Effective supply chain management is crucial for businesses to optimise their operations, reduce costs, and deliver products or services to customers in a timely and efficient manner. It involves the planning, execution, and control of the flow of goods, services, information, and finances from the point of origin to the point of consumption and encompasses a wide range of activities, including procurement, production, logistics, and distribution.

In the past decade, the complexity of supply chains has increased exponentially. Businesses must navigate a web of suppliers, manufacturers, distributors, and customers, all while ensuring seamless coordination and visibility across the entire supply chain. This challenge has led to the emergence of innovative solutions that leverage the power of financial technology (fintech) to enhance overall efficiency.

The Importance of Optimising Business Operations

Inefficiencies in the supply chain can lead to increased costs, delayed deliveries, and dissatisfied customers, ultimately impacting the bottom line. By implementing innovative solutions, businesses can streamline their operations and enhance overall business performance.

Effective supply chain management can unlock a range of benefits, including:

- Cost Reduction: Identifying and eliminating waste, streamlining processes, and leveraging data-driven insights can lead to significant cost savings.

- Improved Efficiency: Coordinating the flow of goods, services, and information can enhance productivity, reduce lead times, and increase overall operational performance.

- Enhanced Customer Satisfaction: Timely deliveries, accurate order fulfillment, and responsive customer service can contribute to higher customer satisfaction and loyalty.

- Increased Visibility and Transparency: Gaining real-time visibility into the supply chain can enable better decision-making, risk management, and collaboration with partners.

- Agility and Resilience: Adaptable supply chain systems can help businesses respond quickly to changing market conditions and mitigate disruptions.

How Fintech is Revolutionising Supply Chain Management

Fintech, has emerged as a powerful tool for transforming the way businesses manage their supply chain operations. Through the integration of B2B2C (business-to-business-to-consumer) solutions, fintech is enabling organisations to streamline their financial processes, improve cash flow management, and enhance the overall supply chain.

These solutions create a seamless and efficient ecosystem that connects businesses, suppliers, and customers, enabling them to collaborate more effectively and optimise their financial transactions.

Exploring B2B2C Fintech Solutions

B2B2C fintech solutions are designed to address the unique challenges faced by businesses in the supply chain, providing a comprehensive suite of tools and services.

These solutions typically include features such as:

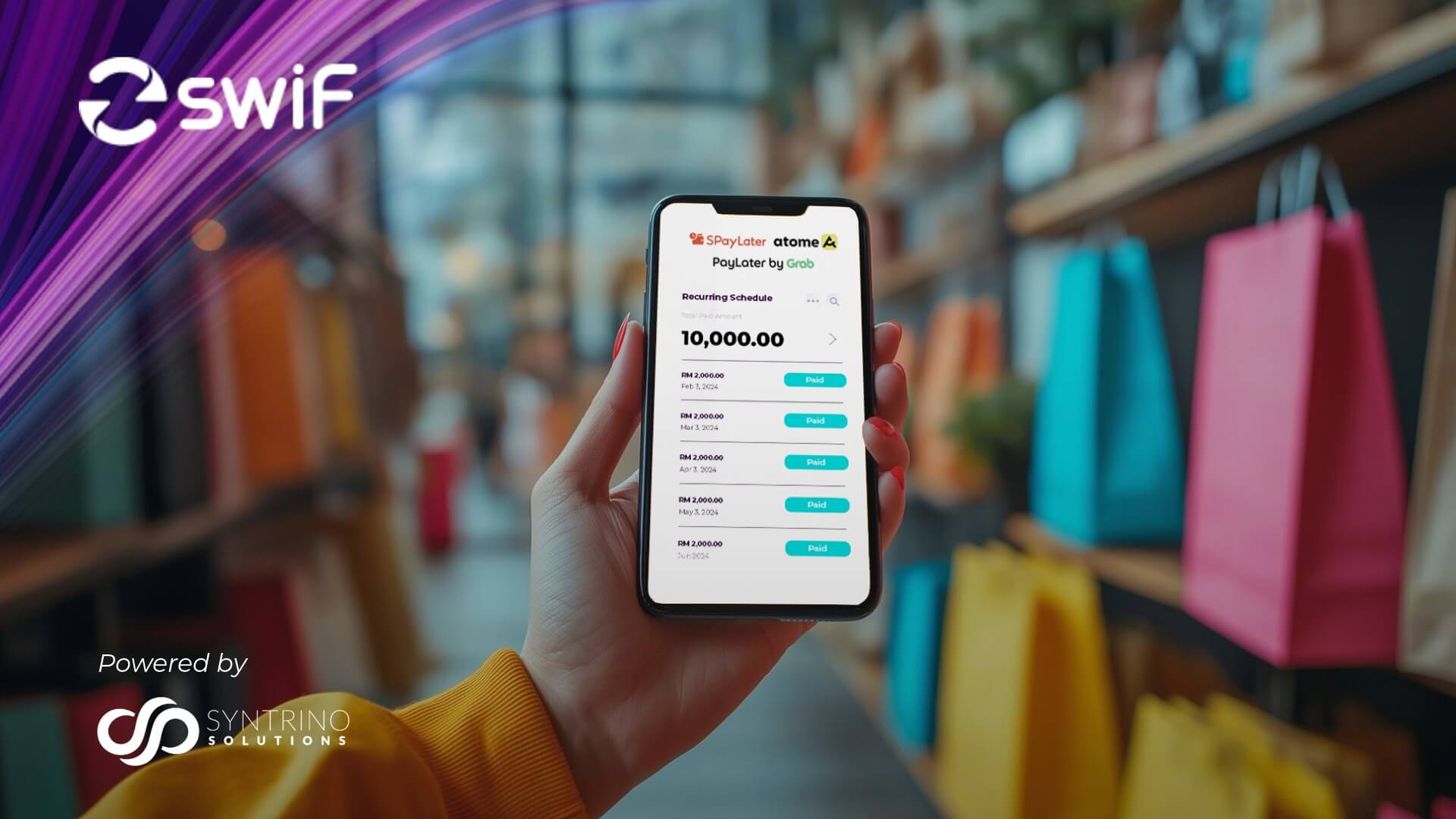

- Digital Collections and Payments: Secure digital payment platforms that enable faster and more efficient transactions between businesses, suppliers, and customers.

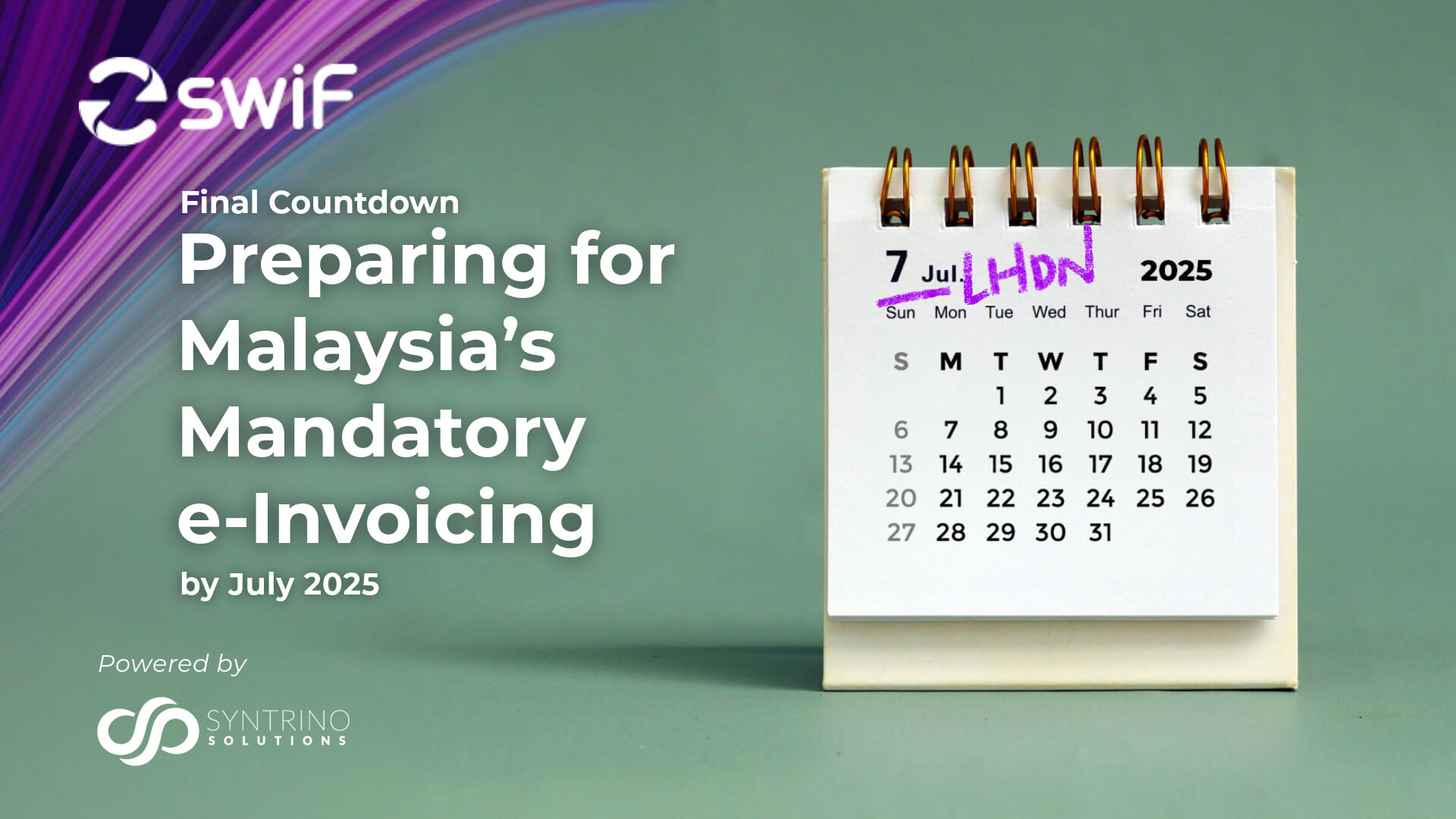

- E-invoicing: Automated invoicing streamlines tax processes, enhances business efficiency and compliance. It simplifies invoicing, automates data entry, and integrates seamlessly for tax filing. This saves time and costs, benefiting businesses greatly.

- Supply Chain Financing: Innovative financing options, such as supply chain finance and dynamic discounting, that provide businesses with access to working capital and improve cash flow management.

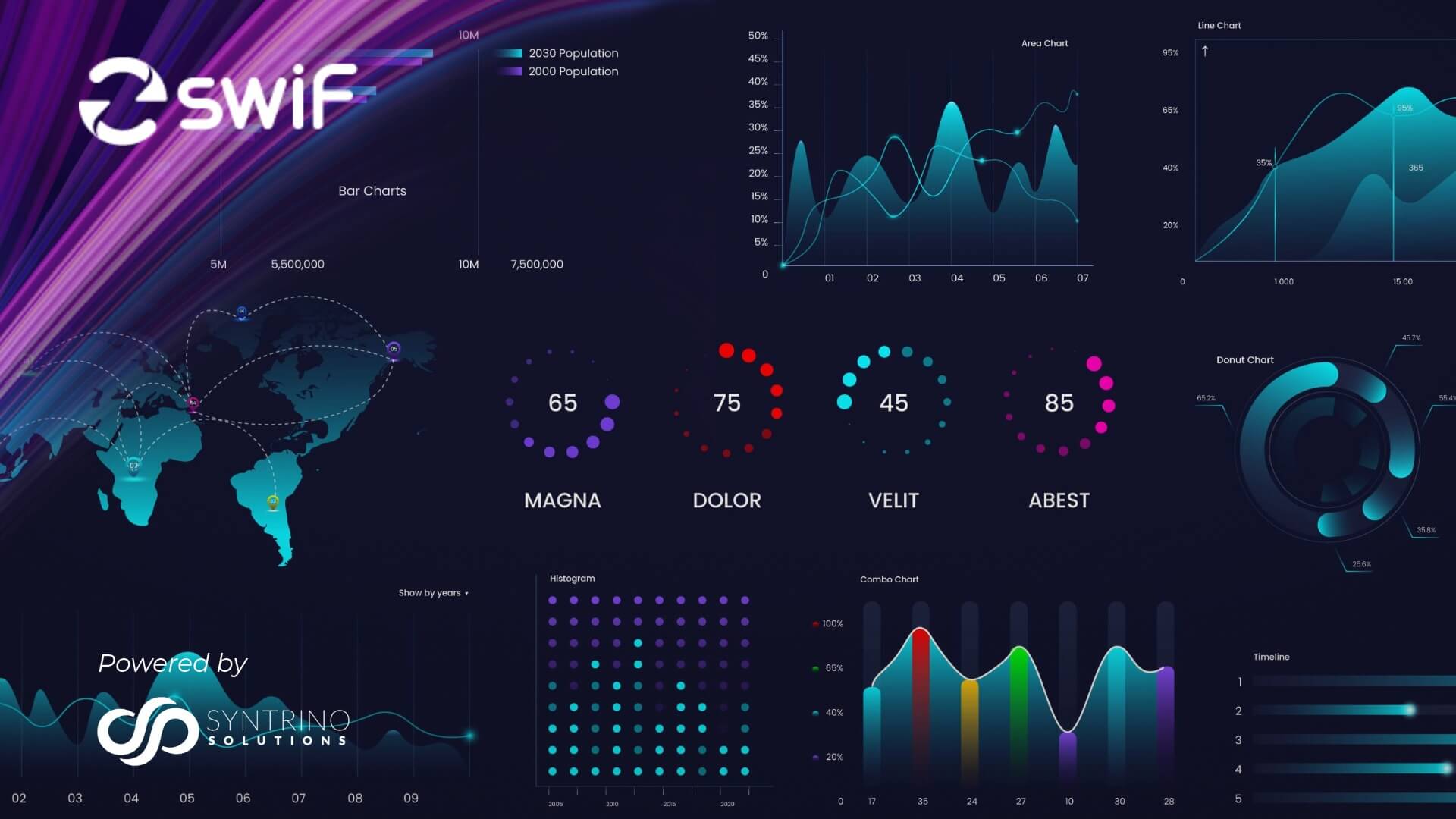

- Data Analytics and Insights: Advanced data analytics and reporting tools that provide businesses with real-time visibility into their supply chain performance, enabling them to make informed decisions and optimise their operations.

- Integrated Supply Chain Platforms: Comprehensive platforms that integrate various supply chain functions, including procurement, logistics, and financial management, to create a seamless and efficient ecosystem.

Benefits of Implementing B2B2C Fintech Solutions in Supply Chain Management

The integration of B2B2C fintech solutions offers a range of compelling benefits for businesses to enhance their competitive advantage, and better serve their customers.

Improved Cash Flow Management

Features such as automated invoicing, digital payments, and supply chain financing can help businesses accelerate the invoicing and payment processes, improve liquidity, and better manage their working capital.

Enhanced Supplier and Customer Relationships

B2B2C fintech solutions can foster stronger relationships with both suppliers and customers. By streamlining financial transactions, improving transparency, and offering flexible payment options, businesses can build trust, increase collaboration, and enhance overall customer and supplier satisfaction.

Increased Operational Efficiency

Automation of invoicing, payments, and other financial processes can reduce administrative overhead, minimise errors, and free up resources for more strategic initiatives.

Improved Data-driven Decision Making

B2B2C fintech solutions often come with advanced data analytics and reporting capabilities. By leveraging these insights, businesses can make more informed decisions, identify optimisation opportunities, and better manage risks across the supply chain.

Competitive Advantage

When businesses embrace B2B2C fintech solutions, they can differentiate themselves from their competitors and enhance their overall competitiveness. The ability to offer seamless financial experiences, flexible payment options, and data-driven supply chain optimisation can be a significant competitive advantage.

Conclusion

As businesses continue to navigate the complexities of supply chain management, the integration of B2B2C fintech solutions has emerged as a transformative force. By harnessing the power of innovative financial technologies, businesses can streamline their operations, improve cash flow management, enhance supplier and customer relationships, and gain a competitive edge in the market.

To unlock the full potential of B2B2C fintech solutions in your supply chain management, we invite you to explore our comprehensive suite of services. Our team of experts can help you identify the right solutions, implement them seamlessly, and guide you through the transformation process.

SwiF is Malaysia’s Leading-Edge B2B2C Fintech Solution.

Powered by Syntrino Solutions, Southeast Asia’s leader in supply chain management,

SwiF’s digital collection and payment gateway streamlines B2B2C transactions with simplicity, transparency, and visibility.

Our comprehensive Payment Gateway solution enables businesses to accept various payment methods, online and offline, including major credit cards, online banking, invoice financing, and e-wallets. With our recent collaboration with Funding Societies Malaysia, SwiF Payment Gateway now seamlessly incorporates micro-financing capabilities.

Contact us today to learn more and take the first step towards revolutionising your supply chain management.