Maintaining competitiveness is essential for every organisation and B2B fintech solutions offers a pathway to gaining a competitive edge by optimising financial processes and operations. These solutions include various tools such as payment gateways, digital wallets, invoicing platforms, and financial analytics softwares.

B2B Fintech Solutions

The adoption of B2B fintech solutions brings numerous benefits to businesses. Firstly, these solutions improve efficiency by automating manual financial processes. Tasks such as invoice generation, payment processing, and financial reporting can now be completed in a fraction of the time, allowing your employees to focus on more value-added activities. This increased efficiency not only saves time but also reduces costs associated with labour and human error.

In addition, B2B fintech solutions offer enhanced security measures compared to traditional financial systems. With the ever-growing threat of cyberattacks, businesses must prioritise data protection. Fintech solutions employ advanced encryption technologies and multi-factor authentication to safeguard sensitive financial information. This heightened security provides peace of mind for both your business and customers.

B2B fintech solutions also provide valuable data insights that can drive informed decision-making. When you leverage on advanced analytics tools, your business can gain a deeper understanding of its financial performance, cash flow, and customer behaviours. These insights will enable you to identify areas for improvement, optimise resource allocation, and capitalise on opportunities for growth.

How B2B Fintech Solutions Drive Value

B2B fintech solutions drive value for businesses in several ways.

Firstly, these solutions optimise resource allocation. With streamlined financial processes, businesses can allocate resources more effectively, reduce waste and maximise productivity. It makes sense to automate tasks such as payment processing and financial reporting. That way, your business can reallocate human capital to strategic initiatives that drive growth and innovation.

B2B fintech solutions also enhance productivity by eliminating manual and repetitive tasks. When businesses automate financial processes, they can reduce the risk of errors and delays, resulting in faster turnaround times. This increased productivity not only improves internal operations but also enhances the overall customer experience. Customers benefit from quicker payment processing, more accurate invoicing, and seamless financial interactions, leading to higher levels of satisfaction and loyalty.

Actionable Insights with Advanced Analytics and Real-Time Reporting

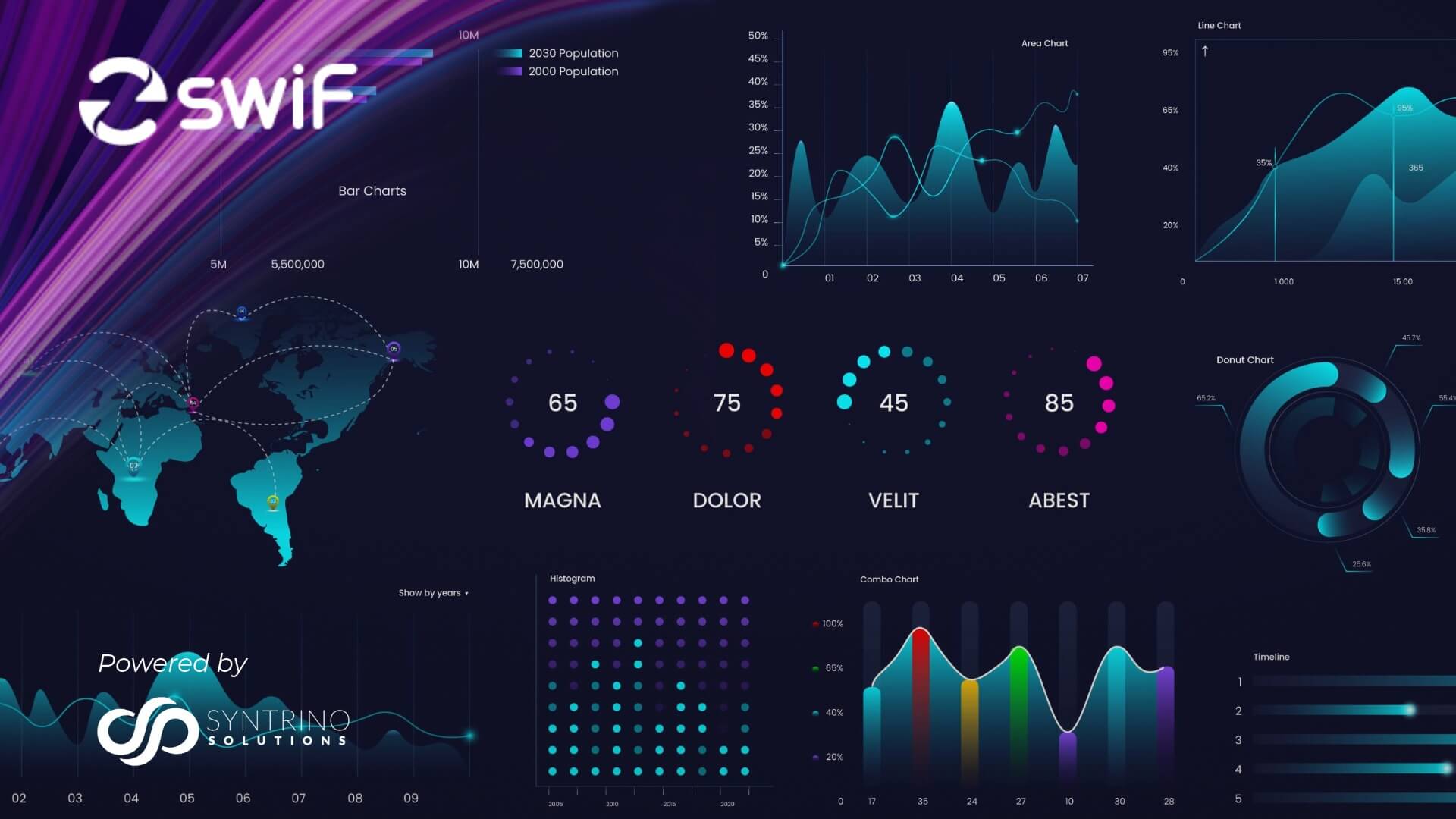

With the advanced analytics tools and real-time reporting dashboards your business can gain actionable insights from its financial data. As you leverage on sophisticated algorithms and machine learning capabilities, you can easily uncover patterns, trends, and anomalies in your financial performance.

Real-time reporting dashboards provide up-to-date information on key financial metrics, such as revenue, expenses, and cash flow. This real-time visibility allows businesses to make informed decisions quickly, adapt to changing market conditions, and seize opportunities as they arise, ultimately gaining a competitive edge in the market.

Increased Market Share and Customer Loyalty

When efficiency is improved, businesses can deliver products and services more quickly and effectively, gaining a competitive edge over their rivals. This increased efficiency translates into cost savings, which can be passed on to customers in the form of lower prices or improved value propositions.

B2B fintech solutions also enhance the customer experience by providing seamless and convenient financial interactions. From simplified payment processes to personalised invoicing, e-wallets and mobile payment, these solutions make it easier for customers to do business with a company. This level of convenience and efficiency fosters customer loyalty and encourages repeat business.

These cutting-edge services, enable businesses to attract new customers and retain existing ones, ultimately increasing their market share and customer loyalty.

How B2B Fintech Solutions Contribute to Profitability

Beyond improving financial processes, attracting and retaining customers, B2B fintech solutions also enable businesses to reduce costs, and increase revenue streams.

Through financial data analysis, businesses can identify areas of inefficiency and implement measures to reduce costs. For example, businesses can identify suppliers with favourable payment terms or negotiate better prices based on their financial performance.

And by leveraging advanced analytics tools, businesses can also identify cross-selling and upselling opportunities, maximising the value of each customer interaction.

In summary, optimising resource allocation, enhancing productivity, and delivering an exceptional customer experience allow businesses to drive sustainable profitability and long-term success.

Key Considerations When Adopting B2B Fintech Solutions

Businesses must evaluate key factors when considering B2B fintech solutions.

Firstly, businesses should assess their current financial processes and identify pain points or areas for improvement, guiding the selection of the most suitable fintech solution for their specific needs.

Secondly, businesses should assess the security measures of each provider to ensure data protection, encompassing encryption, secure storage, and authentication protocols.

Thirdly, businesses should consider the scalability and compatibility of the chosen fintech solutions. As businesses grow and evolve, their financial needs may change. It is crucial to select solutions that can scale with the business and integrate seamlessly with existing systems.

Lastly, businesses should assess the level of support and training provided by the fintech solutions providers. Adoption of new technologies often requires a learning curve, and businesses should have access to comprehensive training resources and ongoing support to maximise the value of the solutions.

Conclusion

In conclusion, B2B fintech solutions have the power to unlock a competitive advantage for businesses. By improving efficiency, reducing costs, and enhancing the customer experience, these solutions drive value and contribute to profitability. The adoption of advanced analytics tools and real-time reporting dashboards empowers businesses to make data-driven decisions and gain a competitive edge in the market. When businesses embrace these solutions, they will stay updated on future trends to revolutionise operations and propel themselves towards further success.

Ready to revolutionise your business operations? Contact our team for information on how SwiF can propel your business towards further success.

SwiF is Malaysia’s Leading-Edge B2B2C Fintech Solution.

Powered by Syntrino Solutions, Southeast Asia’s leader in supply chain management, SwiF gives you access to a variety of collection and payment methods to streamline all aspects of your business operations.

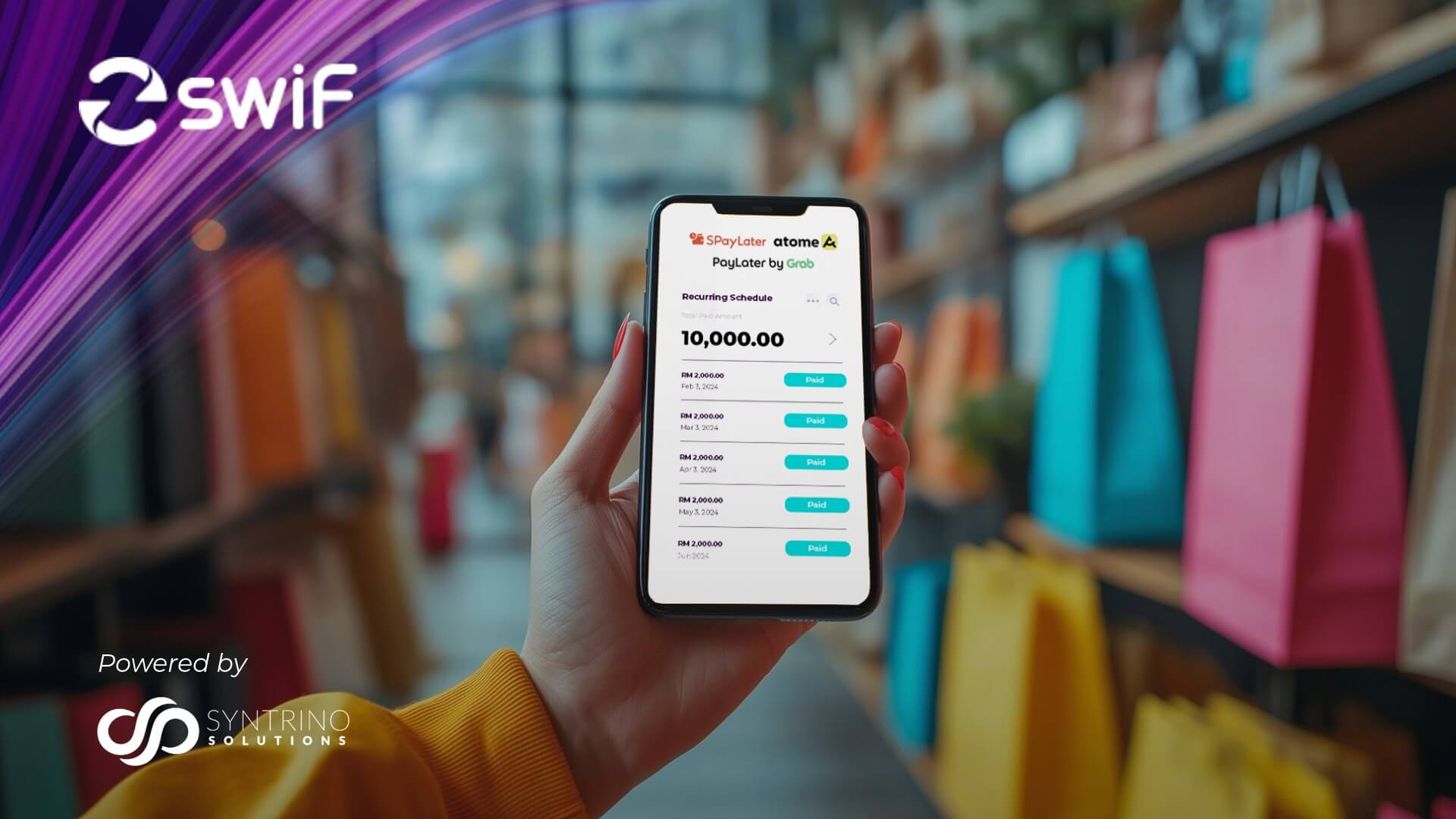

From major credit cards to online banking, e-wallets, Buy Now Pay Later, auto-debit, instalment options, and invoice financing, SwiF helps facilitate all your transactions and stay on top of your business with advanced analytics and reporting.

SwiF also takes regulatory compliance to the next level by integrating its innovative e-invoicing plug-in, ensuring your business remains at the forefront of regulatory standards.