Introduction to Credit Card Collections

As a business owner, managing your accounts receivable is crucial for maintaining a healthy cashflow and ensuring the long-term success of your company. One effective strategy to improve your collections process is to implement a credit card collections system.

Here are the top 10 benefits of incorporating credit card collections into your business operations.

1 – Streamlined Payment Process

One of the primary advantages of credit card collections is the streamlined payment process it offers. By allowing customers to pay their outstanding balances directly through their credit or debit cards, you can significantly reduce the administrative burden associated with traditional invoicing and check-based payments. This not only saves time and resources but also enhances the overall customer experience, making it easier for them to fulfill their financial obligations.

2 – Increased Cashflow

Implementing credit card collections can have a direct and positive impact on your business’s cashflow. When customers pay their invoices through credit or debit cards, the funds are typically deposited into your account much faster than with traditional payment methods. This accelerated payment process can help you maintain a more consistent and predictable cashflow, which is essential for managing your day-to-day operations, meeting financial obligations, and seizing new growth opportunities.

3 – Reduced Risk of Bad Debt

Credit card collections can also help mitigate the risk of bad debt, which can be a significant drain on your financial resources. By requiring customers to provide their credit or debit card information upfront, you can ensure that payments are made on time and in full, reducing the likelihood of outstanding balances that eventually become uncollectible. This, in turn, can lead to improved profitability and a stronger overall financial position for your business.

4 – Improved Customer Satisfaction

Surprisingly, credit card collections can also contribute to enhanced customer satisfaction. By offering a convenient and hassle-free payment option, you can make it easier for your customers to fulfill their financial obligations, which can lead to a more positive overall experience.

5 – Enhanced Security

Credit card collections also offer enhanced security features that can help protect your business from fraud and financial losses. Many credit card processing platforms incorporate robust security measures, such as encryption, fraud detection, and chargeback protection, which can give you peace of mind and safeguard your company’s financial well-being.

6 – Minimised Administrative Tasks

Implementing a credit card collections system can also help reduce the administrative burden associated with traditional invoicing and payment processing. By automating various tasks, such as invoice generation, payment reminders, and reconciliation, you can free up valuable time and resources that can be better allocated to other critical aspects of your business.

7 – Access to Valuable Customer Data

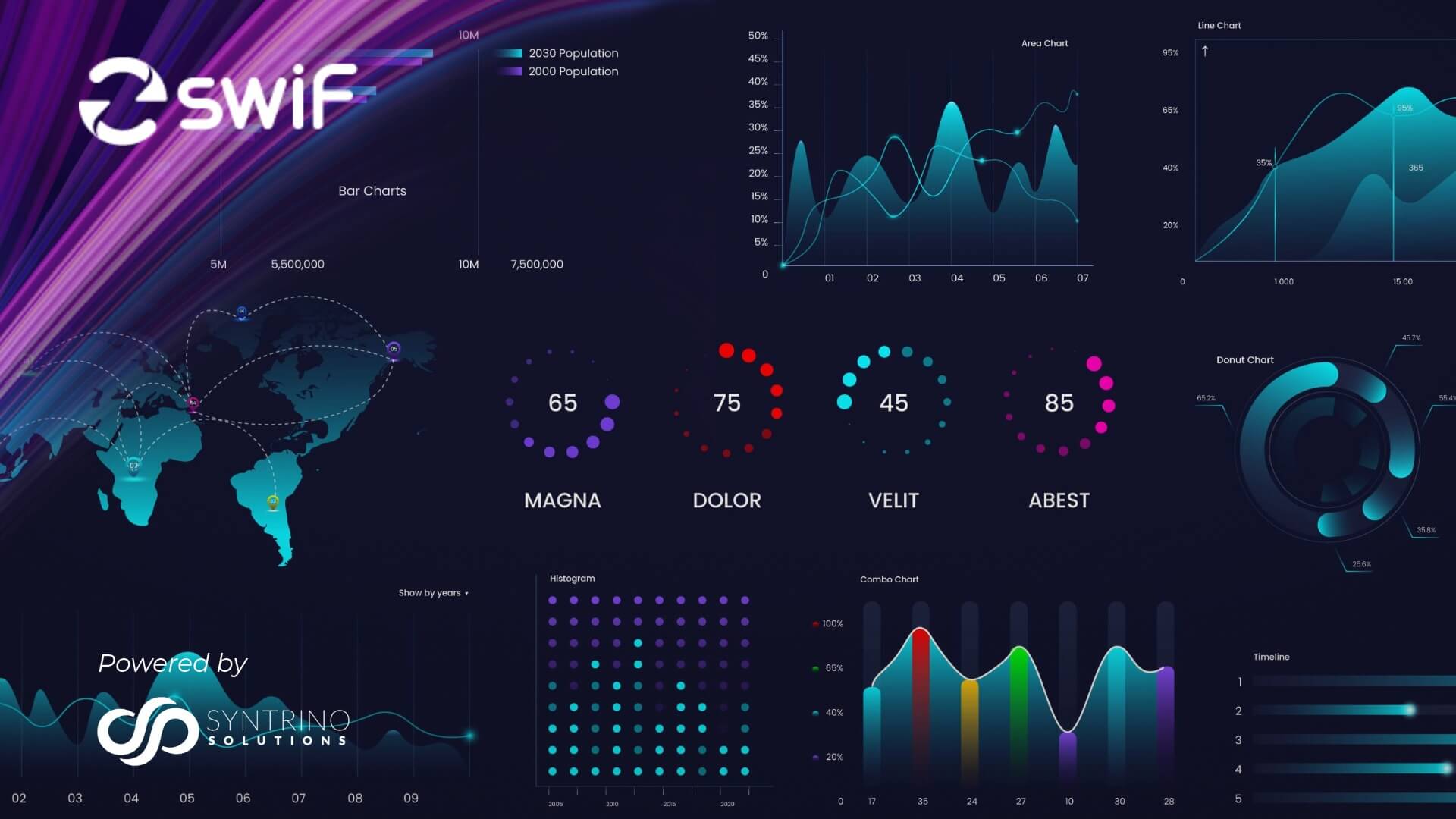

One often-overlooked benefit of credit card collections is the access it provides to valuable customer data. By collecting and analysing information related to customer payment patterns, spending habits, and transaction histories, you can gain valuable insights that can inform your marketing strategies, product development, and overall business decision-making.

8 – Improved Financial Forecasting and Planning

The enhanced visibility and control over your accounts receivable that credit card collections provide can also lead to improved financial forecasting and planning. By having a better understanding of your cashflow and the timing of customer payments, you can make more informed decisions about budgeting, resource allocation, and long-term strategic planning.

9 – Encourage Repeat Business

The implementation of credit card collections not only simplifies payment processes, its overall convenience also boosts customer satisfaction, encourages repeat business, and ultimately, helps in retaining customers, thereby increasing market share and customer loyalty further bolstering your company’s growth and success.

10 – Competitive Advantage

Implementing a credit card collections system can also give your business a competitive advantage in your industry. By offering a seamless and convenient payment experience, you can differentiate yourself from competitors and attract new customers who value the efficiency and reliability of your payment processing capabilities.

Conclusion

In conclusion, the implementation of credit card collections can deliver a wide range of benefits for your business, from streamlined payment processes and increased cashflow to reduced risk of bad debt and improved customer satisfaction. By embracing this powerful tool, you can position your company for long-term success and gain a competitive edge in the marketplace.

To learn more about how credit card collections can benefit your business, schedule a consultation with our team of experts today. We’ll help you assess your specific needs, and helps you achieve your financial goals.

SwiF is Malaysia’s Leading-Edge B2B2C Fintech Solution.

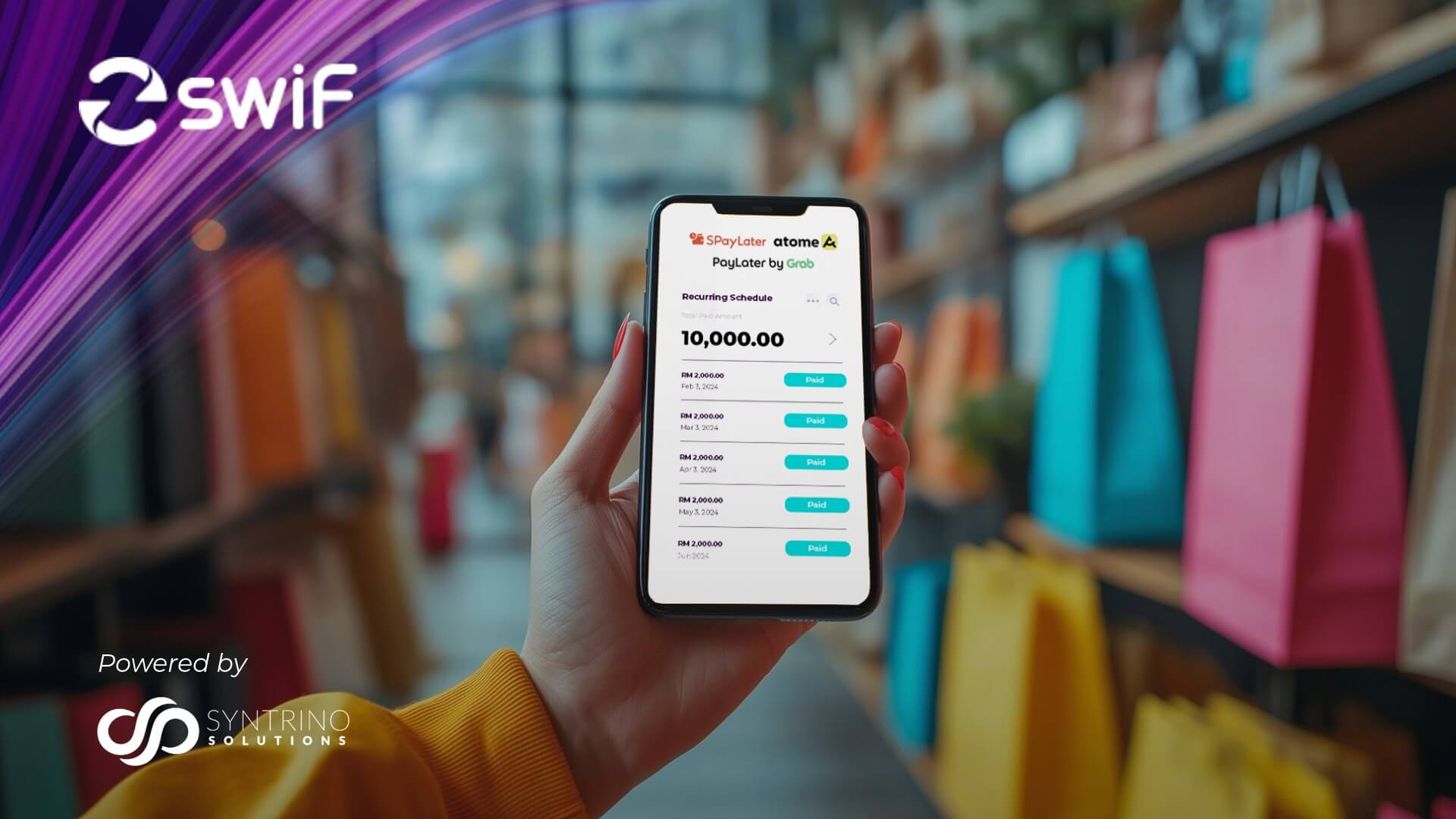

Powered by Syntrino Solutions, Southeast Asia’s leader in supply chain management, SwiF’s digital collection and payment gateway seamlessly integrates with your existing systems, streamlining all your B2B2C transactions.

SwiF empowers businesses to offer flexible payment options, both online and offline, including major credit cards, online banking, e-wallets, BNPL, invoice financing, and micro-financing.

Our innovative e-invoicing plug-in ensures your business stays at the forefront of regulatory standards, while advanced monitoring and analytics keep you on top of your business performance at all times.