Micro-financing has emerged as a powerful tool for businesses, particularly Small and Medium Enterprises (SMEs), to fuel their growth and overcome financial barriers. This innovative approach to lending is revolutionising the way businesses access capital, allowing them to thrive in an increasingly competitive market. At its core, micro-financing aims to provide small loans and financial services to entrepreneurs who lack access to traditional banking services. By bridging this gap, micro-financing opens up a world of opportunities for businesses to expand, create jobs, and contribute to economic development.

Funding Societies Malaysia has been at the forefront of this new model and provides SMEs all over Malaysia with micro-financing options to best fit their needs and support their growth.

Benefits of Micro-Financing for Businesses

The benefits of micro-financing for businesses are numerous.

It provides much-needed capital for businesses to invest in their operations, such as purchasing equipment, inventory, or expanding their workforce. This infusion of funds can be a game-changer for entrepreneurs looking to take their businesses to the next level.

Micro-financing also offers flexible repayment terms, allowing businesses to repay the loans in a manner that aligns with their cash flow. This flexibility reduces the burden on businesses and increases their chances of success.

It also promotes financial inclusion by extending credit to individuals who may not have a credit history or collateral. As a result, this creates opportunities for aspiring entrepreneurs who are often excluded from traditional financing options.

What’s more, micro-financing fosters financial literacy among borrowers, equipping them with the knowledge and skills to manage their finances effectively.

Streamlining the Application Process

One of the key challenges faced by businesses when applying for traditional business financing is the complex and time-consuming application process. However, with micro-financing, this process can be streamlined, making it easier and more efficient for businesses to access the funds they need. Borrowers can submit their loan applications online, eliminating the need for physical paperwork and lengthy processing times. This digital solution expedites the application process, enabling businesses to receive a response within a shorter timeframe.

In addition to streamlining the application, offering micro-financing to your customers facilitates faster cash flow and business operations. Traditional lending processes can sometimes hinder businesses’ ability to seize immediate opportunities and stop your potential customers from doing business with you.

Credit Assessment and Its Role in Micro-Financing

Credit assessment plays a crucial role, as it helps lenders evaluate the creditworthiness of borrowers. With micro-financing providers such as Funding Societies Malaysia, this process becomes more efficient and seamless. By leveraging advanced data analytics and machine learning algorithms, lenders can assess the creditworthiness of borrowers in a more comprehensive and objective manner. This not only reduces the risk for lenders but also increases the chances of deserving businesses accessing the capital they need.

Connecting SMEs with Investors

Micro-financing goes beyond providing access to capital; it also serves as a platform for connecting SMEs with investors. By leveraging the power of technology, micro-financing platforms like Funding Societies create an ecosystem where businesses can showcase their potential to a wide network of investors. This creates new avenues for funding and investment, enabling businesses to secure additional capital for growth.

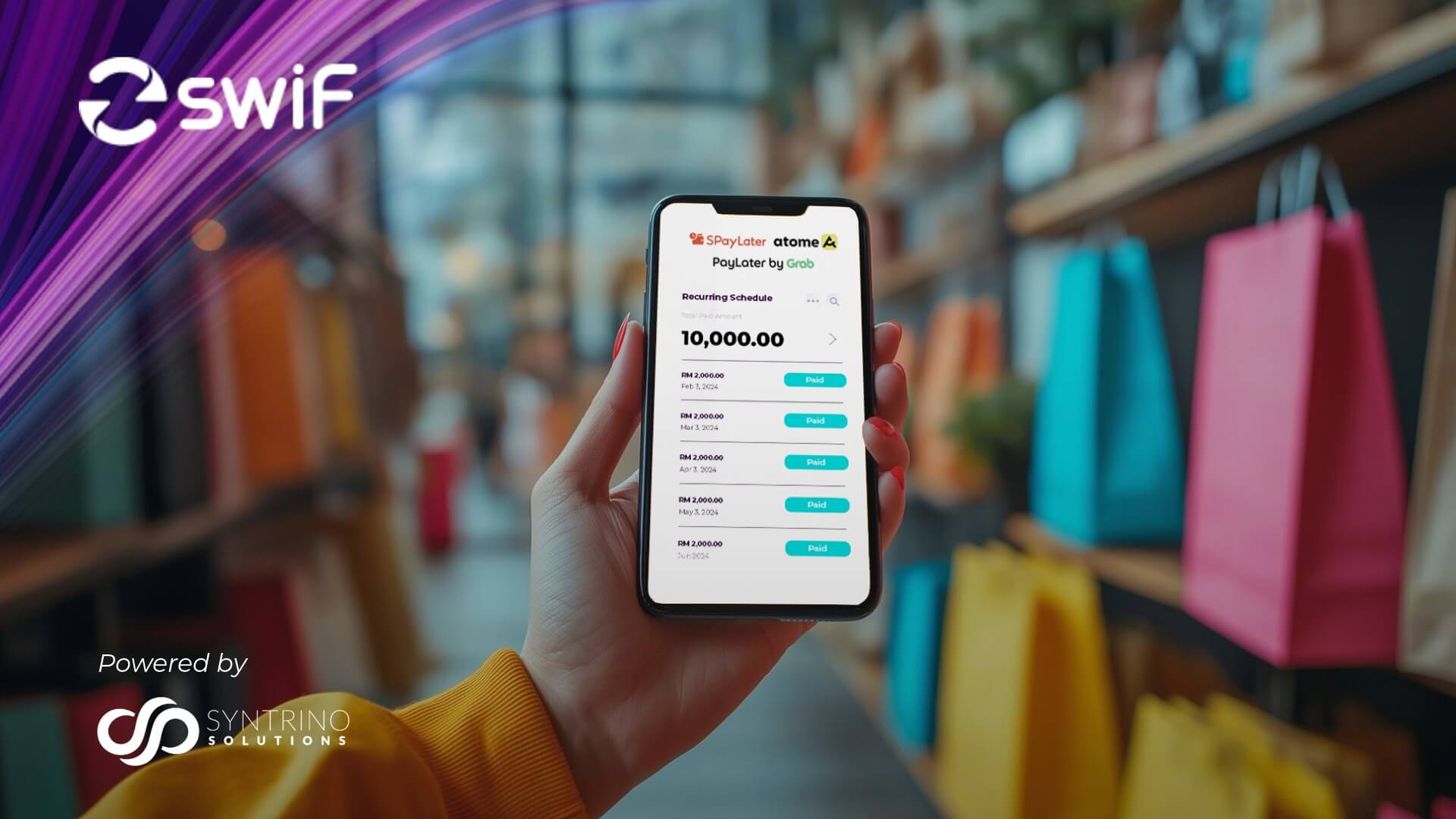

Furthermore, easy access to all aspects of the micro-financing plan, including loan repayment schedules, interest calculations and reporting, enhances transparency and trust between borrowers and investors, fostering a mutually beneficial relationship that drives business growth and prosperity.

SwiF launches SwiF Micro-Financing

SwiF is excited to announce the launch of SwiF Micro-Financing, made possible through our collaboration with Funding Societies Malaysia. This partnership enhances our SwiF Payment Gateway by seamlessly integrating micro-financing capabilities, particularly through Funding Societies Malaysia’s SME Micro Financing/-I option.

By teaming up with Funding Societies Malaysia, we offer your business and its customers a smoother path to financial support directly through the SwiF Payment Gateway. This integration expands your business’s horizons by providing your potential customers with convenient access to micro-financing.

This alliance not only expedites the financing process but also streamlines it by reducing the involvement of multiple parties, ensuring a hassle-free experience for both your business and its customers. And this is just the beginning.

As we continue to evolve and enhance our services, SwiF Micro-Financing will soon offer you access to a range of micro-financing options. Through our integration, customers will effortlessly navigate micro-financing avenues. This innovative approach eliminates the cumbersome document preparation often associated with traditional banks, making financing more accessible and efficient than ever before.

Conclusion

Micro-financing has emerged as a powerful tool for unlocking business growth. By streamlining the application process, facilitating fast approval, offering flexible financing options, and connecting SMEs with investors, micro-financing revolutionises the way businesses access capital.

Payment gateway integration provides enhanced payment solutions for businesses to overcome financial barriers, seize growth opportunities, and contribute to economic development.

SwiF is Malaysia’s Leading-Edge B2B2C Fintech Solution.

Powered by Syntrino Solutions, Southeast Asia’s leader in supply chain management,

SwiF’s digital collection and payment gateway streamlines B2B2C transactions with simplicity, transparency, and visibility.

Our comprehensive Payment Gateway solution enables businesses to accept various payment methods, online and offline, including major credit cards, online banking, invoice financing, and e-wallets. With our recent collaboration with Funding Societies Malaysia, SwiF Payment Gateway now seamlessly incorporates micro-financing capabilities.

Unlock your business’s full potential. Reach out to our team to harness the power of micro-financing.