Fintech, short for financial technology, has revolutionised the financial services industry in recent years, offering innovative solutions to traditional financial processes. One of the significant advantages fintech brings to businesses is its ability to enhance cost efficiency.

The Importance of Cost Efficiency in Businesses

Cost efficiency is crucial for businesses to thrive in a competitive landscape. It allows companies to optimise their resources and maximise profitability. Traditional financial services often involve manual and time-consuming processes, leading to higher costs. Fintech disrupts this status quo by automating various financial processes, reducing operational expenses, and improving overall cost efficiency. By leveraging technology, businesses can streamline operations, eliminate redundancies, and allocate resources more effectively.

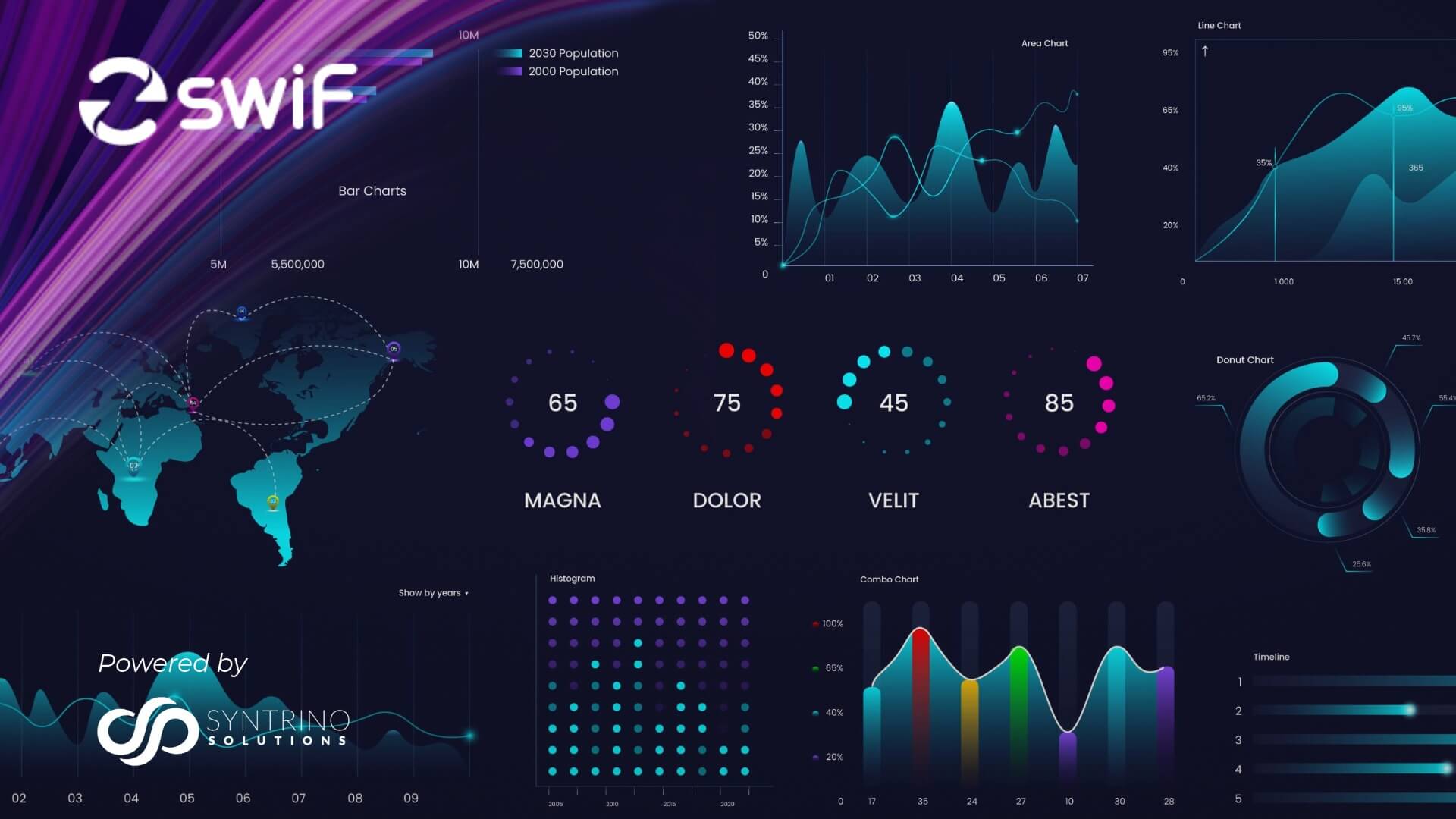

Enhanced Data Analytics and its Role in Cost Efficiency

Data analytics plays a pivotal role in driving cost efficiency for businesses. Fintech platforms leverage advanced data analytics tools and techniques to provide insights into financial transactions, customer behaviour, and market trends. By harnessing the power of big data, businesses can make data-driven decisions that optimise costs. Enhanced data analytics enables businesses to identify areas of inefficiency, streamline processes, and reduce unnecessary expenses. It also helps in identifying potential revenue opportunities and improving overall financial performance.

Improved Customer Experience through Fintech Innovations

Fintech innovations have significantly improved the customer experience in recent years. Traditional financial processes often involve lengthy paperwork, complex documentation, and time-consuming approval processes. Fintech solutions simplify these procedures, making them more efficient and user-friendly. For instance, digital payment platforms and mobile banking apps provide customers with convenient and secure ways to manage their finances. By offering seamless and user-friendly experiences, fintech enhances customer satisfaction, loyalty, and ultimately, cost efficiency for businesses.

The Role of Cybersecurity in Maintaining Cost Efficiency

As businesses embrace fintech solutions, cybersecurity becomes an integral part of maintaining cost efficiency. With the increasing digitisation of financial services, the risk of cyber threats and data breaches also amplifies. Fintech companies invest heavily in robust cybersecurity measures to protect sensitive financial information and secure transactions. By ensuring the integrity and confidentiality of data, businesses can prevent costly cybersecurity incidents that may lead to financial losses and reputational damage.

Regulatory Uncertainties and their Impact on Cost Efficiency

Regulatory uncertainties pose challenges to cost efficiency in financial services. (the highlighted line can be a quote within the article) Fintech operates in a rapidly evolving regulatory landscape, with different jurisdictions having varying regulations. These uncertainties can increase compliance costs and set back innovation. However, regulatory bodies are increasingly recognising the importance of fintech in driving cost efficiency and are adapting their frameworks accordingly. Clear and supportive regulations can foster a conducive environment for businesses to leverage fintech solutions and enhance cost efficiency.

Data Analytics and Business Intelligence in Driving Cost Efficiency

Data analytics and business intelligence are powerful tools that enable businesses to drive cost efficiency. Fintech platforms leverage these tools to analyse vast amounts of data and extract meaningful insights. By understanding customer preferences, market trends, and internal processes, businesses can identify cost-saving opportunities. Data analytics empowers businesses to optimise resource allocation, streamline operations, and identify areas for improvement. It enables proactive decision-making, resulting in improved cost efficiency and overall financial performance.

Fintech Solutions for Cost Efficiency in Financial Services

Fintech offers a range of solutions that directly contribute to cost efficiency in financial services. One such solution is Robotic Process Automation (RPA), which automates repetitive and manual tasks, reducing human errors and increasing operational efficiency. Another solution is Blockchain technology, which provides secure and transparent transactions, eliminating the need for intermediaries and reducing costs. Additionally, Artificial Intelligence (AI) and Machine Learning (ML) algorithms enable businesses to automate data analysis, risk assessment, and customer service, improving efficiency and reducing costs.

The Future of Cost Efficiency in Financial Services

The future of cost efficiency in financial services is closely intertwined with the evolution of fintech. As technology continues to advance, fintech solutions will become more sophisticated, offering even greater cost-saving opportunities. Increased adoption of AI, ML, and automation will further streamline processes, reduce costs, and drive overall efficiency. Additionally, advancements in cybersecurity will ensure the safe and secure implementation of fintech solutions, minimizing risks and enhancing cost efficiency. The future holds immense potential for businesses to leverage fintech and redefine their cost efficiency strategies.

Conclusion : Embracing Fintech for Cost Efficiency in Businesses

Fintech is reshaping the financial services industry and redefining cost efficiency for businesses. Its impact on cost optimisation is evident through enhanced data analytics, improved customer experiences, robust cybersecurity measures, and innovative solutions. Despite regulatory uncertainties, fintech continues to grow, providing businesses with opportunities to automate processes, reduce costs, and drive overall efficiency.

Whether you are a well-established business or startup, embracing fintech can help you streamline operations, optimise resource allocation, and drive overall financial performance for your business.

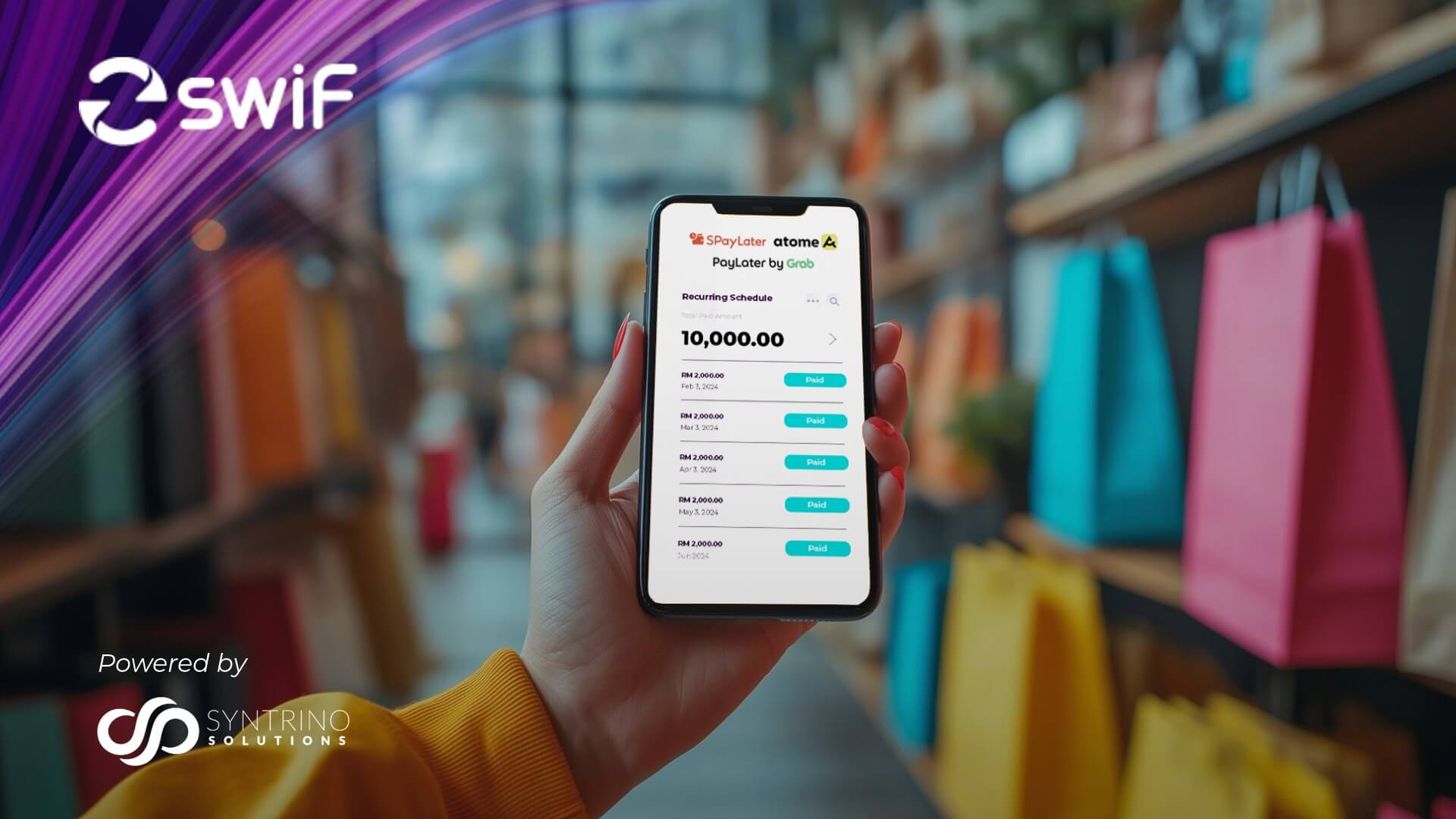

SwiF is Malaysia’s Leading-Edge B2B2C Fintech Solution.

Powered by Syntrino Solutions, Southeast Asia’s leader in supply chain management, SwiF gives you access to a variety of payment methods for all your business transactions both online and offline including all major credit cards, online banking, micro-financing, and e-wallet.

Contact our team to learn how SwiF can redefine cost efficiency for your business.