Businesses are continually seeking innovative ways to streamline operations, boost efficiency, and stay ahead of the competition. E-invoicing is one game-changing innovation that is completely transforming how companies handle their financial transactions. With regulatory bodies and industry leaders acknowledging its huge benefits, the smooth adoption of e-invoicing is essential for businesses that want to succeed in the modern landscape.

Mastering the intricacies of e-invoicing might seem overwhelming, but with the right tools and support, businesses can tap into a wealth of opportunities. SwiF, a reputable fintech solution provider, offers a complete range of services tailored to simplify the shift to e-invoicing, enabling organisations to smoothly and confidently embrace this digital transformation.

1. Effortless Integration: Bridging the Gap Between Legacy Systems and e-Invoicing

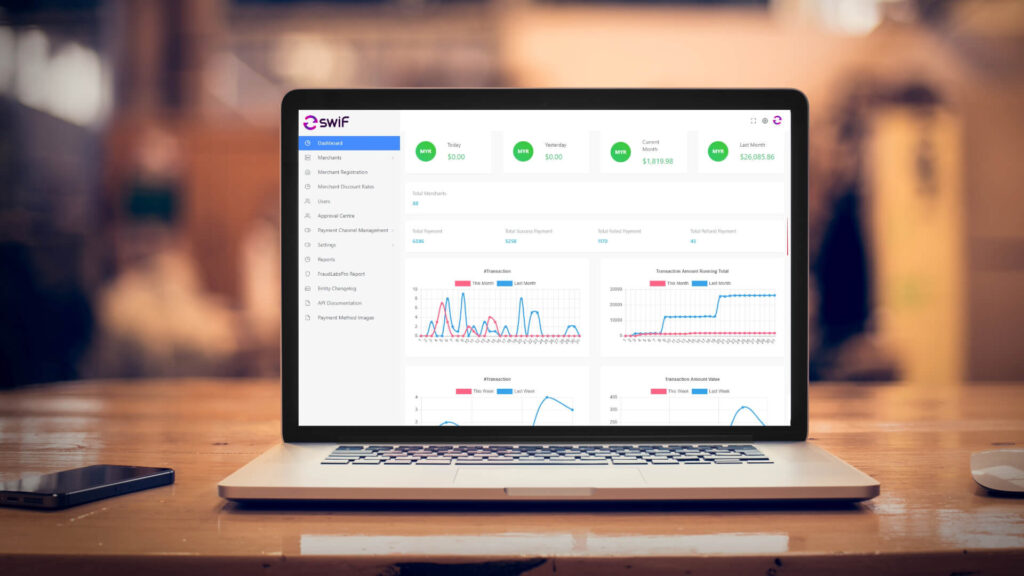

One of the primary challenges businesses face when adopting e-invoicing is the integration with existing systems and processes. SwiF understands this hurdle and offers a seamless integration solution that bridges the gap between legacy systems and the e-invoicing ecosystem. By leveraging SwiF’s advanced APIs and intuitive interfaces, businesses can effortlessly connect their current infrastructure with the e-invoicing platform, minimising disruptions and ensuring a smooth transition.

2. Automated Invoice Generation: Streamlining Document Creation

Manual invoice generation can be a time-consuming and error-prone process, hindering productivity and increasing the risk of non-compliance. SwiF addresses this challenge by providing a robust automated invoice generation solution. With a user-friendly interface, businesses can create invoices, credit notes, debit notes, and refund notes with just a few clicks, saving valuable time and resources while ensuring accuracy and consistency.

3. Bulk Submission Capabilities: Efficient Handling of Large-Scale Operations

For businesses with high transaction volumes, managing e-invoicing processes can become overwhelming. SwiF’s bulk submission capabilities empower organisations to streamline their operations by allowing the submission of consolidated e-invoices to regulatory authorities in a standardised file format. This feature eliminates the need for manual entry, reducing the risk of errors and enabling businesses to scale their operations efficiently.

4. Real-Time Status Tracking: Transparent Visibility into e-Invoicing Processes

Transparency and visibility are crucial elements in any successful e-invoicing implementation. SwiF recognises this need and offers comprehensive real-time status tracking capabilities. Through a user-friendly web portal, businesses can monitor the status of their e-invoice submissions to regulatory authorities, ensuring they remain informed and in control throughout the entire process.

5. Automated Notifications: Staying Ahead with Timely Updates

In the fast-paced business world, timely updates and notifications can make a significant difference in decision-making and operational efficiency. SwiF’s automated notification system keeps businesses informed about the status of their e-invoice submissions, ensuring they are always up-to-date and can respond promptly to any issues or changes.

6. Secure Digital Signatures: Enhancing Authenticity and Compliance

Digital signatures play a crucial role in ensuring the authenticity and integrity of e-invoices. SwiF offers a cost-effective and seamless digital signature integration service, allowing businesses to embed secure digital signatures directly onto their document submissions. This feature not only enhances compliance but also provides an additional layer of security, fostering trust and credibility in the e-invoicing ecosystem.

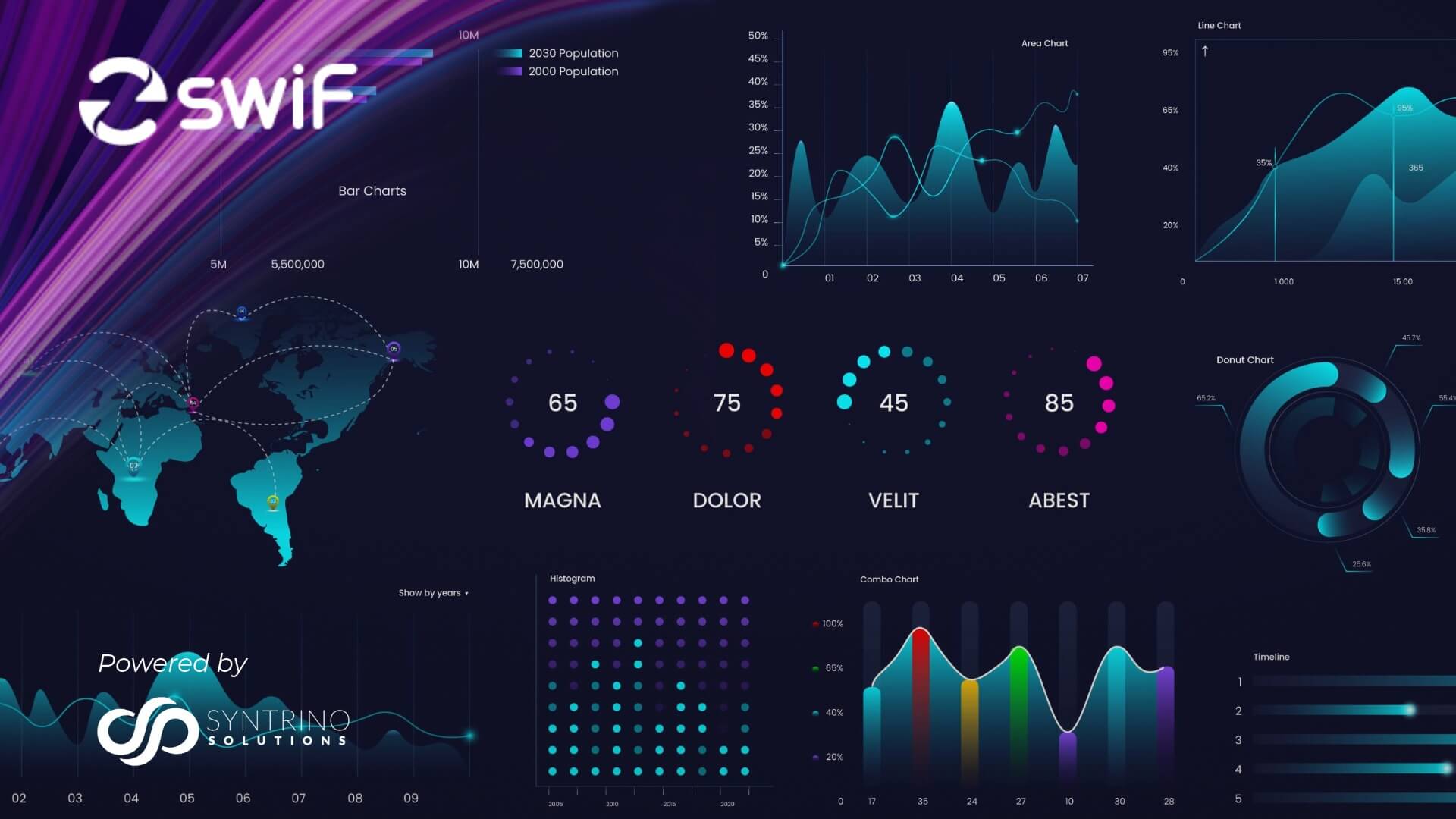

7. Comprehensive Reporting: Gaining Insights for Informed Decision-Making

Data-driven decision-making is essential for businesses to thrive. SwiF’s comprehensive reporting capabilities provide detailed insights into e-invoice submissions, enabling organisations to analyse trends, identify areas for improvement, and make informed decisions to optimise their e-invoicing processes.

8. Tax Identification Number (TIN) Management: Streamlining Customer Data Collection

Collecting and verifying customer Tax Identification Numbers (TINs) can often be a tedious and error-sensitive process. SwiF simplifies this with a self-update page, allowing customers to directly input their information. This feature is linked with regulatory authority servers, ensuring the data’s accuracy and greatly minimising the risk of rejection due to incorrect TIN entries.

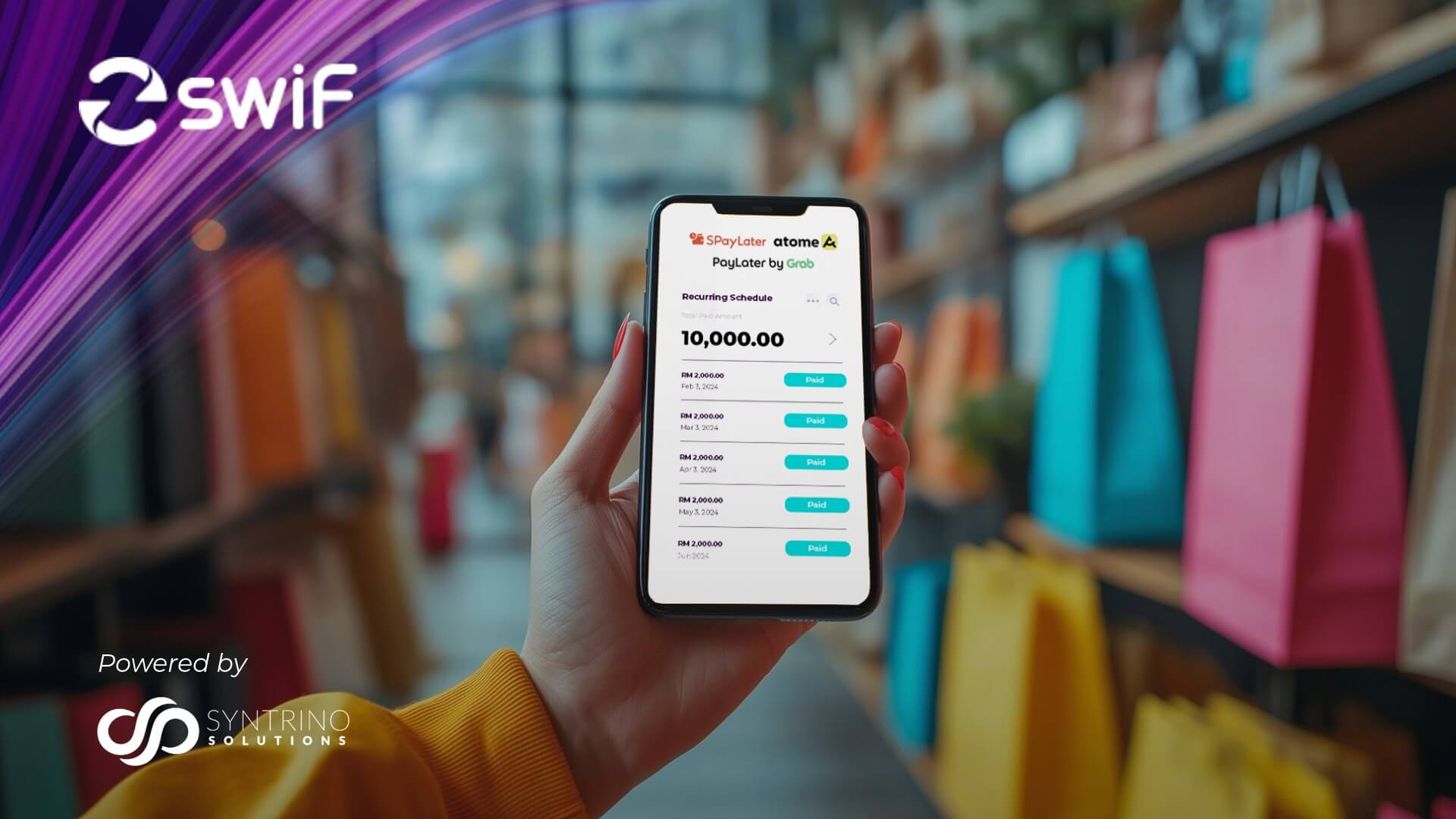

9. Flexible Payment Integration: Enhancing Customer Experience

E-invoicing is not just about compliance; it’s also an opportunity to enhance the customer experience. SwiF recognises this and offers flexible payment integration options, allowing businesses to embed payment links directly into their e-invoices. Customers can then conveniently make payments using their preferred payment methods, easing the entire process and improving customer satisfaction.

10. Scalable and Future-Proof Solutions: Staying Ahead of the Curve

As the e-invoicing landscape continues to evolve, businesses need solutions that can adapt and grow with their changing needs. SwiF’s scalable and future-proof solutions are designed to anticipate and accommodate emerging trends and regulatory requirements, ensuring that businesses remain compliant and competitive in the ever-changing digital landscape.

Conclusion

The transition to e-invoicing is no longer an option but a necessity for businesses. By partnering with SwiF, organisations can navigate this journey with confidence, leveraging a comprehensive suite of solutions that simplify the e-invoicing process, enhance efficiency, and foster compliance. From seamless integration to automated invoice generation, bulk submission capabilities, real-time tracking, and secure digital signatures, SwiF empowers businesses to embrace the e-invoicing revolution seamlessly, unlocking a world of opportunities for growth and success.

SwiF is Malaysia’s Leading-Edge B2B2C Fintech Solution.

Powered by Syntrino Solutions, Southeast Asia’s leader in supply chain management, SwiF’s digital collection and payment gateway seamlessly integrates with your existing systems, streamlining all your B2B2C transactions.

SwiF empowers businesses to offer flexible payment options, both online and offline, including major credit cards, online banking, e-wallets, BNPL, invoice financing, and micro-financing.

Our innovative e-invoicing plug-in ensures your business stays at the forefront of regulatory standards, while advanced monitoring and analytics keep you on top of your business performance at all times.