cash Flow

The ability to accept direct payments through your e-invoices can significantly improve your cash flow, as customers are more likely to settle their bills promptly when the payment process is seamless and integrated.

Enhanced Customer Experience

Embedding payment options within your e-invoices enhances the overall customer experience, demonstrating your commitment to providing an optimised and efficient invoicing process.

6. Automatic Document Numbering

Maintaining a consistent and organised system for document numbering can be a challenge, especially as your business scales. SwiF addresses this by automatically providing invoice numbers or document numbers for your e-invoicing submissions.

Simplified Record-Keeping

SwiF’s automatic document numbering feature ensures that each of your e-invoices, credit notes, debit notes, and refund notes is assigned a unique identifier, improving record-keeping and making it easier to track and manage your documents.

Compliance-Driven Approach

The automatic numbering system employed by SwiF aligns with the requirements set forth by LHDN, ensuring that your e-invoicing documents are compliant and meet the necessary standards.

Improved Traceability

With each document assigned a unique number, you can easily track and reference specific invoices or credit notes, enhancing your ability to manage your finances and address any queries or disputes that may arise.

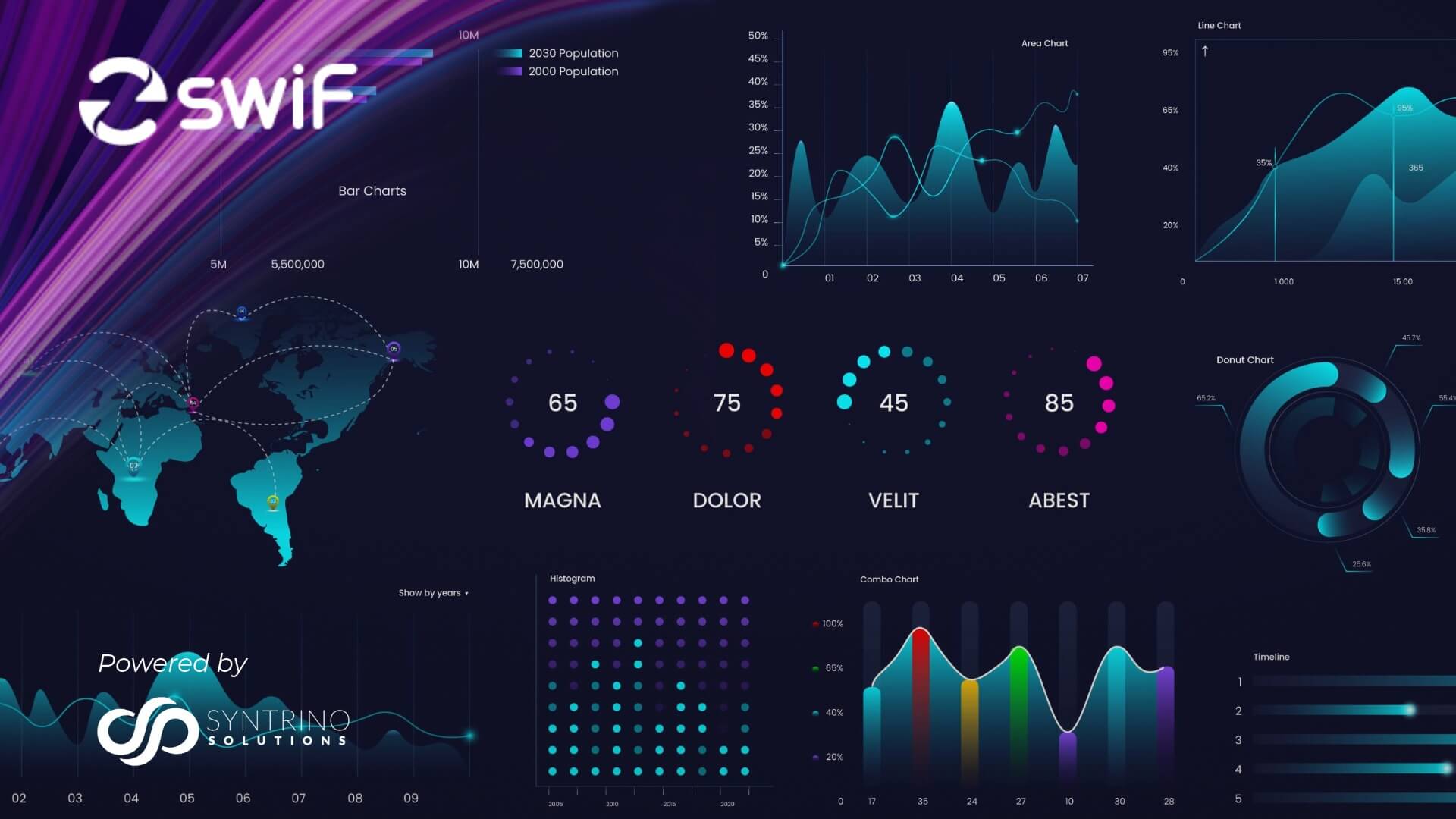

7. Comprehensive Submission Reporting

Maintaining visibility and control over your e-invoicing submissions is crucial for ensuring compliance and addressing any issues that may arise. SwiF’s web portal provides detailed reporting on every submission made to LHDN, empowering you to stay informed and organised.

Detailed Transaction Records

The SwiF web portal offers comprehensive reports that capture the details and status of each e-invoicing submission to LHDN. This allows you to quickly identify any documents that may require attention or resubmission.

Real-Time Status Tracking

With SwiF, you can easily access the current status of your LHDN submissions, enabling you to proactively monitor the progress of your e-invoicing documents and address any validation issues that arise.

Streamlined Compliance Management

The detailed reporting capabilities of SwiF’s web portal help you maintain a clear and organised record of your e-invoicing activities, simplifying the process of demonstrating compliance to regulatory authorities.

8. Cost-Effective Digital Signature Integration

Ensuring the security and authenticity of your e-invoicing documents is a critical requirement. SwiF offers a convenient and cost-effective solution for integrating digital signatures directly onto your submissions.

Effective Integration

SwiF’s digital signature integration allows you to embed the necessary security measures onto your e-invoices, credit notes, and other documents without the need to purchase a separate digital signature solution.

Enhanced Compliance

By incorporating digital signatures, you can be confident that your e-invoicing documents meet the stringent compliance requirements set forth by LHDN, providing an additional layer of trust and credibility.

Cost Savings

The enhanced integration of digital signatures through SwiF eliminates the need for you to invest in a standalone digital signature service, resulting in significant cost savings and a more efficient e-invoicing workflow.

9. Automated Notifications for e-Invoice Submissions

Staying informed about the status of your e-invoicing submissions is crucial for maintaining compliance and addressing any issues that may arise. SwiF’s automated notification system ensures that you are always up-to-date on the progress of your document submissions.

Real-Time Status Updates

SwiF’s system automatically notifies merchants of any status updates regarding their document submissions to LHDN, keeping you informed in real-time about the progress of your e-invoicing activities.

No Additional Development Required

Merchants using SwiF do not need to create any additional programmes or tools to check for status updates. The automated notification system handles this seamlessly, ensuring that you are always informed without the need for additional development efforts.

Enhanced Compliance Monitoring

By receiving timely notifications about the status of your e-invoicing submissions, you can proactively address any issues and maintain a high level of compliance, reducing the risk of penalties or non-compliance.

10. Bulk e-Invoice Submission

For businesses without existing systems or integrations, SwiF offers a user-friendly solution for submitting bulk e-invoices to LHDN. This feature simplifies the e-invoicing process, making it accessible to a wider range of businesses.

Standardised File Format

SwiF’s bulk submission functionality allows merchants to easily upload a standardised file containing multiple e-invoices, eliminating the need to navigate the complexities of the UBL JSON format required by LHDN.

Systemised Integration

Merchants can utilise SwiF’s standard authentication API to submit their bulk e-invoice documents to LHDN, saving time and ensuring a smooth integration experience, even for those without advanced technical capabilities.

Efficient Compliance Management

By providing a user-friendly bulk submission option, SwiF empowers businesses of all sizes to comply with e-invoicing requirements, levelling the playing field and ensuring that no one is left behind in the transition to digital invoicing.

Conclusion

As Malaysian businesses navigate the evolving e-invoicing landscape, the right tools and solutions can make all the difference. SwiF, with its comprehensive suite of features, stands out as a powerful e-invoicing platform that facilitates compliance, enhances efficiency, and empowers businesses to thrive in the digital age.

From automated LHDN submissions and effortless document generation to seamless SAP B1 integration and embedded payment gateways, SwiF offers a holistic approach to e-invoicing that addresses the diverse needs of modern enterprises. By embracing SwiF, businesses can streamline their invoicing processes, improve cash flow, and maintain a strong competitive edge in the market. As you embark on your e-invoicing journey, consider the transformative impact that SwiF can have on your operations. Unlock the full potential of digital invoicing and position your business for sustained success in the years to come.

SwiF is Malaysia’s Leading-Edge B2B2C Fintech Solution.

Powered by Syntrino Solutions, Southeast Asia’s leader in supply chain management, SwiF’s digital collection and payment gateway seamlessly integrates with your existing systems, streamlining all your B2B2C transactions.

SwiF empowers businesses to offer flexible payment options, both online and offline, including major credit cards, online banking, e-wallets, BNPL, invoice financing, and micro-financing.

Our innovative e-invoicing plug-in ensures your business stays at the forefront of regulatory standards, while advanced monitoring and analytics keep you on top of your business performance at all times.